Understanding your car loan rate is crucial before signing on the dotted line. A car loan rate calculator empowers you to estimate your monthly payments and make informed decisions. This guide will delve into the intricacies of car loan rate calculators, providing you with the knowledge you need to navigate the car financing landscape.

Deciphering the Car Loan Rate Calculator

A car loan rate calculator is a powerful tool that helps you estimate your monthly car payments based on several factors: loan amount, interest rate, and loan term. By inputting these values, you can quickly see how different interest rates or loan terms impact your overall cost. This allows you to compare offers from different lenders and choose the best option for your budget. It’s also a great way to pre-qualify for a car loan and get a better understanding of what you can afford. After all, knowing your potential monthly payments before you step into a dealership can greatly reduce stress and help you negotiate effectively. You can find a payment calculator for car online to get started.

Key Factors Affecting Your Car Loan Rate

Several key factors influence your car loan rate. Your credit score is a significant factor, as lenders use it to assess your creditworthiness. A higher credit score generally qualifies you for lower interest rates, saving you money over the life of the loan. The loan term also plays a role. Longer loan terms typically result in lower monthly payments but higher overall interest paid. The type of vehicle you purchase, whether it’s new or used, also affects the interest rate offered by lenders. Finally, the lender itself plays a role. Different lenders have varying lending criteria and interest rate structures.

Credit Score’s Impact on Car Loan Rates

Your credit score is a numerical representation of your credit history. A higher credit score indicates lower risk for lenders, resulting in favorable interest rates. Conversely, a lower credit score might lead to higher interest rates or even loan denial. Checking your credit report regularly and addressing any errors can improve your credit score and, consequently, your car loan rate.

Using a Car Loan Rate Calculator Effectively

Using a car loan rate calculator effectively requires accurate information input. Start by determining the loan amount, which is the total cost of the vehicle minus any down payment. Next, research current auto loan rates to input a realistic interest rate. The loan term, typically expressed in months, should align with your budget and financial goals. Experimenting with different values allows you to understand the interplay between these factors and their impact on your monthly payment. If you are interested in new or used cars, check out our new used cars for sale site.

Understanding Loan Amortization

Loan amortization is the process of gradually paying down your loan principal over time. Each monthly payment consists of both principal and interest. In the early stages of the loan, a larger portion of your payment goes towards interest. As you progress, more of your payment is applied to the principal. Understanding this process helps you appreciate the long-term cost of your loan and make informed decisions.

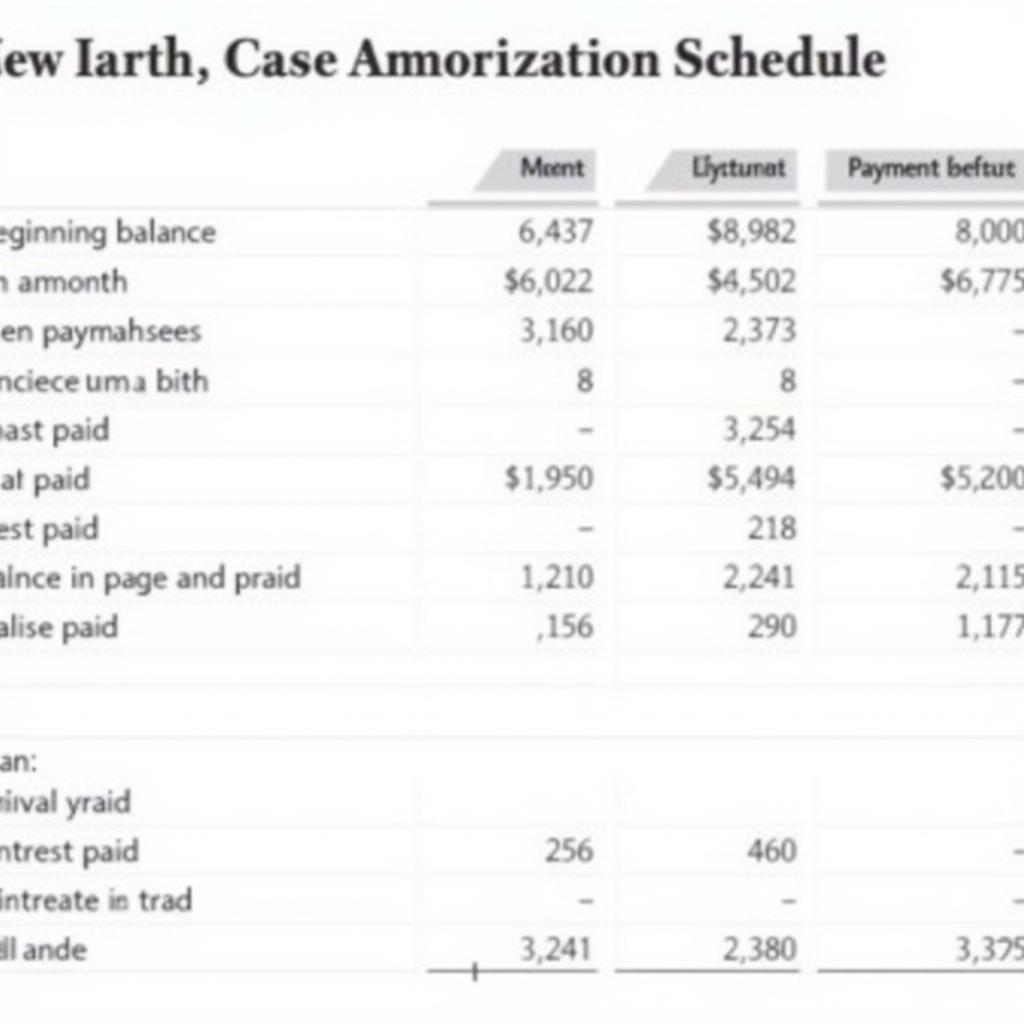

Loan Amortization Schedule Example

Loan Amortization Schedule Example

Tips for Securing the Best Car Loan Rate

Shopping around for the best car loan rates is crucial. Comparing offers from multiple lenders, including banks, credit unions, and online lenders, allows you to identify the most competitive rates. Negotiating the terms of your loan, such as the interest rate and loan term, can also save you money. Consider making a larger down payment to reduce the loan amount and potentially secure a better interest rate. If you’re interested in special financing deals, explore options like 0 percent financing for 72 months cars.

Exploring Different Loan Options

Explore various loan options, including secured and unsecured loans. Secured loans, typically backed by collateral like the vehicle itself, often offer lower interest rates. Unsecured loans, which don’t require collateral, may come with higher interest rates. Understanding the pros and cons of each loan type helps you choose the best fit for your financial situation. You can also look into specific options like a pnc car loan.

Conclusion

A car loan rate calculator is an indispensable tool for anyone considering financing a vehicle. By understanding how to use the calculator effectively and the factors that influence your loan rate, you can navigate the car buying process with confidence and secure the best possible financing terms. Remember to shop around, compare offers, and negotiate to minimize your overall cost and drive away in the car of your dreams without breaking the bank. A monthly payment calculator car can be very helpful in this process.

FAQ

-

What is APR?

APR (Annual Percentage Rate) represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage. -

How does my credit score affect my car loan rate?

A higher credit score generally qualifies you for lower interest rates. -

What is a good car loan rate?

A good car loan rate varies based on market conditions and your credit score, but it’s always wise to shop around and compare offers. -

Can I pre-qualify for a car loan?

Yes, pre-qualifying allows you to get an estimate of your loan terms and interest rate without impacting your credit score. -

What is the difference between a secured and unsecured car loan?

Secured loans are backed by collateral, typically the car itself, while unsecured loans do not require collateral. -

How can I lower my car loan rate?

Improving your credit score, making a larger down payment, and shopping around for the best rates can help lower your car loan rate. -

What is the typical loan term for a car loan?

Car loan terms typically range from 36 to 72 months.

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.