Finding affordable car insurance can be a challenge, especially when aiming for a $2000 annual premium. This price point can offer a good balance between cost and coverage, but navigating the insurance landscape requires careful consideration of various factors. This article will explore strategies for securing car insurance around $2000, covering key aspects like coverage types, factors influencing premiums, and tips for comparing quotes.

Finding a car with a market value under $2000 can also significantly influence your insurance costs, as you might consider opting for liability-only coverage. You can learn more about evaluating car market value on our dedicated page: car market value.

Understanding Car Insurance Costs and Coverage

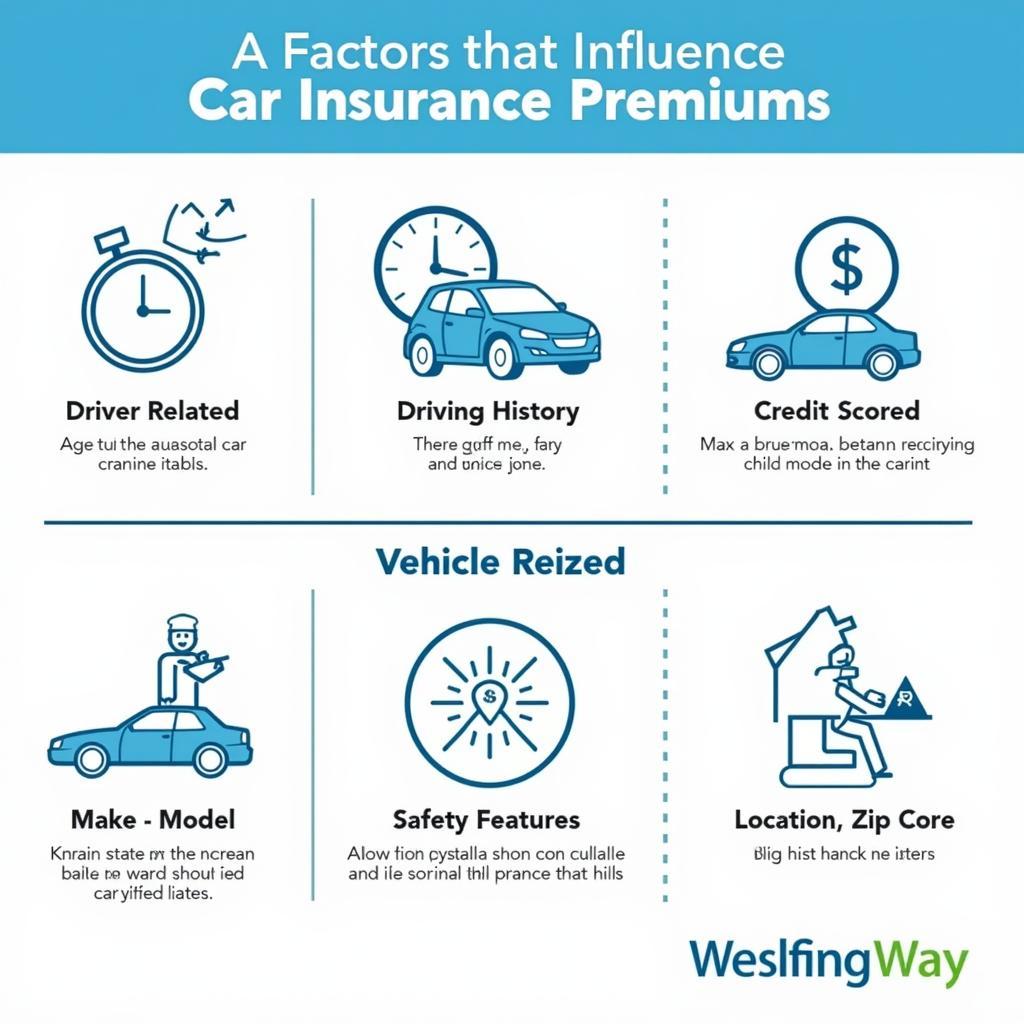

Several factors contribute to the cost of your car insurance premium. Your driving history, age, location, the type of vehicle you drive, and the coverage you choose all play a role. Comprehensive and collision coverage are optional but valuable, protecting your vehicle from damage caused by accidents, theft, or natural disasters. Liability coverage, however, is mandatory in most states and covers damages you cause to others in an accident.

For those seeking more budget-friendly car options, exploring used cars priced under $2000 can be a smart strategy. Check out our listings of used cars for sale under 2000 for some potential options.

Decoding Your Car Insurance Policy

Understanding the different types of coverage within a car insurance policy is crucial. Liability coverage, as mentioned, is essential, while comprehensive and collision provide additional protection for your own vehicle. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with someone who lacks sufficient insurance. Medical payments or personal injury protection (PIP) covers medical expenses for you and your passengers, regardless of fault.

Finding Car Insurance for $2000: Strategies and Tips

Achieving a $2000 car insurance premium often involves strategic planning. Comparing quotes from multiple insurers is essential to ensure you’re getting the best possible rate. Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can also lead to discounts. Maintaining a clean driving record is another significant factor in lowering your premium. Consider increasing your deductible to lower your monthly payments, but be prepared to pay more out of pocket if you file a claim.

If you are considering renting a car for an extended period, it’s important to understand the associated costs. Check our guide on how much to rent a car for a month to get a better understanding of rental expenses.

Factors Influencing Your Car Insurance Premium

Beyond the coverage you choose, other factors can significantly influence your premium. Your age, driving history, location, credit score, and even the make and model of your car all play a role. Vehicles considered safer or less prone to theft are often associated with lower premiums.

“Understanding the factors influencing your premium empowers you to make informed decisions,” says insurance expert, Sarah Miller, Senior Actuary at Insurance Insights. “From choosing the right vehicle to maintaining a clean driving record, proactive steps can significantly impact your insurance costs.”

Factors affecting car insurance premiums visualized in a chart

Factors affecting car insurance premiums visualized in a chart

Comparing Quotes and Securing the Best Deal

Comparing quotes from multiple insurance providers is paramount when searching for car insurance around $2000. Online comparison tools can simplify this process, allowing you to quickly compare rates and coverage options. Don’t hesitate to contact insurers directly to discuss discounts and negotiate better rates.

Minor car scrapes can also impact your insurance premiums if you decide to file a claim. Understanding the repair costs can help you make an informed decision. Visit our resource on how much are car scrape repairds for more details.

Tips for Comparing Car Insurance Quotes

When comparing quotes, focus not just on the price but also on the coverage offered. Ensure the policy meets your specific needs and provides adequate protection. Read reviews of different insurers to gauge their customer service and claims handling processes.

“Don’t just chase the lowest price,” advises David Chen, Independent Insurance Broker. “Focus on finding a reputable insurer with a strong track record of customer satisfaction and efficient claims processing.”

Comparing car insurance quotes online using a comparison website

Comparing car insurance quotes online using a comparison website

Conclusion

Securing car insurance for around $2000 requires careful consideration of your needs, driving profile, and budget. By understanding the factors influencing premiums, comparing quotes effectively, and exploring available discounts, you can find the right coverage without breaking the bank. Remember, a $2000 car insurance policy can provide valuable protection and peace of mind on the road.

FAQ

- What is the average cost of car insurance?

- How can I lower my car insurance premium?

- What is the difference between liability, comprehensive, and collision coverage?

- How does my driving record affect my insurance rate?

- What are the benefits of bundling insurance policies?

- How do I choose the right deductible?

- How often should I compare car insurance quotes?

For those interested in high-end vehicle rentals, explore our exotic car rental houston page for exciting options.

Need more help? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team ready to assist you.