Finding the best insurance for car ownership can feel overwhelming. With so many providers, policy types, and coverage options, it’s easy to get lost in the details. This guide will navigate you through the process of finding the best car insurance to fit your needs and budget.

Understanding Your Car Insurance Needs

Before you start comparing car insurance quotes new york, it’s essential to understand your individual needs. Consider factors like your driving history, the value of your car, your budget, and the level of coverage you’re comfortable with. Are you a new driver requiring more comprehensive coverage? Do you have an older vehicle where liability-only coverage might be sufficient? Thinking through these questions is the first step.

What type of coverage do I need? There are several types of car insurance coverage, including liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection, and more. Understanding each type is crucial for choosing the right combination for your needs. Liability coverage, for example, is legally required in most states and covers damages you cause to others in an accident.

What factors affect my insurance premium? Several factors affect your car insurance premium, including your age, driving record, location, the type of car you drive, and the coverage you choose. Even your credit score can play a role in some states. Understanding these factors will help you anticipate and manage your insurance costs.

Researching and Comparing Car Insurance Providers

Once you understand your needs, it’s time to research and compare different car insurance providers. Don’t settle for the first quote you receive. Use online comparison tools, check with car insurance brokers, and read reviews to find reputable companies with competitive rates. Look beyond the price and consider the provider’s reputation for customer service and claims processing.

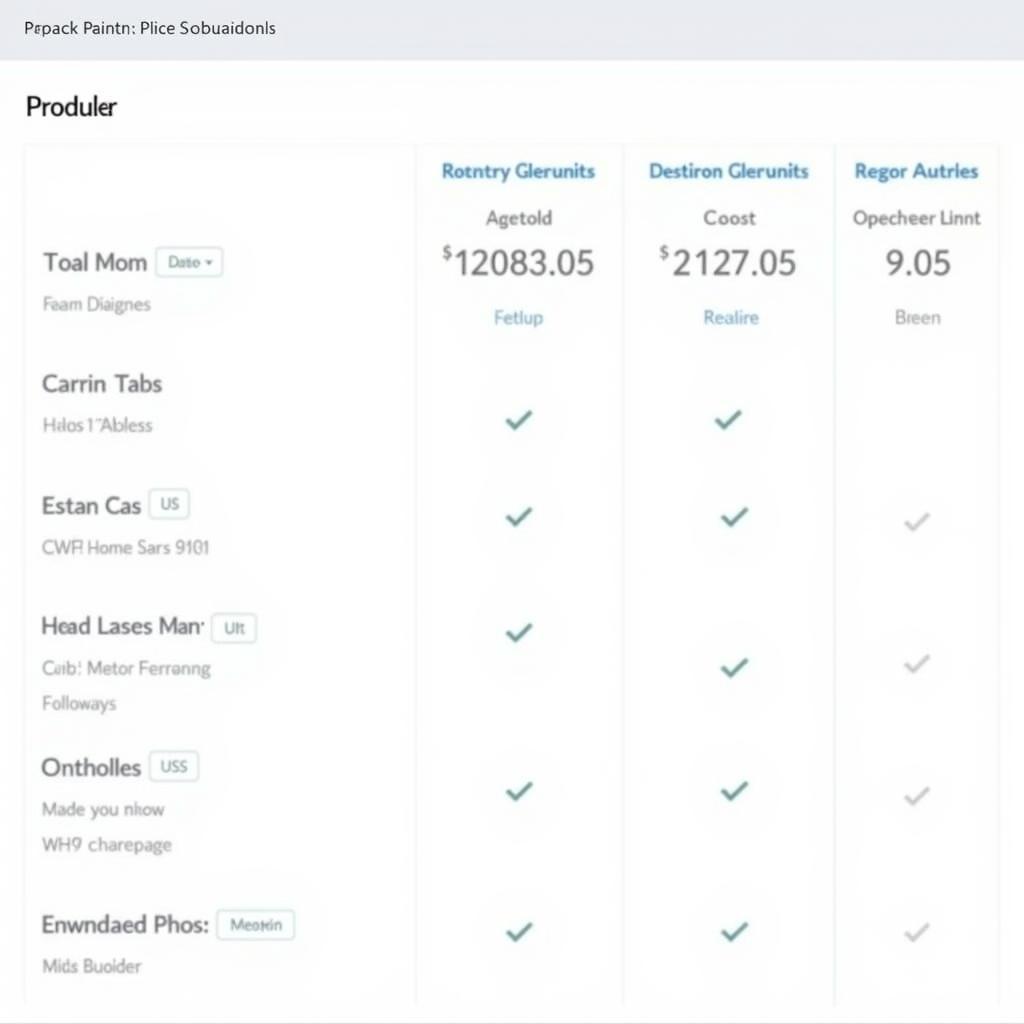

How do I compare car insurance quotes? Comparing quotes involves more than just looking at the bottom line. Pay close attention to the coverage limits, deductibles, and any additional benefits offered by each provider. Ensure you’re comparing apples to apples in terms of coverage before making a decision.

Where can I find reliable car insurance reviews? Reputable websites and consumer advocacy groups offer independent reviews of car insurance companies. These reviews can give you valuable insights into the experiences of other customers, including their satisfaction with claims handling and customer service.

Comparing Car Insurance Quotes Online

Comparing Car Insurance Quotes Online

Tips for Saving Money on Car Insurance

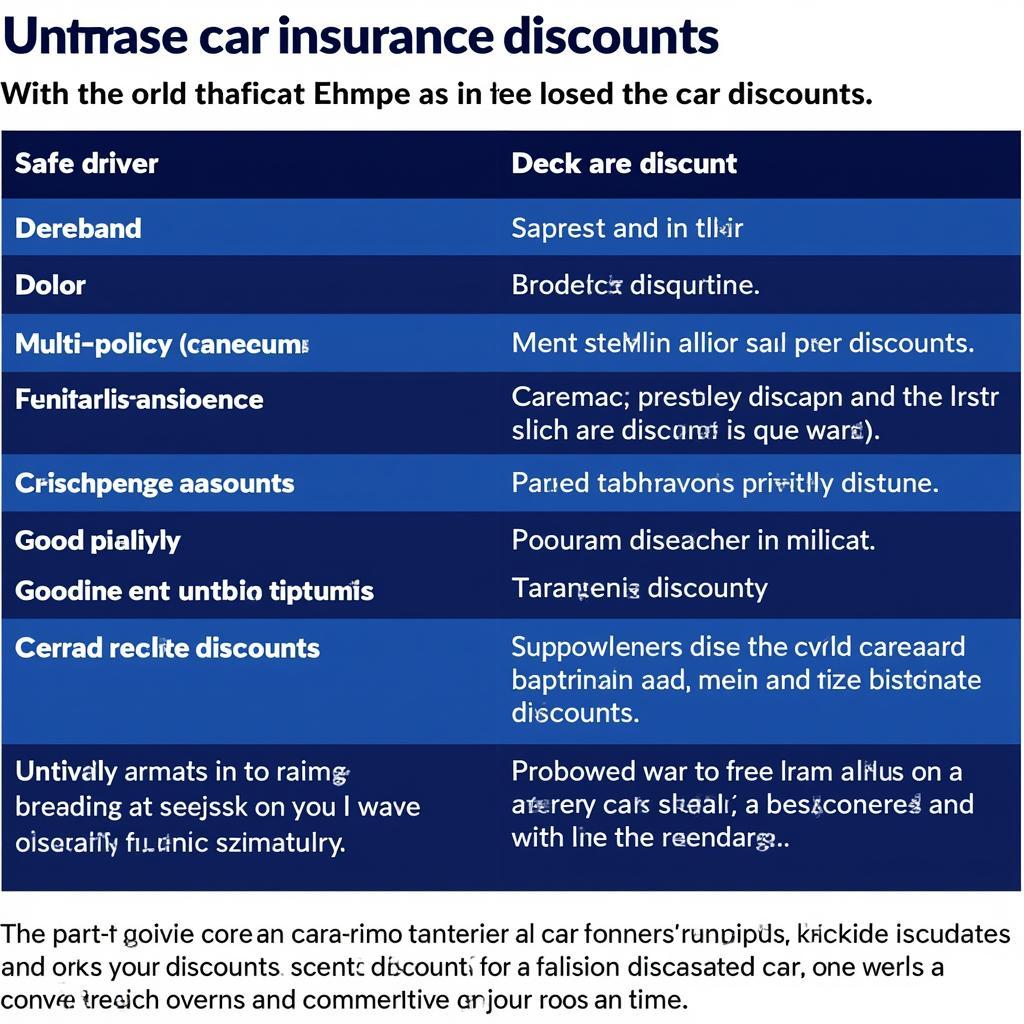

Saving money on car insurance is always a good idea. Explore discounts offered by insurers, such as safe driver discounts, multi-policy discounts, and good student discounts. Consider increasing your deductible to lower your premium, but ensure you can comfortably afford the deductible in the event of an accident. Regularly review your policy and compare rates with other providers to ensure you’re still getting the best deal.

What are the common car insurance discounts? Many insurers offer discounts for things like bundling your car insurance with your homeowners or renters insurance, installing anti-theft devices in your car, completing a defensive driving course, and maintaining a good driving record.

How does my deductible affect my premium? Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but it also means you’ll pay more if you have a claim. Choose a deductible you can comfortably afford.

Car Insurance Discount Options

Car Insurance Discount Options

Getting the Best Insurance for Your Car

Finding the best car insurance requires careful research and comparison. By understanding your needs, comparing providers, and exploring ways to save money, you can find a policy that offers the right protection at a price you can afford. Don’t be afraid to ask questions and seek professional advice if needed. Remember, the best insurance for car owners is the one that best suits their individual circumstances.

FAQ

- What is the minimum car insurance required by law? This varies by state. Check with your state’s Department of Motor Vehicles.

- How often should I review my car insurance policy? At least annually, or whenever your driving habits or circumstances change significantly.

- What should I do after a car accident? Contact your insurance company immediately to report the accident and begin the claims process.

- Can I get car insurance with a bad driving record? Yes, but it will likely be more expensive.

- How can I lower my car insurance premium? Consider increasing your deductible, bundling policies, or maintaining a clean driving record.

- What is gap insurance? Gap insurance covers the difference between what you owe on your car loan and the actual cash value of your car in the event of a total loss.

- Do I need rental car coverage? This optional coverage pays for a rental car while your vehicle is being repaired after an accident.

Finding a Car Insurance Quote

You can find fl car insurance quotes and car insuranse quote by searching online. You can also use a car insurance compare quote tool.

When you need support, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.