An amortization schedule, also known as an amortization table, is a vital document when you’re financing a car. It lays out a detailed breakdown of your car loan payments over the entire loan term. Understanding this document is crucial for making informed decisions about your car loan and managing your finances effectively.

This guide delves into the intricacies of amortization sheets for car loans, explaining what they are, how they work, and how to use them to your advantage. We’ll explore key aspects like payment breakdown, interest calculation, and the impact of various factors on your loan. By the end of this guide, you’ll be equipped to navigate the world of car loans with greater confidence and financial savvy.

What is an Amortization Sheet for a Car Loan?

An amortization sheet is a detailed table that outlines your car loan payments over the duration of your loan. It’s essentially a financial roadmap that reveals how much of each payment goes toward principal and interest, and how the loan balance decreases over time. This transparent breakdown helps you understand the true cost of borrowing and track your loan repayment progress.

Understanding the Components of an Amortization Sheet

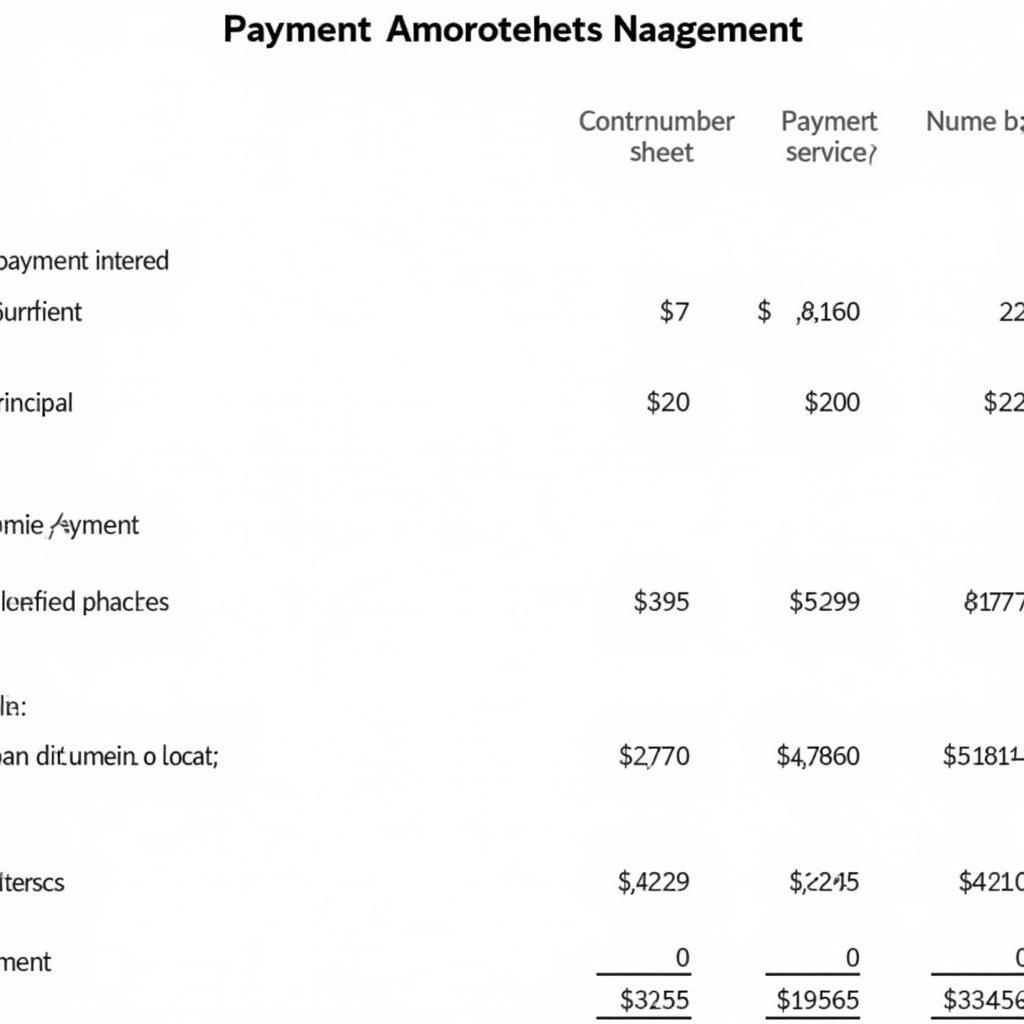

Example of a car loan amortization sheet

Example of a car loan amortization sheet

A typical amortization sheet for a car loan includes the following columns:

- Payment Number: This column lists the sequential number of each payment you make.

- Payment Date: This column indicates the date of each scheduled payment.

- Payment Amount: This column shows the fixed amount you’ll pay each month.

- Principal: This column displays the portion of your payment that goes toward reducing the principal loan amount.

- Interest: This column indicates the portion of your payment that covers the interest charged on the loan.

- Remaining Balance: This column reflects the outstanding loan balance after each payment.

How Amortization Sheets Work

The core principle behind amortization sheets is the gradual repayment of the principal loan amount while simultaneously covering the interest charges. Here’s how it works:

- Initial Payment: In the initial payments, a larger portion of your payment goes toward interest, as you’re paying interest on the entire loan amount.

- Later Payments: As you make more payments, the principal balance decreases, and the interest portion of your payments gradually declines.

- Final Payment: By the end of the loan term, your final payment typically covers the remaining principal balance and any remaining interest charges.

Benefits of Understanding Amortization Sheets

- Financial Transparency: Amortization sheets provide a clear picture of your loan’s financial structure, enabling you to understand the true cost of borrowing.

- Loan Repayment Tracking: These sheets allow you to track your repayment progress and see how your principal balance is decreasing over time.

- Early Repayment Planning: Understanding the amortization schedule helps you determine the impact of making early payments or paying off your loan faster.

- Budgeting and Financial Planning: This document provides valuable data for budgeting, forecasting future expenses, and making informed financial decisions.

Factors Influencing Your Amortization Schedule

Several factors influence the composition of your amortization sheet and the overall cost of your car loan:

- Loan Amount: The initial loan amount directly impacts the principal and interest portions of your payments.

- Interest Rate: A higher interest rate leads to greater interest charges and a larger overall loan cost.

- Loan Term: A longer loan term spreads out your payments, resulting in lower monthly payments but potentially higher overall interest costs.

- Payment Frequency: Making more frequent payments, such as bi-weekly instead of monthly, can help you pay down your loan faster and potentially reduce overall interest charges.

Using Amortization Sheets Effectively

- Compare Loan Offers: Use amortization sheets to compare different loan offers from various lenders, allowing you to choose the option that best aligns with your financial goals.

- Assess Repayment Options: Evaluate different repayment scenarios by adjusting the loan amount, interest rate, or loan term in a spreadsheet or online amortization calculator.

- Plan Early Repayments: Explore the potential benefits of making early payments, which can accelerate your loan repayment and reduce your overall interest costs.

- Monitor Your Progress: Regularly review your amortization sheet to ensure your loan repayment is on track and identify any potential discrepancies or opportunities for improvement.

Amortization Sheets: Your Ally in Responsible Car Financing

“Amortization sheets are like financial compasses, guiding you through the complexities of car loans and ensuring you make informed decisions.” – Jane Smith, Certified Financial Planner

An amortization sheet is a powerful tool for understanding and managing your car loan. By embracing this financial transparency, you can confidently navigate the car-buying process and make informed decisions that benefit your financial well-being.

Frequently Asked Questions (FAQ)

Q: Where can I find an amortization sheet for my car loan?

A: You can usually obtain an amortization sheet from your lender or access it online through your loan account portal.

Q: Can I create my own amortization sheet?

A: Yes, you can use a spreadsheet program like Microsoft Excel or Google Sheets to create your own amortization sheet.

Q: What happens if I make an extra payment on my car loan?

A: Extra payments can significantly reduce your loan’s principal balance and interest charges, potentially saving you money over the life of the loan.

Q: How do I know if I’m getting a good deal on my car loan?

A: Comparing amortization sheets from multiple lenders and evaluating the total interest charges can help you determine if you’re getting a competitive loan offer.

Q: Is it better to choose a longer or shorter loan term?

A: The optimal loan term depends on your financial circumstances. A longer term results in lower monthly payments but potentially higher overall interest costs, while a shorter term involves higher monthly payments but potentially lower overall interest charges.

Need Assistance with Your Car Loan?

If you have any questions or need further guidance on understanding your car loan or amortization sheet, please don’t hesitate to contact us! Our team of experienced financial professionals is here to help you navigate the car financing process with confidence.

Contact us via:

- WhatsApp: +1(641)206-8880

- Email: [email protected]

- Visit: 276 Reock St, City of Orange, NJ 07050, United States

We are available 24/7 to provide support and answer your questions.