Experian car insurance plays a crucial role in determining your insurance rates. Understanding how Experian’s data impacts your insurance premiums can help you make informed decisions and potentially save money. This guide will delve into the details of Experian’s role in car insurance, exploring how your credit score, driving history, and other factors influence your insurance costs.

How Experian Car Insurance Data Impacts Your Rates

Experian, one of the three major credit bureaus, compiles extensive data that insurance companies utilize to assess risk and calculate premiums. While your credit score is a significant factor, Experian car insurance reports consider various data points to create a comprehensive profile.

- Credit-Based Insurance Score: This score predicts the likelihood of filing a claim. A higher score typically translates to lower premiums.

- Driving Record: Your history of accidents, violations, and claims significantly influences your insurance risk profile.

- Vehicle Information: The make, model, and year of your car affect insurance costs based on repair expenses and safety ratings.

- Demographics: Factors like age, location, and marital status also play a role in determining your insurance rates.

If you’re looking to sell your used car, understanding these factors can help you prepare. For instance, maintaining a clean driving record can be a selling point. Check out resources like sell my used car for more information on selling your vehicle.

Understanding Your Experian Auto Insurance Report

Accessing and reviewing your Experian auto insurance report is essential for ensuring accuracy and identifying potential areas for improvement. It empowers you to proactively manage your insurance costs.

- Requesting Your Report: You can obtain your Experian auto insurance report online or by mail.

- Reviewing for Accuracy: Carefully examine the report for any errors or inaccuracies that could negatively impact your premiums.

- Dispute Inaccurate Information: If you find errors, follow Experian’s dispute process to have them corrected.

Maintaining a positive credit history is crucial, not only for insurance but also when buying a used car. Explore options like classic bmw used car values to get an idea of pricing before making a purchase.

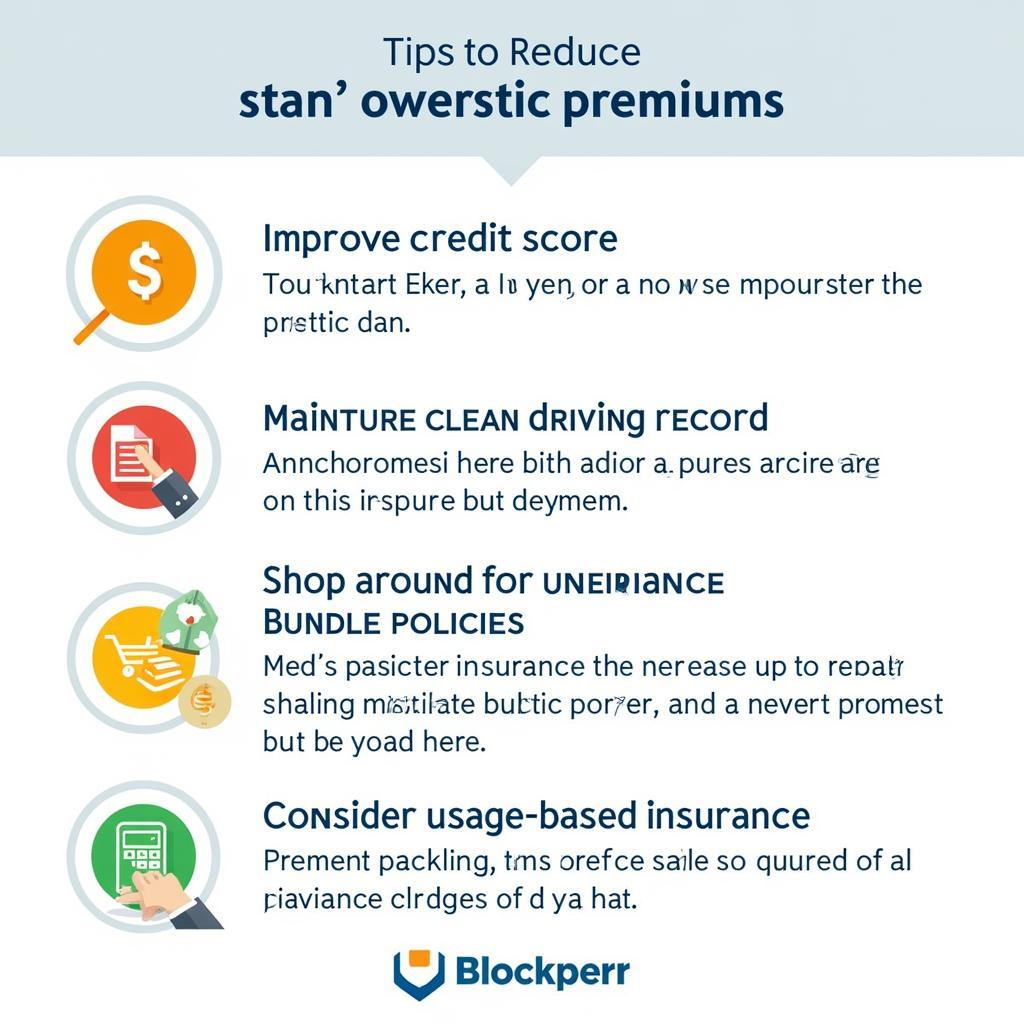

Tips for Lowering Your Experian Car Insurance Costs

While many factors influence your Experian car insurance rates, you can take proactive steps to potentially lower your premiums.

- Improve Your Credit Score: Paying bills on time and managing debt effectively can positively impact your credit-based insurance score.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations demonstrates lower risk to insurers.

- Shop Around for Insurance: Comparing quotes from different insurers can help you find the best rates.

- Bundle Your Insurance Policies: Combining auto and home insurance with the same provider often leads to discounts.

- Consider Usage-Based Insurance: If you drive infrequently, programs like pay-per-mile insurance could offer savings.

When looking for used cars for sell, consider factors that impact insurance costs like safety features and vehicle history. This can help you make a financially sound decision.

Tips for Lowering Experian Car Insurance Costs

Tips for Lowering Experian Car Insurance Costs

Conclusion

Experian car insurance data significantly impacts your insurance premiums. By understanding how Experian uses this data and taking proactive steps to improve your profile, you can potentially save money and make more informed decisions about your car insurance coverage. Remember to regularly review your Experian auto insurance report for accuracy and stay informed about factors affecting your rates.

FAQ

- What is an Experian car insurance report? It’s a report used by insurers containing information about your driving record, credit history, and other factors that determine your insurance risk.

- How can I get a copy of my Experian auto insurance report? You can request it online or by mail directly from Experian.

- How does my credit score affect my car insurance rates? Insurers use a credit-based insurance score to assess risk. A higher score typically means lower premiums.

- Can I dispute errors on my Experian auto insurance report? Yes, Experian has a dispute process you can follow to correct inaccuracies.

- What are some ways to lower my car insurance premiums? Improving your credit score, maintaining a clean driving record, and shopping around for insurance are some effective strategies.

- Does my vehicle type affect my insurance costs? Yes, the make, model, and year of your car influence insurance rates based on repair costs and safety ratings.

- What is usage-based insurance? It’s a type of insurance where premiums are based on how much you drive, often using a device to track mileage.

Looking for reputable USA used car sellers? DiagXcar offers valuable resources and insights to assist you in your search. You can also find listings on platforms like ksl com cars.

For assistance, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer service team.