Have you ever dreamt of driving a sleek, new car? Maybe you need a reliable vehicle for your daily commute or family adventures. But the cost of a car can be daunting. That’s where car loans come in. They allow you to finance your dream car and spread the payments over time. But getting approved for a car loan can feel like a mystery.

What Does “Applying for a Car Loan” Really Mean?

Applying for a car loan means requesting a financial institution to lend you money to purchase a vehicle. This loan is secured, meaning the car itself acts as collateral. If you default on payments, the lender can repossess the vehicle.

Understanding the Process from a Mechanic’s Perspective

As an auto mechanic specializing in European car electrical systems, I often see clients who struggle with financing. From a mechanic’s perspective, applying for a car loan is the first step in a long journey. It’s about finding the right vehicle within your budget and securing the funds to purchase it.

How the Loan Process Works from a Financial Perspective

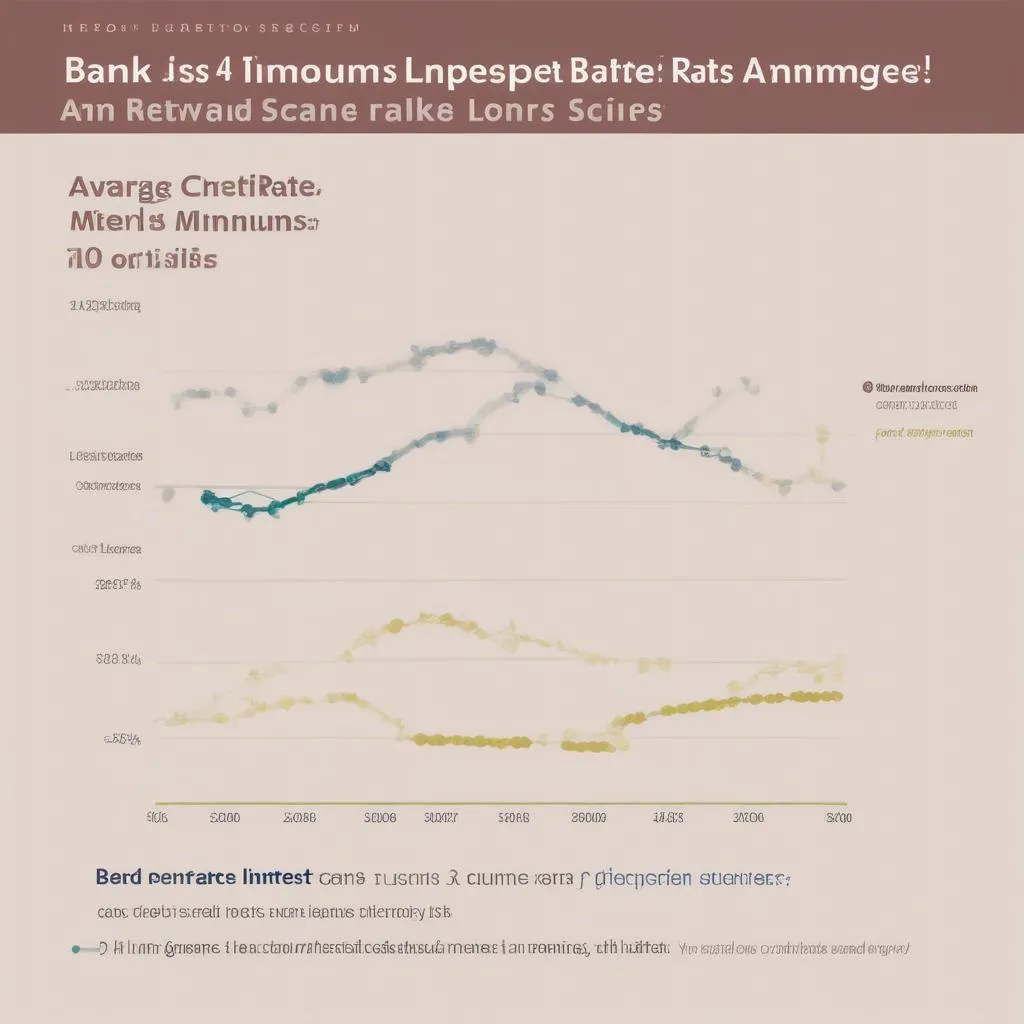

Lenders consider several factors when evaluating your loan application. They assess your credit score, income, employment history, and debt-to-income ratio. A strong credit history and stable income increase your chances of approval and secure a lower interest rate.

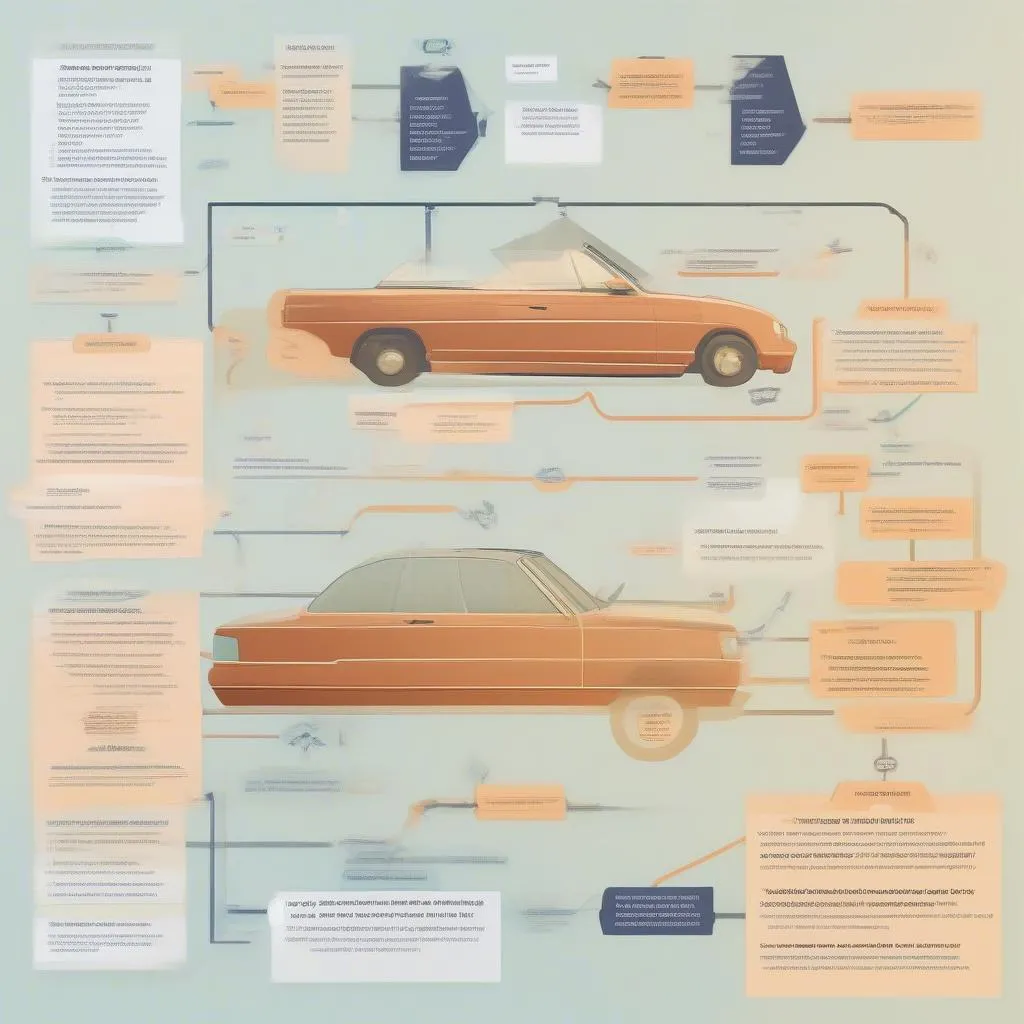

How to Apply for a Car Loan: A Step-by-Step Guide

1. Pre-Approval:

- Gather your documents: Credit report, income verification (pay stubs, tax returns), employment history, and proof of residence.

- Compare loan offers: Visit several lenders (banks, credit unions, online lenders) to compare interest rates, loan terms, and fees.

- Shop around for the best deal: Get pre-approved before visiting dealerships to know how much you can afford.

2. Choosing a Car:

- Determine your needs: Consider your lifestyle, family size, and commuting needs.

- Set a realistic budget: Factor in the price of the car, monthly payments, insurance, and maintenance costs.

- Research different models: Compare features, safety ratings, and reliability.

3. Financing the Car:

- Negotiate the price: Don’t be afraid to haggle with the dealer.

- Secure the loan: Provide the lender with all necessary documentation.

- Finalize the purchase: Sign the loan agreement and take ownership of your new car.

Tips for Getting Approved for a Car Loan

- Improve your credit score: Pay bills on time, reduce debt, and avoid opening new credit accounts.

- Build a strong financial history: Establish a positive credit history by using credit responsibly.

- Save for a down payment: A larger down payment can help secure a lower interest rate.

- Shop around for the best loan: Compare offers from multiple lenders.

Frequently Asked Questions About Car Loans

1. What is the best credit score for a car loan?

A credit score of 670 or higher is generally considered good for car loans. However, some lenders may have stricter requirements.

2. How long does it take to get a car loan approved?

The approval process can take anywhere from a few days to a week, depending on the lender and the complexity of your application.

3. Can I get a car loan if I have bad credit?

Yes, but you may face higher interest rates and stricter lending requirements.

4. How do I know if I can afford a car loan?

Use a car payment calculator to estimate your monthly payments. Aim to keep your total debt-to-income ratio below 43%.

5. What are the risks of taking out a car loan?

If you default on payments, you could lose your car, damage your credit score, and face legal action.

Conclusion

Applying for a car loan can be a daunting process, but it doesn’t have to be a nightmare. By understanding the process, preparing your finances, and shopping around for the best deal, you can increase your chances of getting approved and driving off in your dream car.

Remember, we’re here to help! If you have questions about car loans, financing, or the auto repair process, contact us via Whatsapp at +84767531508. Our team of experts is available 24/7 to support you.

Car Loan Application Process Flowchart

Car Loan Application Process Flowchart

Car Loan Interest Rates Comparison Chart

Car Loan Interest Rates Comparison Chart

Car Loan Calculator Tool

Car Loan Calculator Tool