Jerry car insurance is a popular option for drivers looking to save money and simplify the process of comparing and buying car insurance. In this comprehensive guide, we’ll delve into everything you need to know about Jerry, from its features and benefits to its potential drawbacks. We’ll also explore how it compares to traditional insurance brokers and offer tips for getting the best deals.  Jerry Car Insurance App Interface

Jerry Car Insurance App Interface

Understanding Jerry Car Insurance

Jerry acts as a licensed insurance broker, partnering with numerous insurance companies to provide users with a wide range of quotes. It utilizes artificial intelligence and machine learning to analyze your driving profile and match you with policies that best suit your needs and budget. This automated process eliminates the need to manually contact multiple insurers, saving you time and effort.

How Does Jerry Car Insurance Work?

Jerry streamlines the car insurance shopping experience. You simply provide some basic information about yourself and your driving history, and Jerry takes it from there. It compares quotes from its network of insurers and presents you with the best options. You can then choose the policy that meets your requirements and purchase it directly through the app.

Benefits of Using Jerry

- Saves Time: Jerry eliminates the need to spend hours researching and comparing car insurance quotes.

- Saves Money: By comparing multiple quotes, Jerry helps you find the most affordable policy.

- Convenience: The entire process can be completed through the Jerry app, making it quick and easy.

- Personalized Recommendations: Jerry uses AI to suggest policies tailored to your specific needs.

Comparing Car Insurance Quotes on Jerry

Comparing Car Insurance Quotes on Jerry

Jerry Car Insurance vs. Traditional Brokers

While traditional insurance brokers also offer comparison shopping, Jerry differentiates itself through its automated process and focus on technology. Traditional brokers often require phone calls and in-person meetings, while Jerry handles everything digitally. This streamlined approach can be particularly appealing to those who prefer a more tech-savvy experience.

Potential Drawbacks of Jerry

- Limited Insurer Network: While Jerry partners with many insurers, it may not include every company in your area. dallas rent a car

- Technology Dependence: If you prefer working with a human agent, Jerry’s fully digital approach might not be ideal.

Tips for Getting the Best Deals with Jerry Car Insurance

- Provide Accurate Information: Accurate information ensures that you receive relevant and accurate quotes.

- Review Coverage Options Carefully: Don’t just focus on the price. Make sure the policy provides adequate coverage for your needs.

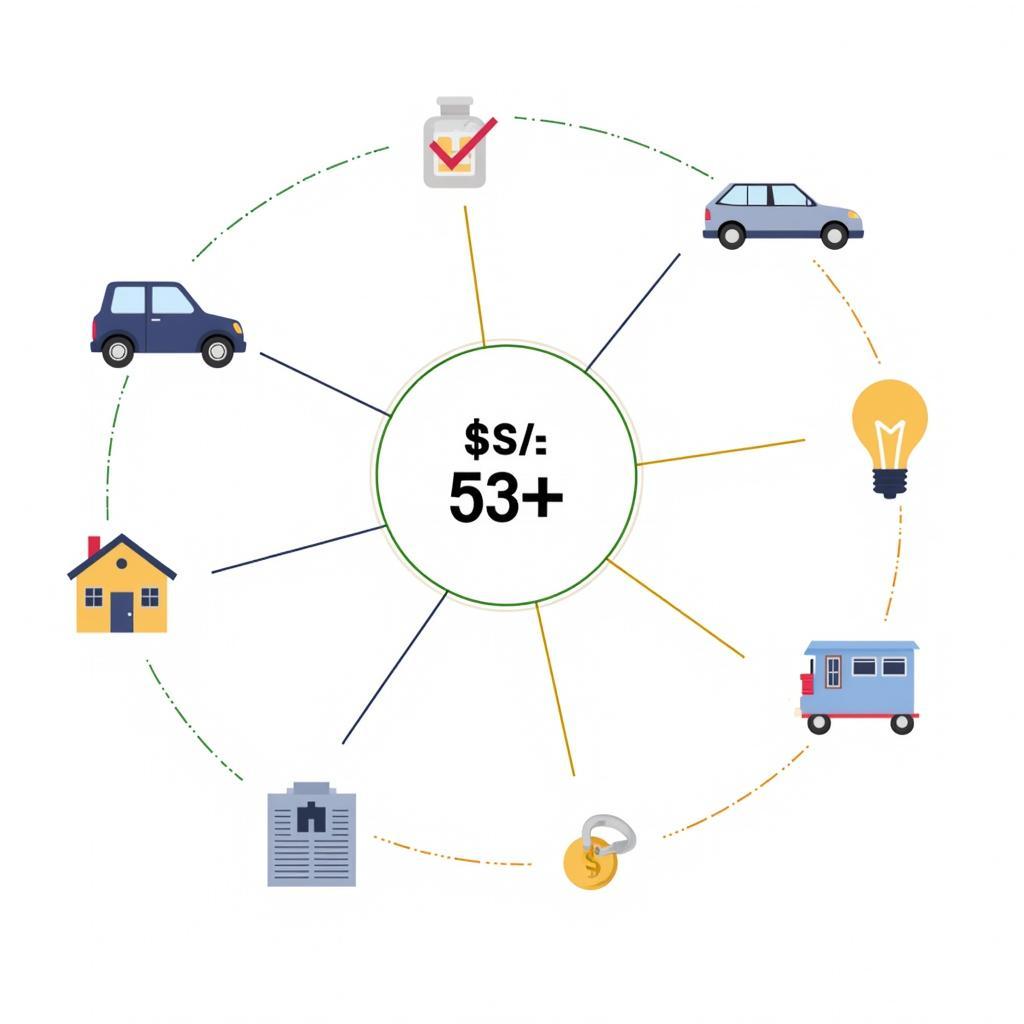

- Consider Bundling: Bundling your car insurance with other policies, such as homeowners’ insurance, can often lead to discounts.

Bundling Insurance Policies for Discounts

Bundling Insurance Policies for Discounts

Jerry Car Insurance: Is it Right for You?

Jerry car insurance offers a convenient and efficient way to compare and purchase car insurance. Its automated process and personalized recommendations can save you time and money. However, it’s important to consider its potential drawbacks and ensure that its insurer network meets your needs. If you’re comfortable with a technology-driven approach and prioritize convenience, Jerry might be a good fit for you.

Conclusion

Jerry car insurance presents a modern solution for navigating the often complex world of car insurance. By leveraging technology, Jerry simplifies the process and empowers consumers to make informed decisions. While it’s not a one-size-fits-all solution, Jerry offers a compelling alternative to traditional methods and is certainly worth considering for those seeking a streamlined and efficient car insurance experience.

FAQ

- Is Jerry a legitimate insurance company? Jerry is a licensed insurance broker, not an insurance company itself. It partners with various insurers to provide quotes.

- How much does Jerry cost? Jerry is free to use. It earns a commission from the insurance companies when you purchase a policy through its platform.

- Does Jerry offer all types of car insurance? Jerry offers a variety of car insurance coverage options, including liability, collision, and comprehensive coverage.

- Can I cancel my policy through Jerry? Yes, you can manage and cancel your policy directly through the Jerry app.

- Does Jerry offer other types of insurance? Yes, Jerry is expanding its offerings and now provides quotes for other types of insurance, such as homeowners and renters insurance.

- How often should I compare car insurance quotes? It’s a good idea to compare quotes annually or whenever your driving situation changes.

- How does Jerry protect my personal information? Jerry uses industry-standard security measures to protect your data.

Scenarios

- Scenario 1: A young driver is looking for their first car insurance policy and wants to find the most affordable option. Jerry can help them compare quotes and find the best deal.

- Scenario 2: A busy professional wants to save time and simplify the process of buying car insurance. Jerry’s automated process and digital platform can make this a breeze.

- Scenario 3: Someone moving to a new state needs to find new car insurance coverage. Jerry can help them compare quotes from insurers in their new location.

Related Resources

For more information on related topics, check out these resources:

Contact Us

For any assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.