Buying a car is a significant financial decision, and one of the biggest questions is how much should you put down on a car? The down payment you make can significantly impact your loan terms, monthly payments, and overall cost of ownership. There’s no one-size-fits-all answer, and the ideal down payment depends on various factors, including your budget, credit score, and the type of car you’re buying. Let’s explore the different aspects of a car down payment and help you determine the right amount for your situation.

Understanding the Impact of Your Down Payment

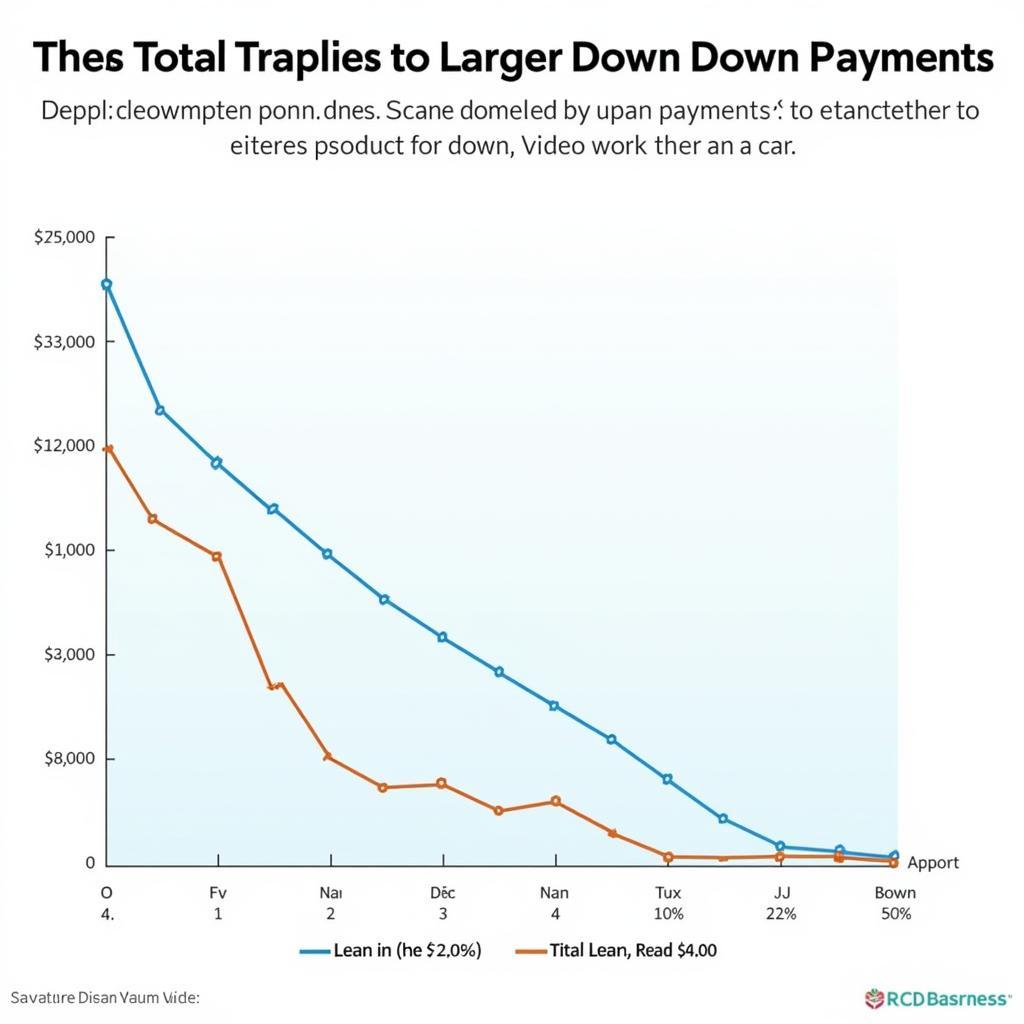

A larger down payment generally translates into more favorable loan terms. It reduces the loan principal, which in turn lowers your monthly payments and the total interest paid over the life of the loan. A substantial down payment can also help you avoid being “upside down” on your loan, meaning you owe more than the car is worth. This can be especially important if you plan to sell or trade in your car before the loan is fully paid.

Choosing a cheapest used car lots near me might also influence your down payment decision.

How Much Should You Put Down on a Car: Calculating the Sweet Spot

There are several factors to consider when deciding how much to put down on a car.

Your Budget and Savings

The first and most crucial factor is your personal budget. How much can you comfortably afford to put down without depleting your emergency fund or impacting other financial goals? It’s essential to strike a balance between a healthy down payment and maintaining a financial safety net.

Your Credit Score

Your credit score plays a vital role in determining your loan interest rate. A higher credit score typically qualifies you for lower interest rates, which can reduce the overall cost of borrowing. If you have a good credit score, you might be able to put down a smaller amount and still secure a favorable loan.

The Car’s Price and Type

The price of the car you’re buying also influences the down payment amount. A higher-priced car will likely require a larger down payment to keep your monthly payments manageable. Additionally, the type of car, whether new or used, can impact your decision. Used cars often depreciate faster than new cars, so a larger down payment can help protect you from negative equity.

Calculating Car Down Payment

Calculating Car Down Payment

What is the 20/4/10 Rule for Car Buying?

The 20/4/10 rule is a guideline suggesting a 20% down payment, a four-year loan term, and spending no more than 10% of your gross income on car-related expenses (including loan payments, insurance, gas, and maintenance). While this rule can be helpful, it’s not a hard and fast rule and may not be feasible for everyone.

Are you looking for a fun way to explore cars virtually? Try some car games free.

What Happens If I Put Less Than 20% Down?

Putting less than 20% down often means a higher interest rate and potentially higher monthly payments. You may also be required to purchase private mortgage insurance (PMI) if you put down less than 20% on a conventional loan, which adds to your overall cost.

Benefits of a Larger Down Payment

A larger down payment reduces the loan amount, leading to lower monthly payments and less interest paid over time. It can also help you build equity faster and avoid being upside down on your loan.

Benefits of a Large Down Payment on a Car

Benefits of a Large Down Payment on a Car

How Much Should You Put Down on a Used Car?

When buying a used car, a down payment of 10-20% is often recommended. This can help offset the faster depreciation of used vehicles and potentially improve your loan terms.

For a professional car check-up and tune-up, consider visiting a precisión tune auto care center.

Conclusion

Determining how much should you put down on a car requires careful consideration of your individual financial situation and the specific car you’re buying. By weighing the factors discussed in this article and understanding the impact of your down payment, you can make an informed decision that aligns with your budget and financial goals. Remember, a well-chosen down payment can significantly impact your overall car ownership experience.

FAQ

- Is it always better to put more money down on a car? Not necessarily. While a larger down payment can have benefits, it’s essential to balance it with your overall financial picture.

- Can I get a car loan with no down payment? Yes, it’s possible to get a no-down-payment car loan, but it may come with higher interest rates and stricter lending requirements.

- What is a good down payment percentage for a new car? A down payment of 20% or more is generally considered a good starting point for a new car.

- Does the down payment affect my car insurance rates? No, the down payment itself doesn’t directly affect your car insurance rates.

- How can I calculate my ideal down payment? Use online car loan calculators and consider your budget, credit score, and the car’s price.

Considering a thorough car hand wash can help maintain the value of your car.

For any assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.