Understanding your car loan terms is crucial before signing on the dotted line. A car auto loan calculator is a powerful tool that empowers you to make informed decisions, estimate monthly payments, and navigate the complexities of auto financing. It allows you to explore various loan scenarios and find the best fit for your budget. Use a car auto loan calculator to compare interest rates, loan terms, and down payments before you even step foot in a dealership.

Unlocking the Power of a Car Auto Loan Calculator

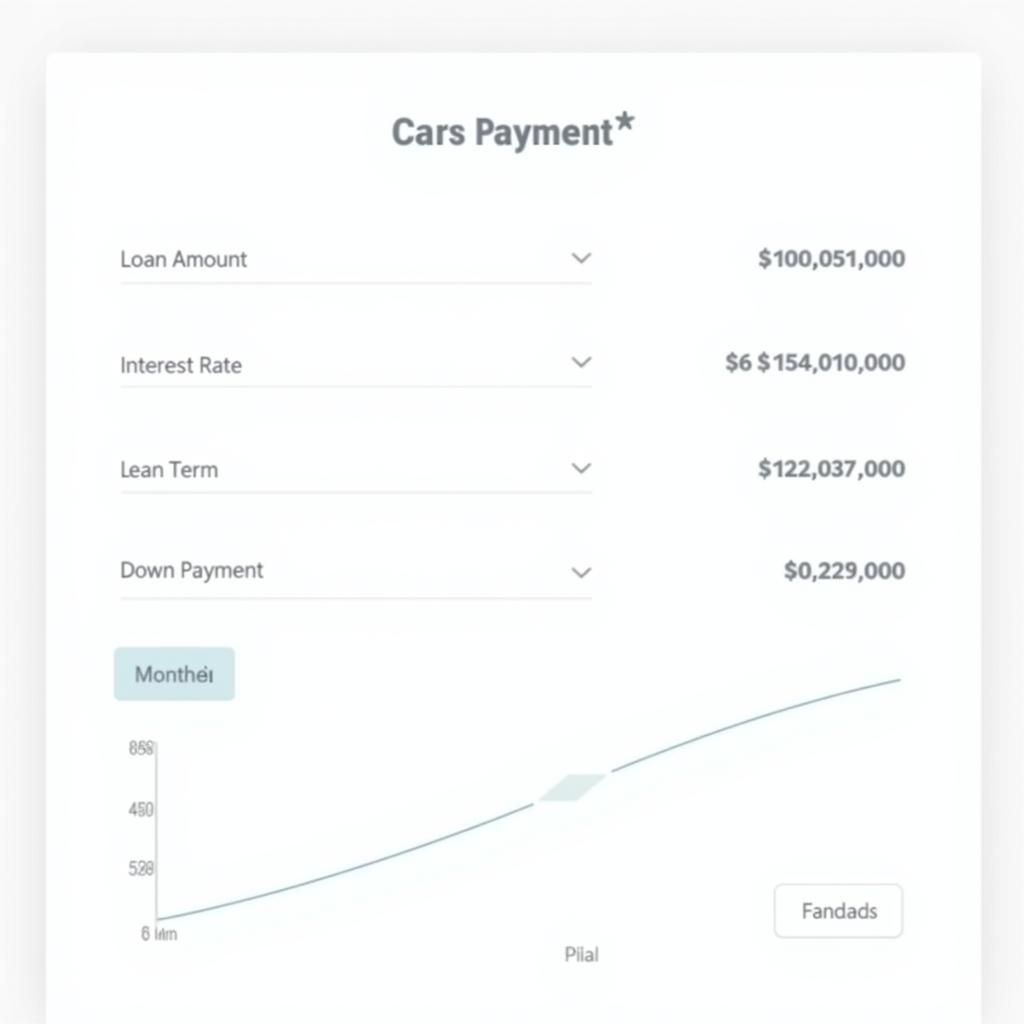

A car auto loan calculator is essentially a software program designed to estimate the monthly payments on a car loan. By inputting key details like loan amount, interest rate, and loan term, you can quickly see how these factors interact and impact your overall cost. It’s a simple yet effective way to gain control over your car financing and avoid potential financial pitfalls. Using a car loan finance calculator helps you visualize the long-term cost of your vehicle and plan accordingly.

How a Car Auto Loan Calculator Works

The mechanics behind a car auto loan calculator are straightforward. It uses a mathematical formula to calculate your monthly payment based on the loan amount, annual percentage rate (APR), and loan term. The formula takes into account the principle, which is the amount you borrow, and the interest accrued over the loan term. You can experiment with different input values to see how they affect your monthly payment. For instance, increasing your down payment reduces the loan amount and subsequently lowers your monthly payments.

Car Loan Calculator Interface

Car Loan Calculator Interface

Key Benefits of Using a Car Auto Loan Calculator

The advantages of using a car auto loan calculator are numerous, and it is an invaluable tool for anyone considering buying a car. It allows you to:

- Budget Effectively: Determine a comfortable monthly payment that aligns with your financial goals.

- Compare Loan Offers: Evaluate different loan offers from various lenders to find the most competitive rates.

- Negotiate with Confidence: Armed with accurate payment estimations, you can negotiate effectively with dealerships.

- Avoid Overspending: By setting realistic budget parameters, you can avoid taking on a loan you can’t afford.

- Save Money: Choosing the optimal loan terms can save you a significant amount of money over the life of the loan.

Understanding Loan Terms

Familiarizing yourself with key loan terminology is essential when using a car auto loan calculator. Here’s a quick breakdown:

- Loan Amount: The total amount of money you borrow to purchase the car.

- Interest Rate (APR): The annual percentage rate charged on the loan amount.

- Loan Term: The length of time you have to repay the loan, typically measured in months.

- Down Payment: The upfront payment you make towards the purchase price, reducing the loan amount.

Choosing the Right Car Auto Loan Calculator

With a plethora of car auto loan calculators available online, it’s important to choose a reliable and accurate one. Look for calculators provided by reputable financial institutions or automotive websites. An amortization calculator for car loans can provide a detailed breakdown of your payments over time. Ensure the calculator takes into account all relevant factors, such as taxes and fees, to provide the most accurate estimate. Consider trying an amortization calculator car loan for a comprehensive overview of your loan repayment schedule.

Factors Affecting Your Car Loan

Several factors influence your car loan terms and interest rates, including:

- Credit Score: A higher credit score typically qualifies you for lower interest rates.

- Income: Lenders consider your income to assess your ability to repay the loan.

- Debt-to-Income Ratio: Your overall debt compared to your income is a key factor in loan approval.

- Loan Term: Longer loan terms result in lower monthly payments but higher overall interest costs.

- Down Payment: A larger down payment reduces the loan amount and often leads to better interest rates.

When considering refinancing, a refinance calculator car is helpful. A financing calculator car can assist with initial financing planning.

Conclusion: Making Informed Decisions with a Car Auto Loan Calculator

A car auto loan calculator is an indispensable tool for anyone navigating the complexities of auto financing. By leveraging this powerful tool, you can make informed decisions, secure the best loan terms, and drive away with confidence. Using a car auto loan calculator empowers you to take control of your finances and embark on your car buying journey with clarity and peace of mind.

FAQ

- What is APR? APR stands for Annual Percentage Rate and represents the yearly interest rate on your loan.

- How does my credit score affect my car loan? A higher credit score typically results in lower interest rates.

- What is a down payment? A down payment is an upfront payment made towards the purchase price, reducing the loan amount.

- How long is a typical car loan term? Car loan terms typically range from 36 to 72 months.

- Can I refinance my car loan? Yes, refinancing your car loan is often possible to secure better interest rates.

- How can I improve my credit score? Paying bills on time, reducing debt, and avoiding new credit applications can help improve your credit score.

- What is a good debt-to-income ratio for a car loan? A debt-to-income ratio below 43% is generally considered favorable for loan approval.

Do you have any more questions regarding car auto loans, or perhaps you are interested in learning more about specific car models and their financing options? Explore our website for further resources and insights!

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our customer service team is available 24/7.