Understanding the Autel stock price is crucial for anyone interested in investing in this innovative company. This article delves into the factors influencing Autel’s stock performance, providing valuable insights for potential and current investors. We’ll explore the company’s background, its diverse product lines, and the market forces that impact its valuation.

Deciphering the Autel Stock Price

Autel Robotics, a leading player in the drone and automotive diagnostics industries, has seen fluctuating stock prices in recent years. Several factors contribute to these fluctuations, including market trends, technological advancements, and overall economic conditions. Analyzing these factors is essential for understanding the potential risks and rewards of investing in Autel. Navigating the complexities of the stock market requires careful consideration of these elements.

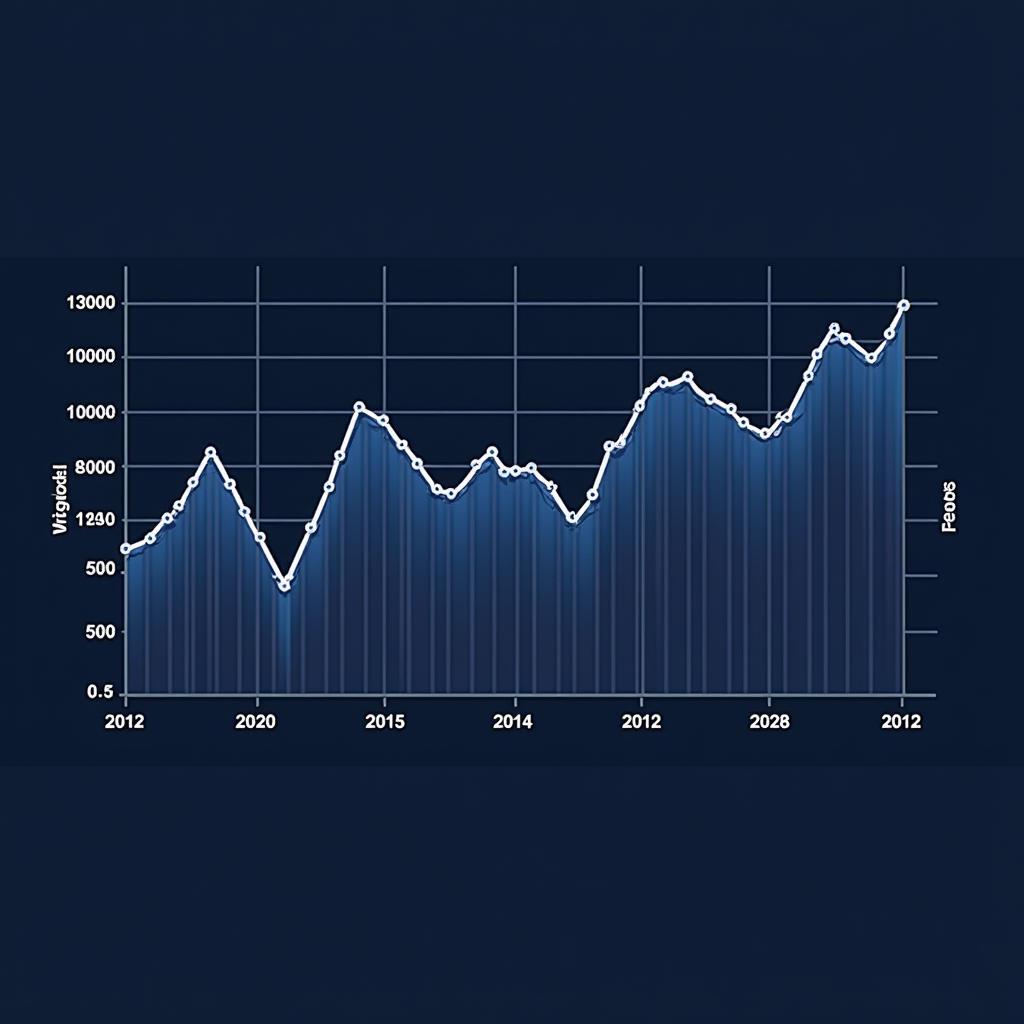

Autel Stock Price Chart Over Time

Autel Stock Price Chart Over Time

One key factor influencing the Autel stock price is the company’s performance in the rapidly evolving drone market. Autel’s innovative drone technology, including its EVO series, has garnered significant attention. The demand for commercial drones in various sectors like agriculture, construction, and surveillance continues to rise, potentially impacting Autel’s stock positively. However, competition within the drone industry remains fierce, requiring constant innovation and strategic marketing to maintain a competitive edge.

Understanding Autel’s Business Model

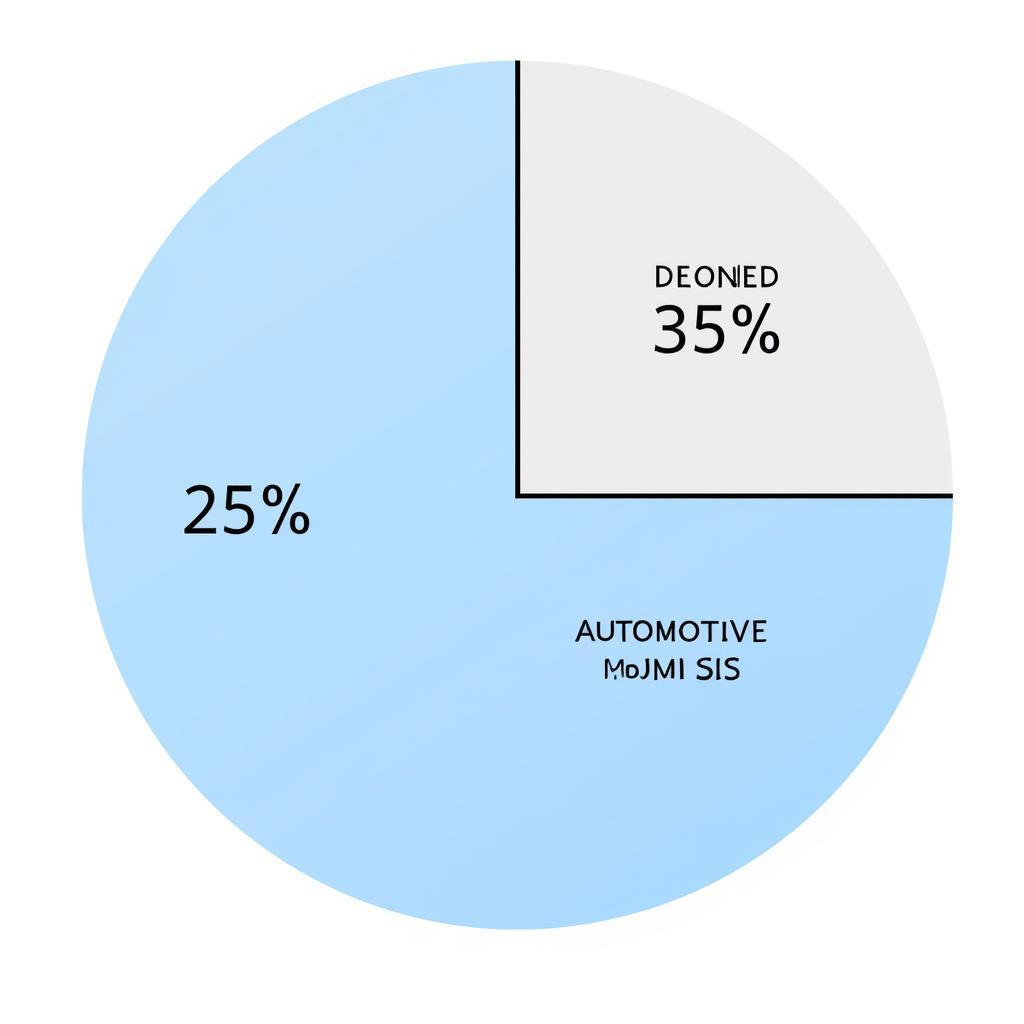

Autel operates across two primary sectors: drone technology and automotive diagnostics. This diversification can impact the Autel stock price in different ways. While the drone market offers high growth potential, the automotive diagnostics sector provides a more established revenue stream. Understanding this dual focus is crucial for investors assessing the company’s overall financial health. You might also want to check the autel robotics stock price.

Autel's Business Segments: Drones and Automotive Diagnostics

Autel's Business Segments: Drones and Automotive Diagnostics

Factors Influencing Autel Stock Price

Several factors can impact the Autel stock price, both directly and indirectly. These include:

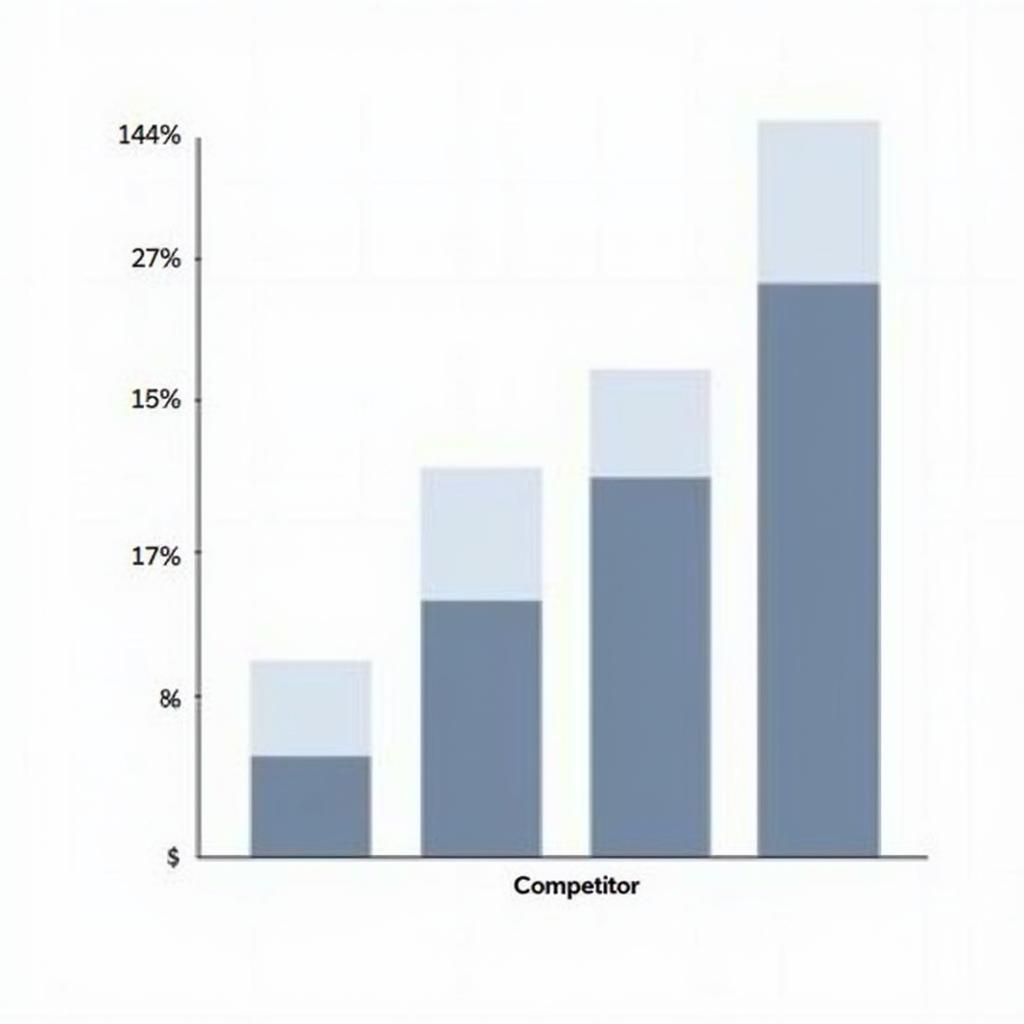

- Market Competition: The drone and automotive diagnostics markets are highly competitive. Autel’s ability to innovate and differentiate its products is crucial for maintaining market share and driving stock price growth.

- Technological Advancements: Rapid technological advancements can impact both positively and negatively. While Autel benefits from innovation, it also faces the risk of its technology becoming obsolete if it fails to keep pace. The autel ts401 with mobiletron tx-s008-4 sensors exemplifies this constant technological advancement.

- Economic Conditions: Overall economic conditions, such as recessions or periods of growth, can influence investor confidence and, consequently, stock prices.

- Regulatory Changes: Regulations surrounding drone usage and automotive standards can impact Autel’s operations and market access, potentially affecting its stock price.

- Company Performance: Factors such as revenue growth, profitability, and debt levels directly influence investor sentiment and Autel stock valuation. Considering the autel energy stock provides further insight into the company’s overall financial landscape.

“Staying informed about market dynamics and technological trends is paramount for navigating the complexities of Autel’s stock,” says David Miller, a senior market analyst at Tech Insights.

What is the current Autel stock price?

The current Autel stock price can be found on various financial websites and trading platforms. It’s essential to access real-time data for up-to-date information.

How has the Autel stock price performed historically?

Historical stock price data can provide valuable insights into Autel’s performance over time. Analyzing historical trends can help investors identify potential patterns and make more informed decisions. The mx808 autel autozone is a testament to the company’s presence in the automotive market.

Competitive Landscape of the Drone Market

Competitive Landscape of the Drone Market

“Autel’s diverse product portfolio, spanning both drones and automotive diagnostics, positions the company for potential growth across multiple markets. However, understanding the nuances of each market is crucial for assessing the company’s overall prospects,” adds Sarah Chen, a financial consultant specializing in tech investments. Consider checking the autel al619 autozone as an example of their automotive offerings.

Conclusion: Evaluating Autel as an Investment

The Autel stock price reflects a complex interplay of market forces, technological advancements, and company performance. While the company’s innovative products and diverse business model offer potential growth opportunities, investors should carefully consider the risks and rewards before making any investment decisions. Thorough research and analysis are essential for navigating the complexities of the Autel stock price.

FAQ

- Where can I find real-time Autel stock price information?

- What are the primary factors influencing Autel’s stock valuation?

- How does Autel’s performance in the drone market affect its stock price?

- What are the risks and rewards of investing in Autel stock?

- How does Autel’s diversification into automotive diagnostics impact its overall financial health?

- What are some key competitors in the drone and automotive diagnostics markets?

- How can I stay informed about the latest news and developments related to Autel?

When you need support, please contact WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.