Car refinance rates are a key factor in determining whether refinancing your auto loan is a smart financial move. Understanding how these rates work, what influences them, and how to secure the best possible rate can save you significant money over the life of your loan. Refinancing can be a powerful tool, but only if you approach it strategically.

Navigating the world of auto loan refinancing can feel overwhelming, but with the right knowledge, you can make informed decisions that benefit your financial well-being. Let’s dive into the details of car refinance rates and explore how you can leverage them to your advantage. You might find that car refinancing is a worthwhile endeavor.

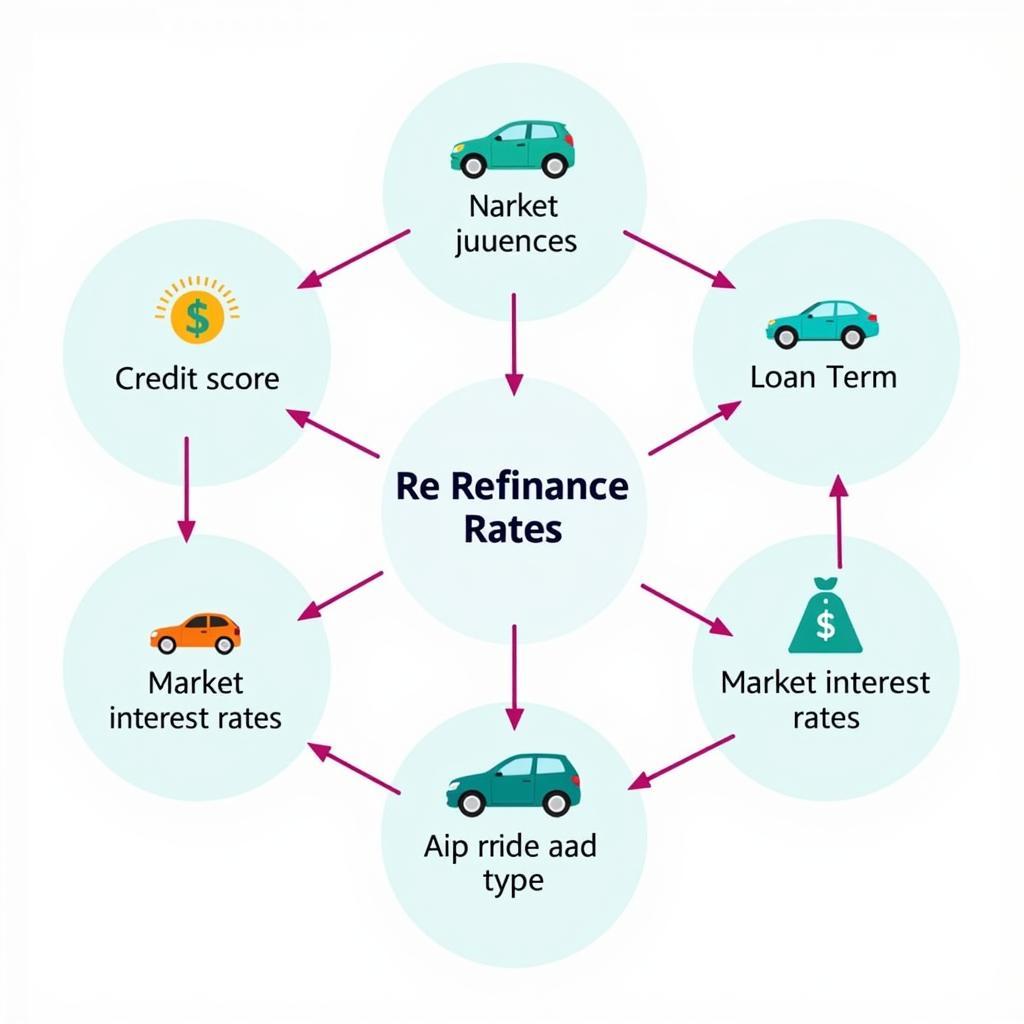

What Factors Influence Car Refinance Rates?

Several factors contribute to the car refinance rates offered by lenders. These include your credit score, the length of the loan term, the age and type of vehicle, and the current market interest rates. Lenders assess these factors to determine the level of risk involved in refinancing your loan.

The Impact of Credit Score on Refinance Rates

Your credit score is a crucial factor in determining the interest rate you’ll qualify for. A higher credit score signals lower risk to lenders, resulting in more favorable interest rates. Conversely, a lower credit score can lead to higher interest rates. Improving your credit score before applying for refinancing can significantly impact the rates you’re offered.

Loan Term and Its Effect on Rates

The length of your loan term also plays a role in determining the interest rate. Shorter loan terms generally have lower interest rates but higher monthly payments. Longer loan terms can have higher interest rates but lower monthly payments. Consider your budget and long-term financial goals when choosing a loan term.

Vehicle Age and Type: How They Affect Refinance Rates

The age and type of your vehicle can also influence refinance rates. Newer vehicles in good condition typically qualify for better rates than older vehicles or those with high mileage. Lenders consider the vehicle’s value as collateral for the loan.

Current Market Interest Rates and Their Influence

Prevailing market interest rates have a direct impact on car refinance rates. These rates fluctuate based on economic conditions and central bank policies. Staying informed about market trends can help you time your refinancing application strategically.

Factors influencing car refinance rates

Factors influencing car refinance rates

How to Find the Best Car Refinance Rates

Finding the best car refinance rates requires research and comparison shopping. Obtain quotes from multiple lenders, including banks, credit unions, and online lenders. Don’t settle for the first offer you receive. Comparing offers allows you to identify the most competitive rates and terms. Checking resources like best car refinance rates can be a great starting point.

Utilizing Online Tools for Rate Comparison

Online tools and calculators can simplify the process of comparing refinance rates. These tools allow you to input your loan details and receive personalized quotes from various lenders. This saves you time and effort compared to contacting lenders individually. You can even use a car loan finance calculator to get an estimate.

Negotiating with Lenders for Better Rates

Don’t hesitate to negotiate with lenders to secure a better rate. If you’ve received a lower offer from another lender, use it as leverage to negotiate a more favorable rate with your preferred lender. Lenders are sometimes willing to match or beat competitor offers.

When Is Refinancing Your Car Loan a Good Idea?

Refinancing your car loan can be a beneficial financial decision in certain circumstances. If interest rates have dropped since you took out your original loan, refinancing can lower your monthly payments and save you money on interest. It’s also a good idea to consider refi car loan rates if your credit score has improved.

When car refinancing is a good idea

When car refinancing is a good idea

When Interest Rates Fall

Lower interest rates can significantly reduce your overall loan cost. If current rates are lower than your existing rate, refinancing can save you substantial money over the life of your loan.

When Your Credit Score Improves

A better credit score can qualify you for lower interest rates. If your credit score has improved since you obtained your initial loan, refinancing can lead to better terms and lower monthly payments.

How Much Will My Car Payment Be After Refinancing?

Determining how much your car payment will be after refinancing requires calculating the new loan amount, interest rate, and loan term. Use online calculators or consult with a financial advisor to estimate your new monthly payment. Sites like how much will my car payment be can help you determine this.

“Refinancing your car loan can be a smart financial decision if you approach it strategically. Understanding the factors that influence rates and comparing offers from multiple lenders is crucial to securing the best possible terms.” – John Smith, Senior Auto Finance Advisor.

In conclusion, car refinance rates are dynamic and influenced by a variety of factors. By understanding these factors and utilizing available resources, you can make informed decisions about refinancing your auto loan and potentially save significant money. Don’t hesitate to explore your options and secure the best car refinance rates available.

FAQ

- What is car refinancing?

- How does car refinancing work?

- What are the benefits of car refinancing?

- What are the risks of car refinancing?

- How can I improve my chances of getting approved for car refinancing?

- What documents do I need for car refinancing?

- How long does the car refinancing process take?

Need More Help?

For further assistance, contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our customer service team is available 24/7.