Transferring car ownership within a family is a common occurrence, often motivated by gifting, inheritance, or simply helping a family member acquire a vehicle. While seemingly straightforward, the process involves several crucial steps and legal requirements that vary depending on your location. Understanding these steps can save you time, money, and potential legal headaches.

Understanding the Process of Transferring Car Ownership

Whether you’re gifting a car to your child, inheriting a vehicle from a parent, or selling it to a sibling, the process generally involves similar steps. These include transferring the title, updating the registration, and addressing insurance considerations. However, specific requirements can differ depending on your state or country. Always check with your local Department of Motor Vehicles (DMV) or equivalent agency for the most up-to-date information. Overlooking these crucial steps could lead to complications down the road.

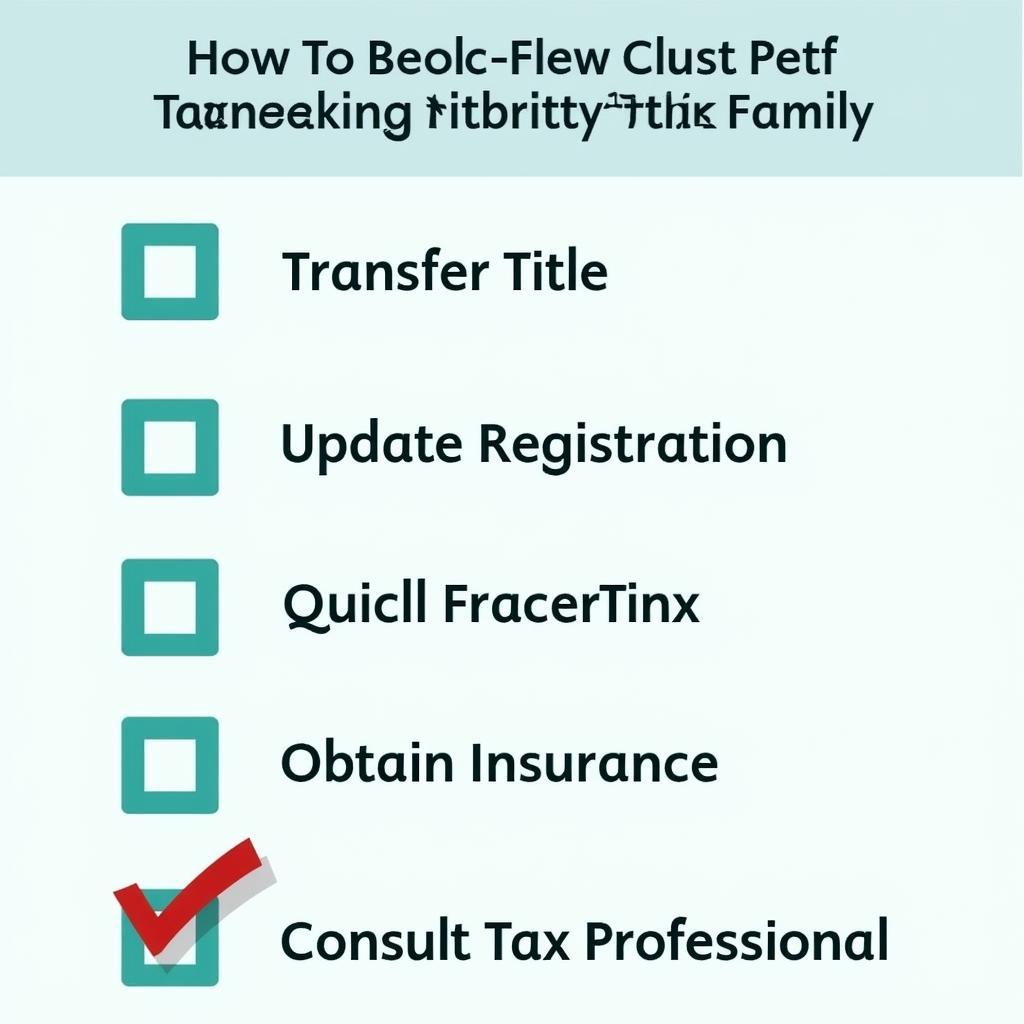

Key Steps Involved in Transferring Car Ownership

- Transferring the Title: This is the most crucial step, legally establishing the new owner. Both the seller and the buyer must sign the title in the designated areas. Some states require notarization of signatures.

- Updating the Registration: After the title is transferred, the new owner must register the vehicle in their name with the DMV. This usually involves completing a registration application and paying the associated fees.

- Addressing Insurance: The new owner must obtain car insurance in their name before driving the vehicle legally. Failure to do so can result in fines and other penalties.

Navigating the Legal Requirements

Legal requirements for transferring car ownership within a family differ based on location. While the core steps remain consistent, the specifics of documentation, fees, and taxes can vary significantly. For instance, some states might require a bill of sale, even for gifts, while others might waive certain fees for family transfers.

Specific Requirements by State/Country

It is essential to research your specific state or country’s requirements. DMV websites are excellent resources for finding this information. They often provide detailed instructions, downloadable forms, and contact information for assistance. Remember, ignorance of the law is not a valid excuse.

“Understanding the specific regulations in your area is paramount to a seamless transfer,” says automotive expert, Amelia Carter, Senior Vehicle Compliance Officer at the National Automotive Regulatory Agency. “Don’t rely on hearsay or assumptions. Consult the official DMV resources for accurate and up-to-date information.”

Tax Implications of Transferring Car Ownership

Transferring car ownership within a family can have tax implications, especially if money is exchanged. Even gifts might be subject to gift tax depending on the vehicle’s value and your local tax laws. Understanding these implications beforehand can help you avoid unexpected tax burdens.

Gift Tax and Other Tax Considerations

Consult with a tax professional to understand the potential tax implications in your specific situation. They can advise you on how to minimize any tax liabilities and ensure compliance with tax laws. “Navigating the tax implications can be tricky,” warns David Miller, CPA and Partner at Miller & Associates. “Seeking professional tax advice can save you money and ensure you’re following the correct procedures.”

Gift Tax on Car Transfer within Family

Gift Tax on Car Transfer within Family

Tips for a Smooth Transfer Process

To ensure a hassle-free transfer of car ownership within your family, here are some valuable tips:

- Gather all necessary documents: This includes the title, registration, bill of sale (if required), and proof of insurance.

- Complete all forms accurately: Double-check all information before submitting to avoid delays or rejection.

- Keep copies of all documents: This provides a record of the transaction and can be helpful in case of any future disputes.

- Communicate clearly with all parties involved: This ensures everyone is on the same page and understands their responsibilities.

Conclusion

Transferring car ownership within a family, while seemingly simple, involves critical legal and administrative steps. By understanding the process, navigating the legal requirements, and considering the tax implications, you can ensure a smooth and legally compliant transfer. Remember to consult your local DMV or equivalent agency and a tax professional for specific guidance relevant to your location and situation. Properly transferring car ownership within a family not only safeguards all parties involved but also ensures a hassle-free transition for the new owner.

Family Car Ownership Transfer Checklist

Family Car Ownership Transfer Checklist

FAQs

- What documents are required to transfer car ownership within a family? Generally, you will need the title, registration, and possibly a bill of sale. Requirements vary by location.

- Do I need to pay taxes when gifting a car to a family member? This depends on the value of the car and your local tax laws. Consult a tax professional.

- How do I update the car registration after the transfer? Contact your local DMV to complete the necessary paperwork and pay the required fees.

- Can I transfer ownership without a title? Generally, no. A title is the legal proof of ownership.

- What happens if I don’t transfer ownership properly? You could face legal penalties and complications down the road.

- Is a bill of sale always required? It depends on the state or country. Some require it even for gifts.

- How long does the transfer process usually take? This varies by location and the efficiency of the DMV.

Common Scenarios

- Parent gifting a car to a child: This often involves minimal or no monetary exchange and requires proper title and registration transfer.

- Inheriting a car from a deceased relative: This requires navigating probate laws and transferring ownership through the appropriate legal channels.

- Selling a car to a sibling: This usually involves a monetary exchange and requires a bill of sale along with the title and registration transfer.

Further Reading and Related Topics

- Understanding Vehicle Title Transfers

- Navigating Car Insurance After Ownership Transfer

- Tax Implications of Gifting and Inheriting Vehicles

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] Or visit us at: 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.