Virginia car sales tax can seem complicated, but understanding the basics can save you money and headaches. This guide will break down everything you need to know about Virginia’s car sales tax, from the current rate to exemptions and how it’s calculated.

Navigating Virginia Car Sales Tax: A Comprehensive Guide

Buying a car in Virginia involves more than just the sticker price. A significant portion of your total cost will be the virginia car sales tax. This tax is applied to the purchase price of the vehicle, and understanding how it works is essential for budgeting and making informed decisions. Whether you’re buying from a dealership or a private seller, this guide will help you navigate the process. Just after this introductory paragraph, you’ll find a helpful link to more resources regarding sales tax in VA on cars.

What is the current rate? How is it calculated? Are there any exemptions? These are common questions we’ll address. We’ll also explore common scenarios and offer tips for a smooth transaction.

Calculating Your Virginia Car Sales Tax

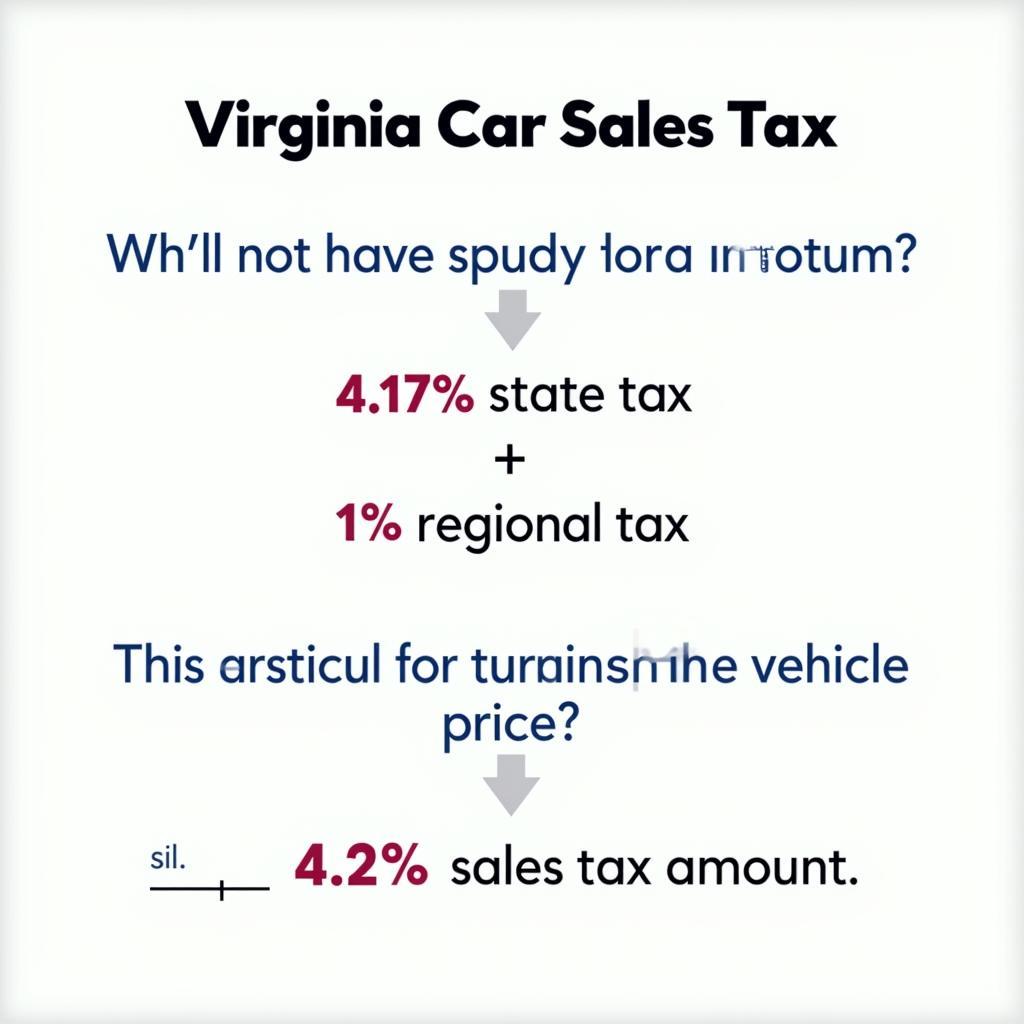

The virginia car sales tax is calculated based on the vehicle’s purchase price. The current rate is 4.15% of the sale price. This means for every $1,000 you spend on a vehicle, you’ll pay $41.50 in sales tax. However, in addition to the 4.15% state tax, localities can impose an additional regional tax of up to 1%, resulting in a combined rate of up to 5.15%. Be sure to check the specific rate for your locality. This can significantly impact the overall cost, especially for higher-priced vehicles.

Virginia Car Sales Tax Calculation Example

Virginia Car Sales Tax Calculation Example

Exemptions and Special Cases

While most vehicle purchases are subject to virginia car sales tax, certain exemptions and special cases may apply. For instance, if you are trading in a vehicle, the tax is only applied to the difference between the new car’s price and the trade-in value. This can significantly reduce your tax burden. Additionally, certain vehicles, such as those used for agricultural purposes or by disabled individuals, may qualify for exemptions or reduced rates. It’s essential to research and understand these exceptions to ensure you are not paying more tax than necessary.

Tips for a Smooth Transaction

When purchasing a vehicle in Virginia, understanding the sales tax implications is crucial. Be sure to factor in the tax when negotiating the price. Request a detailed breakdown of the sales tax calculation from the dealer or seller. This transparency can prevent misunderstandings and ensure you’re paying the correct amount. Don’t hesitate to ask questions if anything is unclear.

Tips for Navigating Virginia Car Sales Tax

Tips for Navigating Virginia Car Sales Tax

“Understanding the nuances of virginia car sales tax is crucial for anyone buying a car in the Commonwealth,” says Amelia Carter, a Senior Tax Advisor at Carter & Associates. “Being proactive and informed can save you significant money and avoid potential complications.”

Virginia Car Sales Tax FAQs

Here are some frequently asked questions about virginia car sales tax:

- What is the current virginia car sales tax rate? The current rate is 4.15% plus a potential local tax of up to 1%.

- How is the tax calculated? It’s calculated based on the purchase price of the vehicle.

- Are there any exemptions? Yes, certain exemptions exist, such as for trade-ins and specific vehicle types.

- Where can I find more information about local tax rates? Contact your local Department of Motor Vehicles or county treasurer’s office.

- Do I have to pay sales tax when buying from a private seller? Yes, you are still responsible for paying the tax even if purchasing from a private party.

- What documentation do I need for tax purposes? Retain your bill of sale and other relevant paperwork.

- How do I pay the sales tax? Typically, you pay it through the dealer or directly to the DMV when registering the vehicle.

Virginia Car Sales Tax Frequently Asked Questions

Virginia Car Sales Tax Frequently Asked Questions

“Don’t underestimate the impact of the regional tax component,” adds Ms. Carter. “That extra 1% can add up, so always confirm the total rate for your specific location.”

Conclusion

Understanding virginia car sales tax is an essential part of the car buying process in Virginia. By familiarizing yourself with the rates, calculations, exemptions, and tips provided in this guide, you can approach your next vehicle purchase with confidence and avoid unexpected costs. Remember to factor the sales tax into your budget and seek clarification whenever necessary.

Beyond the articles linked above, DiagXcar offers a wealth of information on various automotive topics. For personalized assistance or to learn more about our services, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our customer service team is available 24/7.