Getting the right insurance for car coverage can feel overwhelming. From understanding different policy types to navigating insurance jargon, it’s a lot to take in. This guide will break down everything you need to know about car insurance, helping you make informed decisions and find the best coverage for your needs. We’ll cover key aspects of car insurance, from liability coverage to comprehensive protection, and even delve into specialized areas like gap insurance. Let’s get started.

Understanding the Basics of Car Insurance

Car insurance protects you financially in case of an accident. It covers damages to your vehicle, medical expenses, and legal liabilities. Different types of insurance for car policies offer varying levels of protection. Understanding these differences is crucial to choosing the right coverage. Think of it as building a safety net for your vehicle and your finances.

One of the first things to understand is liability insurance. This covers damages you cause to others in an accident, including property damage and bodily injury. Most states require a minimum amount of liability coverage. Beyond the basics, you can opt for collision coverage, which covers damages to your own car in an accident, regardless of fault. Comprehensive coverage takes it a step further, protecting your car from non-collision incidents like theft, vandalism, and natural disasters.

Finding the Best Insurance for Car

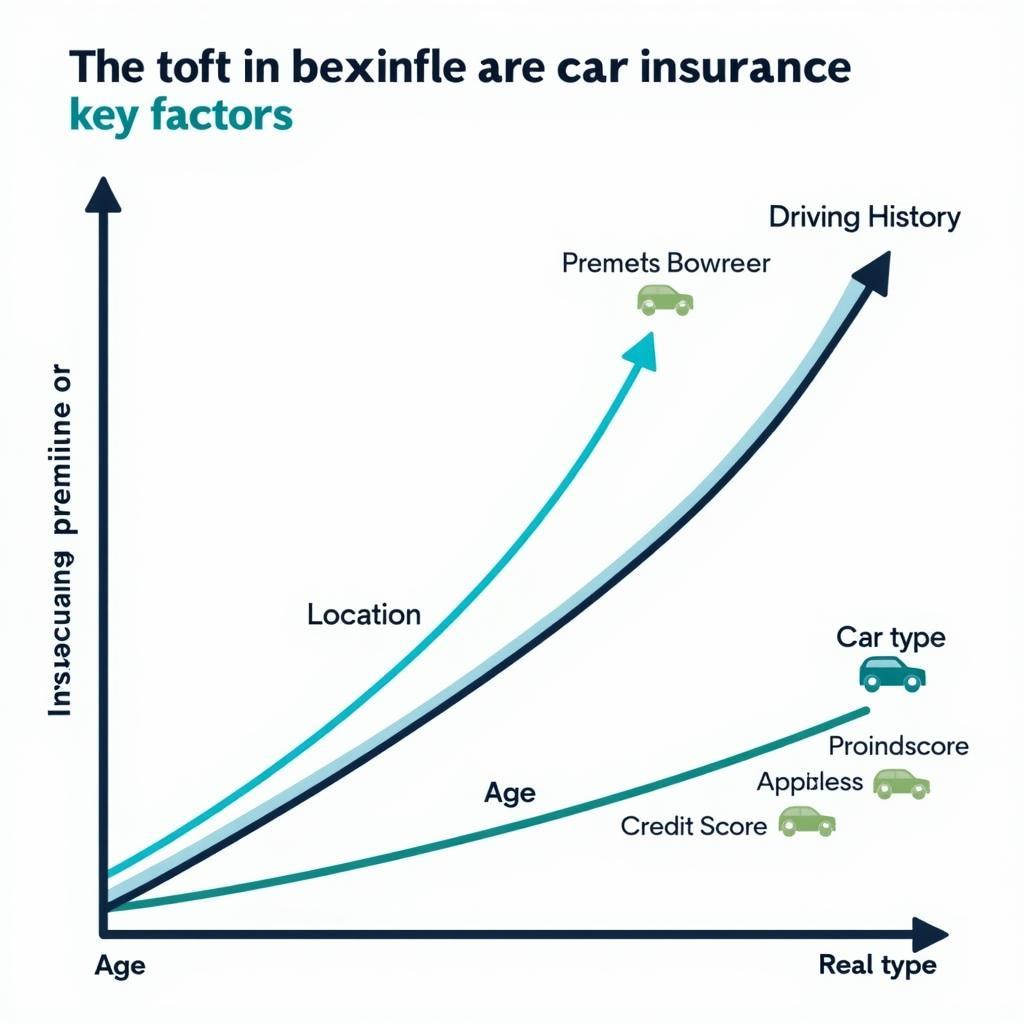

Choosing the best insurance for car depends on your individual needs and budget. Several factors influence your insurance premium, including your driving history, the type of car you drive, and where you live. Comparing quotes from different insurers is essential to finding the best deal. Online comparison tools can simplify this process, allowing you to see multiple quotes side-by-side.

What factors affect my car insurance premium?

Several factors affect your car insurance premium. Your driving record plays a significant role, as accidents and traffic violations can lead to higher premiums. The type of car you drive also matters; more expensive and high-performance cars generally cost more to insure. Your location is another key factor, as areas with high accident rates or theft rates often have higher premiums.

How can I get cheap insurance for cars?

Finding cheap insurance for cars requires some research and comparison shopping. Maintaining a clean driving record is crucial, as it demonstrates responsible driving habits. Opting for a higher deductible can also lower your premium, but it means you’ll pay more out-of-pocket in case of a claim. Consider bundling your car insurance with other types of insurance, such as homeowners or renters insurance, as many insurers offer discounts for bundled policies.

Factors Affecting Car Insurance Premiums

Factors Affecting Car Insurance Premiums

Utilizing VIN to Calculate Insurance

Did you know your Vehicle Identification Number (VIN) can be used to calculate insurance for car by vin? Your VIN provides insurers with detailed information about your car, including its make, model, year, and safety features. This information helps them assess the risk associated with insuring your vehicle and determine your premium.

Gap Insurance: Bridging the Financial Gap

What is gap insurance for cars? It’s a specialized type of coverage that protects you if your car is totaled or stolen and you owe more on your loan or lease than the car is worth. Gap insurance covers the difference, preventing you from being stuck with debt.

Understanding Liability Insurance Car

Liability insurance car is a crucial component of any car insurance policy. It covers the costs associated with damages or injuries you cause to others in an accident. This includes property damage, medical expenses, and legal fees.

Gap Insurance Explained

Gap Insurance Explained

Conclusion

Finding the right insurance for car coverage is a crucial step in responsible car ownership. By understanding the different types of coverage, comparing quotes, and considering your individual needs, you can make informed decisions and protect yourself financially. Remember to research and ask questions to ensure you have the best possible coverage.

FAQ

- What is the minimum car insurance required by law? This varies by state.

- How can I lower my car insurance premium? Maintaining a clean driving record, bundling policies, and opting for a higher deductible can help.

- What is comprehensive car insurance? This covers damages to your car from non-collision incidents like theft and vandalism.

- Do I need gap insurance? It depends on your loan or lease agreement and the value of your car.

- How do I file a car insurance claim? Contact your insurance company as soon as possible after an accident.

- What is an insurance deductible? The amount you pay out-of-pocket before your insurance coverage kicks in.

- How often should I review my car insurance policy? At least annually, or when your circumstances change.

Common Car Insurance Scenarios:

- Scenario 1: You’re at fault in a minor fender bender. Your liability insurance covers the damages to the other car, while your collision coverage covers the damages to your car (minus your deductible).

- Scenario 2: Your car is stolen. Comprehensive coverage will reimburse you for the value of your car (minus your deductible).

- Scenario 3: A tree falls on your parked car during a storm. Comprehensive coverage will cover the damages.

Further Reading:

For more information on specific car insurance topics, visit our website for articles on choosing the best insurance, finding cheap options, understanding gap insurance, and more.

Contact Us:

Need assistance with your car diagnostic needs? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer service team ready to assist you.