Understanding car loan interest rates is crucial when financing a vehicle. It directly impacts your monthly payments and the total cost of your car. Several factors influence the interest rate you’ll receive, including your credit score, loan term, and the type of vehicle you’re purchasing. Let’s delve deeper into the intricacies of car loan interest rates.

Factors Influencing Car Loan Interest Rates

Several key factors play a significant role in determining the interest rate offered on a car loan. Understanding these factors can help you secure the lowest interest rate car loan.

Credit Score and History

Your credit score is a numerical representation of your creditworthiness. A higher credit score generally qualifies you for lower interest rates, as it indicates a lower risk to lenders. Conversely, a lower credit score may result in higher interest rates or even loan denial. Lenders also consider your credit history, including payment history, outstanding debt, and the length of your credit history.

Loan Term

The loan term, or the length of time you have to repay the loan, also affects the interest rate. Longer loan terms typically result in lower monthly payments but higher overall interest paid. Shorter loan terms mean higher monthly payments but less total interest paid over the life of the loan.

Type of Vehicle

The type of vehicle you purchase can also influence the interest rate. New cars often qualify for lower interest rates than used cars, as they are considered less risky for lenders. Furthermore, the make and model of the vehicle can also play a role.

Lender

Different lenders offer varying interest rates. It’s essential to shop around and compare rates from multiple lenders, including banks, credit unions, and online lenders, to find the best deal. Don’t settle for the first offer you receive.

How to Get the Best Interest Rate on a Car Loan

Securing a favorable interest rate requires careful planning and preparation. Here are some tips to help you get the best possible rate:

- Improve your credit score: Before applying for a car loan, take steps to improve your credit score by paying bills on time, reducing outstanding debt, and correcting any errors on your credit report.

- Shorten your loan term: While a longer loan term may seem appealing due to lower monthly payments, opting for a shorter loan term will save you money on interest in the long run. Consider what you can realistically afford and choose the shortest loan term possible.

- Shop around for the best rates: Don’t settle for the first offer you receive. Compare rates from multiple lenders to find the most competitive rate. Check with banks, credit unions, and online lenders to ensure you’re getting the best deal.

- Make a larger down payment: A larger down payment reduces the loan amount, which can lead to a lower interest rate. It also demonstrates your commitment to repaying the loan. See our article on the average interest rate for car loan for more insights.

Key Factors Affecting Car Loan Interest Rates

Key Factors Affecting Car Loan Interest Rates

What is a good interest rate for a car loan?

A “good” interest rate is relative and depends on your individual circumstances and the prevailing market conditions. However, comparing rates offered by different lenders and understanding the factors influencing those rates can help you determine what constitutes a good rate for you. You can find more information on the rate of interest on car.

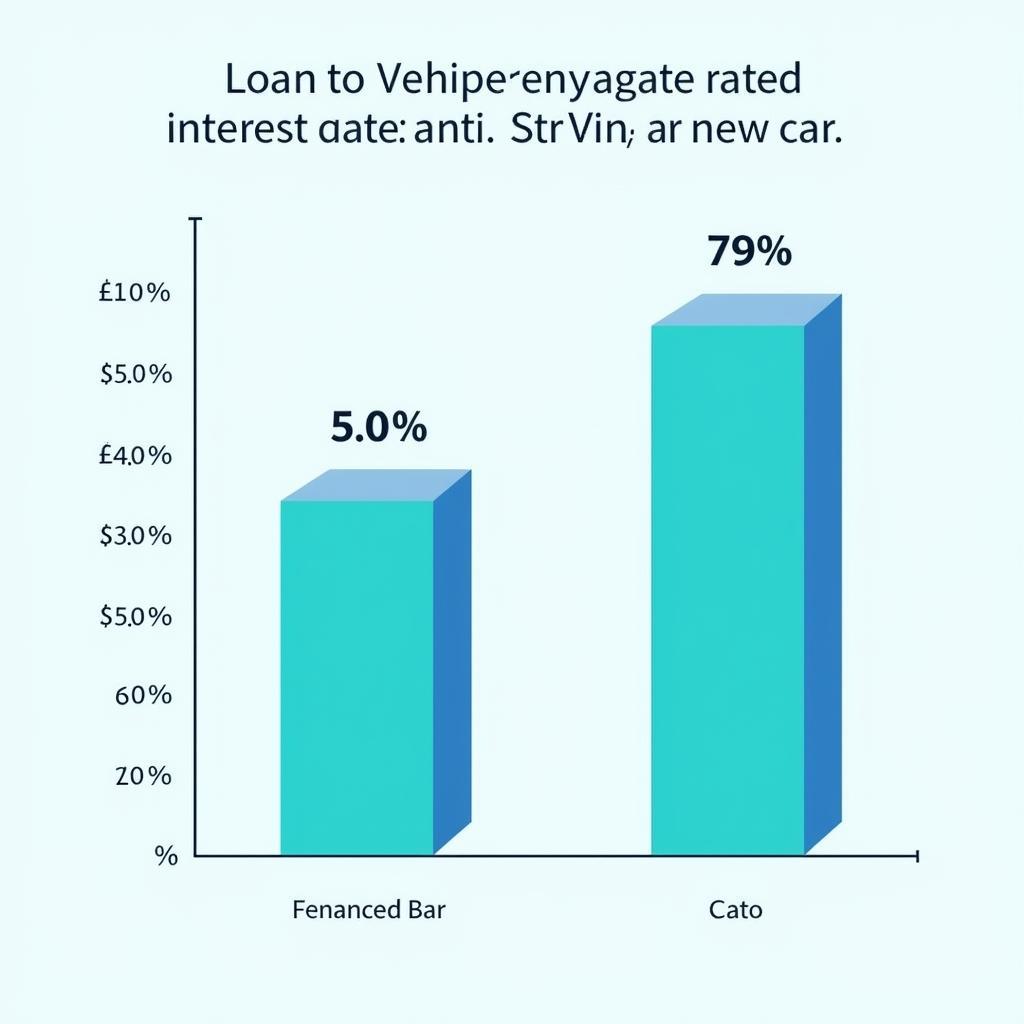

Understanding New Car Loan Interest Rates

New car loan interest rates are typically lower than those for used cars. This is because new cars are seen as less of a risk for lenders. However, these rates can still vary based on your creditworthiness and the specific lender.

Comparing New vs. Used Car Loan Interest Rates

Comparing New vs. Used Car Loan Interest Rates

Conclusion

Understanding the factors that influence car loan interest rates is essential for making informed financial decisions. By considering your credit score, loan term, the type of vehicle, and shopping around for the best rates, you can secure a favorable interest rate and minimize the overall cost of your car loan. Remember to research the average car loan interest rate for 730 credit score to get a benchmark. By understanding what is the interest rate on a car loan you’re better equipped to navigate the car financing process.

FAQ

- What is a typical car loan interest rate?

- How does my credit score affect my car loan interest rate?

- Should I choose a shorter or longer loan term?

- How can I lower my car loan interest rate?

- Where can I find the best car loan interest rates?

- What is the difference between a fixed and variable interest rate car loan?

- How much should I put down on a car?

Situations people might find themselves in:

- First-time car buyer unsure about interest rates.

- Someone with bad credit looking to finance a car.

- Someone trying to decide between a new and used car.

Suggested further reading: Find more helpful articles on DiagXcar.com.

Call to action: Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.