This comprehensive guide explores the ins and outs of car payment calculators and how they can help you make informed decisions about your next car purchase. Whether you’re a first-time buyer or a seasoned car owner, understanding car payments is crucial to avoid financial strain and achieve your automotive goals.

Why Use a Car Payment Calculator?

Car payment calculators are online tools that estimate your monthly car payments based on various factors like the car’s price, down payment, loan term, and interest rate. Using a car payment calculator offers numerous benefits, including:

- Budgeting and Financial Planning: Predicting your monthly payments helps you establish a realistic budget and plan for car ownership expenses.

- Comparing Loan Options: You can easily compare different loan terms and interest rates to find the most affordable option.

- Assessing Affordability: Calculate your potential payments before you even start shopping for a car, helping you determine a price range you can comfortably afford.

- Understanding the Impact of Down Payment: See how a larger down payment reduces your monthly payments and overall borrowing costs.

- Exploring Different Loan Scenarios: Experiment with different loan terms and interest rates to see how they affect your payments.

How to Use a Car Payment Calculator Effectively

While using a car payment calculator is simple, several tips can maximize its effectiveness:

-

Gather Essential Information: Before you start, have the following information ready:

- Vehicle Price: The negotiated price of the car you’re considering.

- Down Payment: The amount of money you plan to pay upfront.

- Loan Term: The length of the loan, typically ranging from 3 to 7 years.

- Interest Rate: The annual percentage rate (APR) quoted by lenders.

-

Explore Different Scenarios: Play around with different variables to see how they impact your payments. For example, consider the impact of:

- Higher Down Payment: A larger down payment reduces the amount you need to borrow, leading to lower monthly payments.

- Shorter Loan Term: A shorter loan term typically means a higher monthly payment but less interest paid over the loan’s duration.

- Lower Interest Rate: A lower interest rate reduces the overall cost of borrowing, resulting in lower monthly payments.

-

Factor in Additional Costs: Remember that your monthly car payments are only part of the overall cost of car ownership. Consider other expenses like:

- Car Insurance: Premiums vary depending on your vehicle, location, and driving history.

- Maintenance and Repairs: Allocate funds for regular maintenance and unexpected repairs.

- Fuel Costs: Factor in the cost of gasoline based on your driving habits and fuel efficiency.

Key Factors Affecting Your Car Payment

Several factors influence your car payment, and understanding their impact is crucial:

- Vehicle Price: The price of the car is the most significant factor determining your monthly payments. A higher price typically leads to higher payments.

- Down Payment: A larger down payment reduces the amount you need to finance, resulting in lower monthly payments.

- Loan Term: The loan term (duration) affects your monthly payment. A shorter term generally means a higher monthly payment but less interest paid over the loan’s duration. A longer term means a lower monthly payment, but you’ll pay more interest overall.

- Interest Rate: The interest rate charged by the lender directly impacts your monthly payments. Lower interest rates lead to lower monthly payments, while higher interest rates result in higher payments.

Expert Insights on Car Payment Calculators

“Car payment calculators are essential tools for budgeting and making smart financial decisions. They help you avoid overspending on a car and ensure you can comfortably handle your monthly expenses.” – [Expert Name], [Title] at [Organization]

“By experimenting with different loan terms and interest rates, you can find the most cost-effective financing option that aligns with your budget and financial goals.” – [Expert Name], [Title] at [Organization]

Conclusion: Empowering You to Drive with Confidence

Car payment calculators are invaluable tools for making informed car purchase decisions. By understanding how these calculators work, you can effectively budget for car ownership, compare loan options, and make informed choices that align with your financial goals. With a little planning and research, you can confidently embark on your next automotive journey while staying within your financial limits.

FAQ

Q: What is the difference between a car payment calculator and a loan calculator?

A: A car payment calculator is specifically designed for car loans, considering factors like vehicle price, down payment, and loan term. Loan calculators are more general and can be used for various loan types.

Q: How accurate are car payment calculators?

A: Car payment calculators provide estimates based on the information you input. The accuracy depends on the calculator’s algorithm and the completeness of the data you provide.

Q: What should I do if my car payment is too high?

A: If your estimated car payment is too high, consider:

- Negotiating a lower vehicle price

- Increasing your down payment

- Exploring financing options with lower interest rates

- Choosing a car with a lower price tag

- Considering a used car instead of a new one

Q: Can I use a car payment calculator to determine the price range I can afford?

A: Yes, you can input different car prices and see how they affect your monthly payments. This can help you establish a realistic budget for your car purchase.

Q: Should I use a car payment calculator before or after visiting a dealership?

A: Ideally, use a car payment calculator before visiting a dealership. This will give you a better understanding of your affordability and help you avoid getting pressured into financing options you can’t afford.

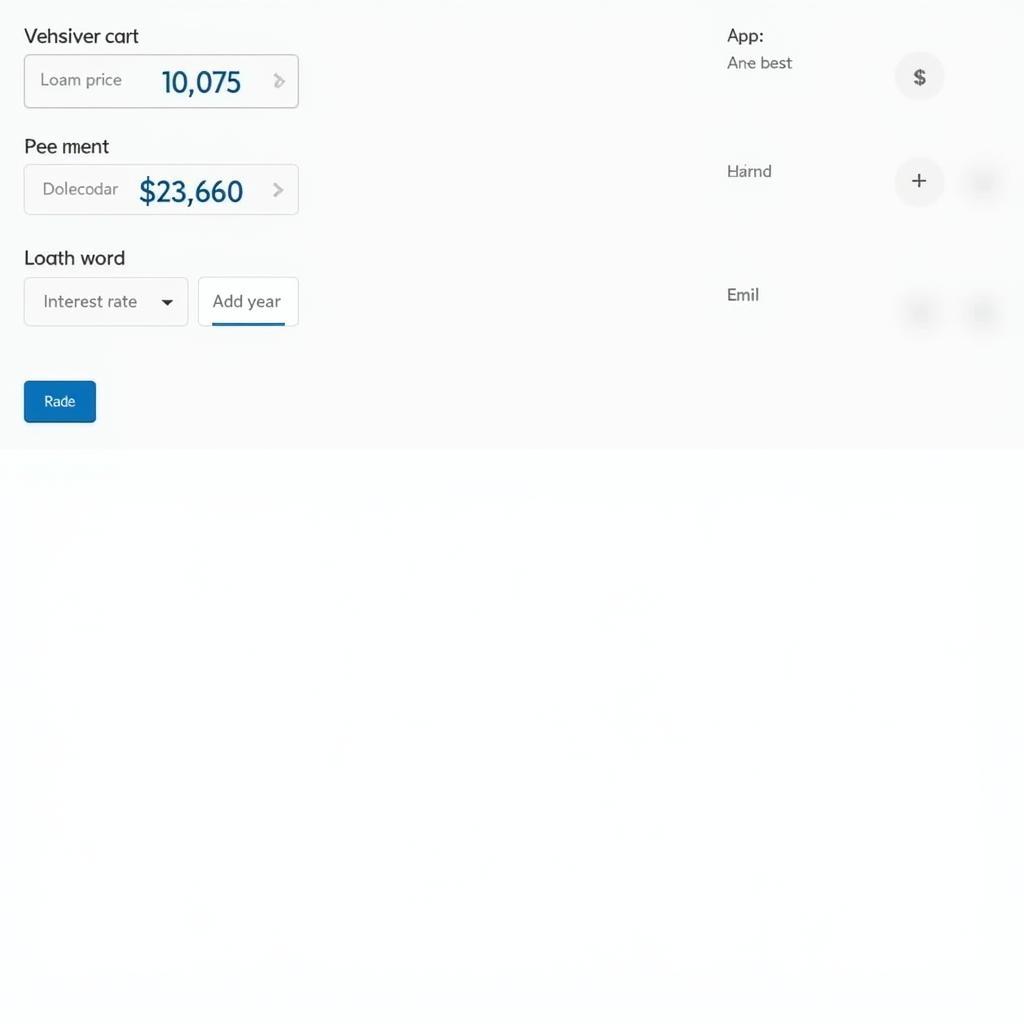

Using an online car payment calculator to estimate monthly payments

Using an online car payment calculator to estimate monthly payments

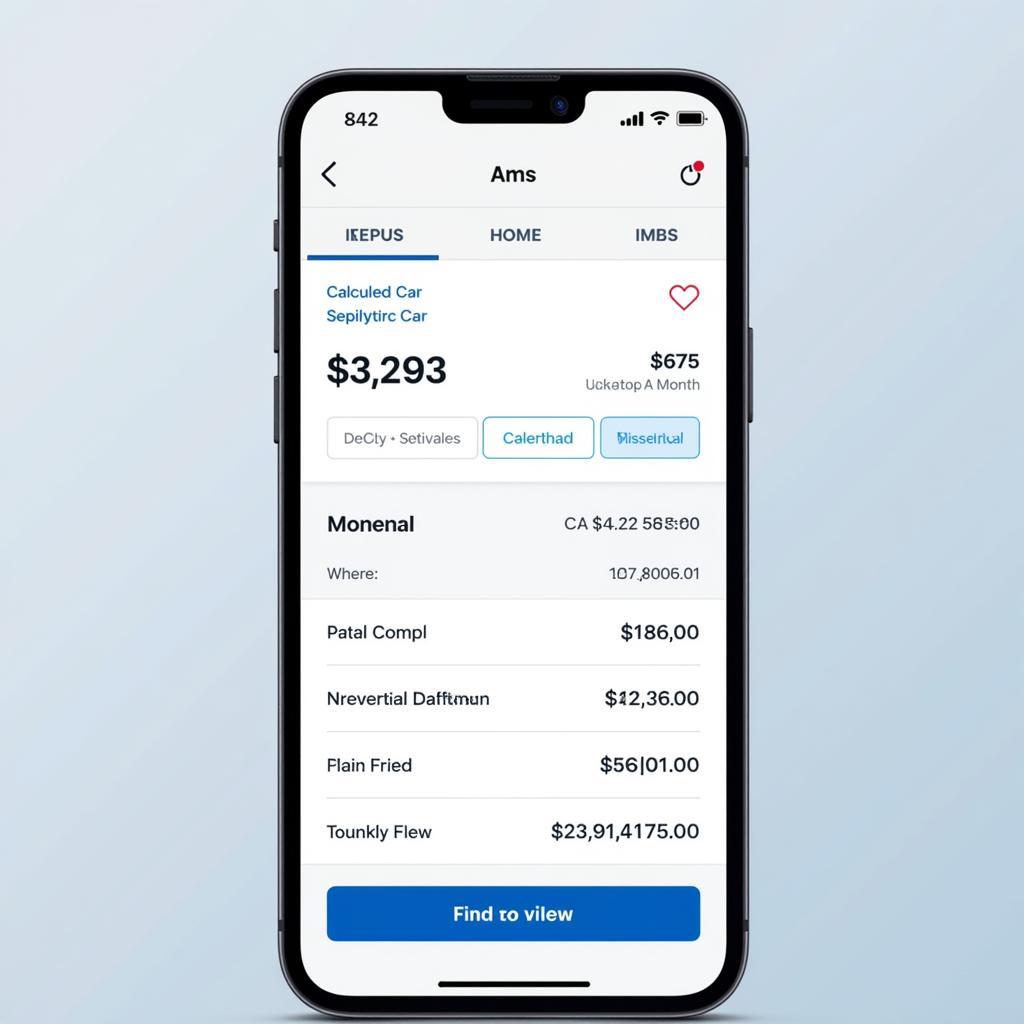

Car payment calculator mobile app interface

Car payment calculator mobile app interface

Financial advisor using car payment calculator with client

Financial advisor using car payment calculator with client

When you need assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at: 276 Reock St, City of Orange, NJ 07050, United States. We have 24/7 customer service.