Imagine this: you’ve finally found the perfect car, the one that checks all the boxes on your wish list. The only thing left is securing financing. But with the vast array of loan options available, it can be overwhelming to determine which one is the best fit for you. Enter Navy Federal Credit Union, a renowned financial institution offering competitive car loan rates tailored specifically for active-duty military personnel, veterans, and their families.

Understanding Navy Fed Car Loan Rates

What are Navy Fed Car Loan Rates?

Navy Federal Car Loan Rates represent the annual percentage rate (APR) that Navy Federal Credit Union charges for financing your vehicle purchase. This rate determines the total cost of borrowing money, which includes both the principal amount and the interest accrued over the loan’s duration.

Why are Navy Fed Car Loan Rates Important?

Understanding Navy Fed car loan rates is crucial for several reasons:

- Cost Calculation: It helps you estimate the total cost of your car loan, allowing you to plan your budget accordingly.

- Loan Comparison: Comparing rates with other lenders allows you to make informed decisions and potentially secure the most favorable financing.

- Financial Impact: Lower rates mean lower interest payments, ultimately saving you money on your car purchase.

Deciphering Navy Fed Car Loan Rates: A Closer Look

Factors Affecting Navy Fed Car Loan Rates

Several factors influence the rates you qualify for, including:

- Credit Score: A higher credit score typically translates into lower rates.

- Loan Term: Longer loan terms often come with higher rates but allow for smaller monthly payments.

- Vehicle Type: The make, model, and year of your vehicle can impact the rates you receive.

- Loan Amount: Larger loan amounts may result in higher interest rates.

- Down Payment: A larger down payment often lowers the loan amount and potentially improves your rate.

Frequently Asked Questions about Navy Fed Car Loan Rates

What are the current Navy Fed car loan rates?

Navy Federal Credit Union offers a range of car loan rates that fluctuate based on market conditions and your individual creditworthiness. To obtain the most up-to-date rates, you can visit their website or contact a loan officer directly.

How can I improve my chances of getting a lower Navy Fed car loan rate?

- Build a Strong Credit Score: Pay bills on time, maintain a low credit utilization ratio, and avoid opening new credit accounts excessively.

- Shop Around: Compare rates from multiple lenders to find the most competitive offers.

- Secure a Larger Down Payment: This lowers the loan amount, which could lead to a lower interest rate.

- Choose a Shorter Loan Term: Although monthly payments will be higher, shorter loan terms often come with lower interest rates.

What are the advantages of financing a car through Navy Federal Credit Union?

- Exclusive Benefits: As a member-owned financial institution, Navy Federal Credit Union prioritizes serving its members with competitive rates and personalized service.

- Competitive Rates: They often offer competitive rates compared to other lenders, potentially saving you money on your car loan.

- Flexible Loan Terms: They provide various loan terms to accommodate your specific needs and financial situation.

- Convenient Online Application: You can apply for a car loan online, simplifying the process and saving time.

What documents do I need to apply for a Navy Fed car loan?

- Valid Identification: A driver’s license or military ID card.

- Social Security Number: To verify your identity and credit history.

- Proof of Income: Pay stubs or tax returns.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number).

- Seller’s Information: Dealer contact information if applicable.

Can I refinance my existing car loan with Navy Federal Credit Union?

Yes, Navy Federal Credit Union offers car loan refinancing options. This can be beneficial if you have a high interest rate on your current loan or want to consolidate debt and lower your monthly payments.

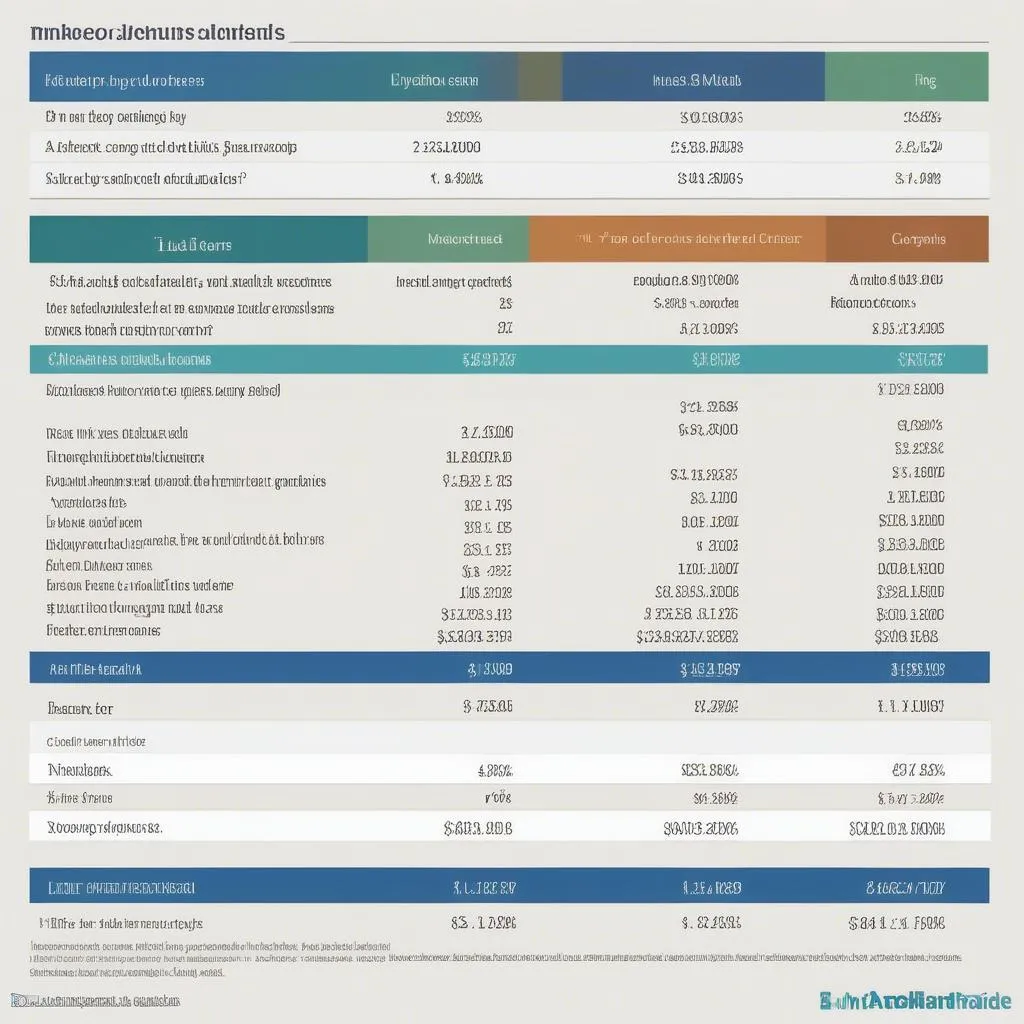

Car Loan Rate Comparison

Car Loan Rate Comparison

Navigating the Process: Tips for Success

Pre-Approval: Setting the Stage for Success

Before heading to the dealership, obtaining pre-approval for a Navy Federal car loan can give you a significant advantage. It provides an estimated loan amount and rate based on your creditworthiness.

- Streamline the Process: Knowing your budget and loan terms upfront simplifies negotiations with car dealerships.

- Empowerment: Pre-approval can give you leverage during negotiations and potentially lead to more favorable purchase terms.

Seeking Professional Guidance: The Value of an Experienced Loan Officer

Navy Federal Credit Union has a network of experienced loan officers ready to assist you. They can provide valuable advice on navigating the car loan process, answer any questions you might have, and help you determine the most suitable loan option for your circumstances.

Case Study:

Sarah, a military spouse, was seeking a new vehicle. She initially visited several dealerships, but felt overwhelmed by the variety of financing options. She then connected with a Navy Federal Credit Union loan officer who provided personalized guidance, explaining the various loan terms and rates in detail. With the loan officer’s support, Sarah successfully secured a car loan at a competitive rate, saving her significant interest charges over the life of the loan.

Protecting Yourself: Understanding Loan Terms

- Loan Term: Choose a loan term that aligns with your budget and financial goals. Longer terms can lead to lower monthly payments but result in higher total interest charges.

- Interest Rate: Negotiate the lowest possible interest rate by utilizing your pre-approval, improving your credit score, and exploring various loan options.

- Fees and Charges: Understand any associated fees, such as origination fees or prepayment penalties, to ensure transparency.

Beyond Rates: Exploring Additional Services

Navy Federal Credit Union offers additional services that can enhance your car ownership experience:

- Gap Insurance: This protects you against financial losses in case your vehicle is totaled in an accident.

- Mechanical Breakdown Coverage: Provides protection against unexpected repair costs.

- Roadside Assistance: Offers assistance in case of breakdowns or emergencies.

Related Resources:

- Navy Federal Credit Union Website: https://www.navyfederal.org/

- Car Loan Rate Comparison Tools: https://www.nerdwallet.com/

- Financial Education Resources: https://www.investopedia.com/

Conclusion

Securing a car loan is an important financial decision that requires careful consideration. Understanding Navy Federal car loan rates and the factors that influence them allows you to make informed choices that align with your budget and financial goals. Remember to build a strong credit score, compare rates from multiple lenders, and explore the additional services offered by Navy Federal Credit Union. By taking a proactive approach, you can navigate the car loan process confidently and drive away with a vehicle that fits your needs and budget.

Contact Us Today:

For expert advice and personalized support with your car loan financing needs, reach out to our team at Whatsapp: +84767531508. Our team of automotive experts is available 24/7 to guide you through the process and answer any questions you may have.

Leave a comment below or share this article with your friends and family who might be interested in learning more about Navy Federal car loan rates.

Car Loan Process Illustration

Car Loan Process Illustration