Health care insurance California can be a complex landscape to navigate. This guide provides valuable information to help you understand the California health insurance marketplace, make informed decisions, and find the best coverage for your needs.

Understanding the California Health Insurance Market

California’s health insurance marketplace, Covered California, offers a range of plans from different providers. Understanding the different types of plans, metal tiers (Bronze, Silver, Gold, Platinum), and provider networks is crucial to selecting the right coverage. Choosing the right health care insurance California plan depends on factors like your budget, health needs, and preferred doctors. After this paragraph, check out long term care ins.

Key Considerations When Choosing a Plan

- Premium: The monthly cost of your insurance.

- Deductible: The amount you pay out-of-pocket before your insurance starts covering costs.

- Copay: A fixed amount you pay for covered services, like doctor visits.

- Coinsurance: The percentage of costs you share with your insurance company after you meet your deductible.

- Out-of-Pocket Maximum: The most you’ll pay out-of-pocket for covered services in a year.

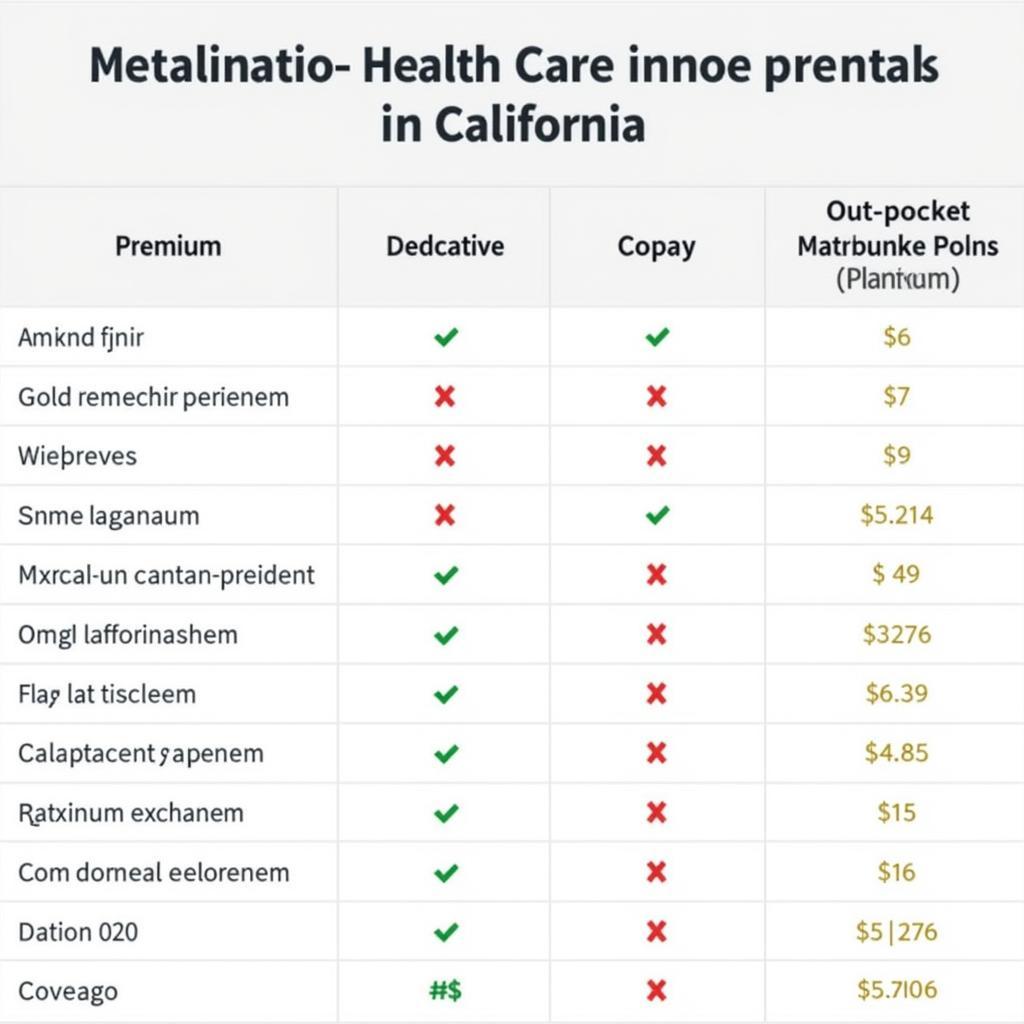

California Health Insurance Plans Comparison

California Health Insurance Plans Comparison

Navigating Covered California

Covered California provides resources and tools to help you find and enroll in a health plan. You can browse plans, compare costs, and determine your eligibility for financial assistance. Open enrollment occurs annually, but you may qualify for special enrollment if you experience a qualifying life event, such as job loss or marriage. Learn more about health care privacy in our article, health care privacy part 2.

How to Apply for Coverage

- Online: Visit the Covered California website.

- By Phone: Call the Covered California help center.

- In Person: Meet with a certified enrollment counselor.

Financial Assistance and Subsidies

Many Californians qualify for financial assistance to lower the cost of health insurance. Subsidies are available based on your income and household size. You can estimate your potential savings using the Covered California subsidy calculator. Financial assistance can significantly reduce your monthly premiums and out-of-pocket costs. If you’re looking for other career opportunities, you might be interested in navy federal career opportunities.

Types of Financial Assistance

- Premium Tax Credits: Help lower your monthly premiums.

- Cost-Sharing Reductions: Lower your out-of-pocket costs, such as deductibles and copays.

Finding the Right Provider Network

Health care insurance California plans often have specific provider networks. It’s important to choose a plan that includes your preferred doctors and hospitals. You can check if your doctor is in a plan’s network by visiting the provider’s website or contacting their office. You can also learn more about kern family health care.

Understanding Medicare and Medi-Cal

Medicare is a federal health insurance program for people 65 and older and certain younger people with disabilities. Medi-Cal is California’s Medicaid program, which provides health coverage for low-income individuals and families. Understanding the differences between Medicare, Medi-Cal, and Covered California is essential for choosing the appropriate coverage. For those interested in Medicare Advantage, check out united health care medicare advantage.

Expert Insight: “Choosing the right health insurance plan can be overwhelming,” says Dr. Maria Sanchez, a family physician in Los Angeles. “It’s important to take the time to research your options and consider your individual needs.”

Expert Insight: “Don’t be afraid to ask for help,” adds Sarah Johnson, a certified enrollment counselor. “There are resources available to guide you through the process.”

Conclusion

Finding the right health care insurance California plan is crucial for protecting your health and finances. By understanding the California health insurance market, navigating Covered California, exploring financial assistance options, and researching provider networks, you can make informed decisions and find the best coverage for your needs.

FAQ

- When is open enrollment for Covered California? Open enrollment typically occurs in the fall.

- How can I find a certified enrollment counselor? You can find a counselor through the Covered California website.

- What is a qualifying life event for special enrollment? Qualifying life events include job loss, marriage, birth of a child, and moving to California.

- What is the difference between a PPO and an HMO? A PPO offers more flexibility in choosing doctors, while an HMO typically requires you to choose a primary care physician and get referrals for specialists.

- How can I estimate my subsidy eligibility? Use the Covered California subsidy calculator.

- What if I don’t have health insurance? You may face a penalty for not having health insurance, depending on your income.

- Where can I get more information about Medicare and Medi-Cal? Visit the Medicare.gov and Medi-Cal websites.

Need more help? For further assistance regarding dealer scanners and related inquiries, please contact us through WhatsApp at +1(641)206-8880 or email us at [email protected]. You can also visit our office at 276 Reock St, City of Orange, NJ 07050, United States. Our customer support team is available 24/7 to answer your questions.