Understanding car insurance coverage types is crucial for every driver. Whether you’re a seasoned car owner or just starting out, knowing the different types of coverage available can help you make informed decisions and ensure you have the right protection on the road. This guide will delve into the various car insurance coverage types, explaining what they are, why they’re important, and how they can benefit you. Let’s explore the world of car insurance together. Check out our insurance for car page for more information.

Decoding the Different Car Insurance Coverage Types

Navigating the world of car insurance can feel overwhelming, but understanding the basic coverage types can simplify the process. From liability coverage to comprehensive and collision, each type plays a specific role in protecting you financially in case of an accident.

Liability Coverage: Protecting Others on the Road

Liability coverage is a fundamental component of car insurance and is often legally required in most states. It covers the costs of injuries and property damage you may cause to others in an accident where you are at fault. This includes medical expenses, vehicle repairs, and even legal fees.

Collision Coverage: Repairing Your Vehicle After an Accident

Collision coverage helps pay for repairs to your vehicle after an accident, regardless of who is at fault. This coverage is especially valuable if you’re involved in a single-vehicle accident, such as hitting a tree or a pole. It can also cover damage caused by potholes or other road hazards.

Comprehensive Coverage: Protection Beyond Collisions

Comprehensive coverage extends beyond collisions, protecting your vehicle from a wider range of incidents, including theft, vandalism, fire, natural disasters, and falling objects. This coverage provides peace of mind knowing that your vehicle is protected from unforeseen events.

Uninsured/Underinsured Motorist Coverage: Safeguarding Yourself from Others’ Negligence

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for your damages. This coverage can help cover your medical expenses and lost wages, ensuring you’re not left financially vulnerable.

Car Insurance Coverage Types: Liability, Collision, Comprehensive

Car Insurance Coverage Types: Liability, Collision, Comprehensive

What does car insurance cover for my car specifically?

Your specific car insurance coverage depends on the types and limits you choose. It’s essential to review your policy carefully and understand the details of your coverage.

Medical Payments Coverage (Med-Pay): Covering Your Medical Expenses

Med-Pay coverage helps pay for your medical expenses, regardless of who is at fault in an accident. This coverage can be valuable in covering deductibles, co-pays, and other out-of-pocket expenses. If you need to fix car window near me after an incident, some coverages may apply.

Personal Injury Protection (PIP): A Broader Approach to Medical Coverage

PIP coverage is similar to Med-Pay but often provides broader coverage, including lost wages and other expenses related to your injuries. This coverage can be particularly beneficial if you’re unable to work due to injuries sustained in an accident.

Car Insurance Coverage: Medical Payments and Personal Injury Protection

Car Insurance Coverage: Medical Payments and Personal Injury Protection

How much car insurance do I need?

The amount of car insurance you need depends on various factors, including your state’s minimum requirements, your driving habits, and your financial situation. It’s essential to strike a balance between adequate coverage and affordability. You might want to consider getting cheap car rentals while your car is being repaired.

“Choosing the right car insurance coverage is a critical decision. Don’t just focus on the price; consider the level of protection you need to feel secure on the road.” – John Smith, Certified Insurance Advisor

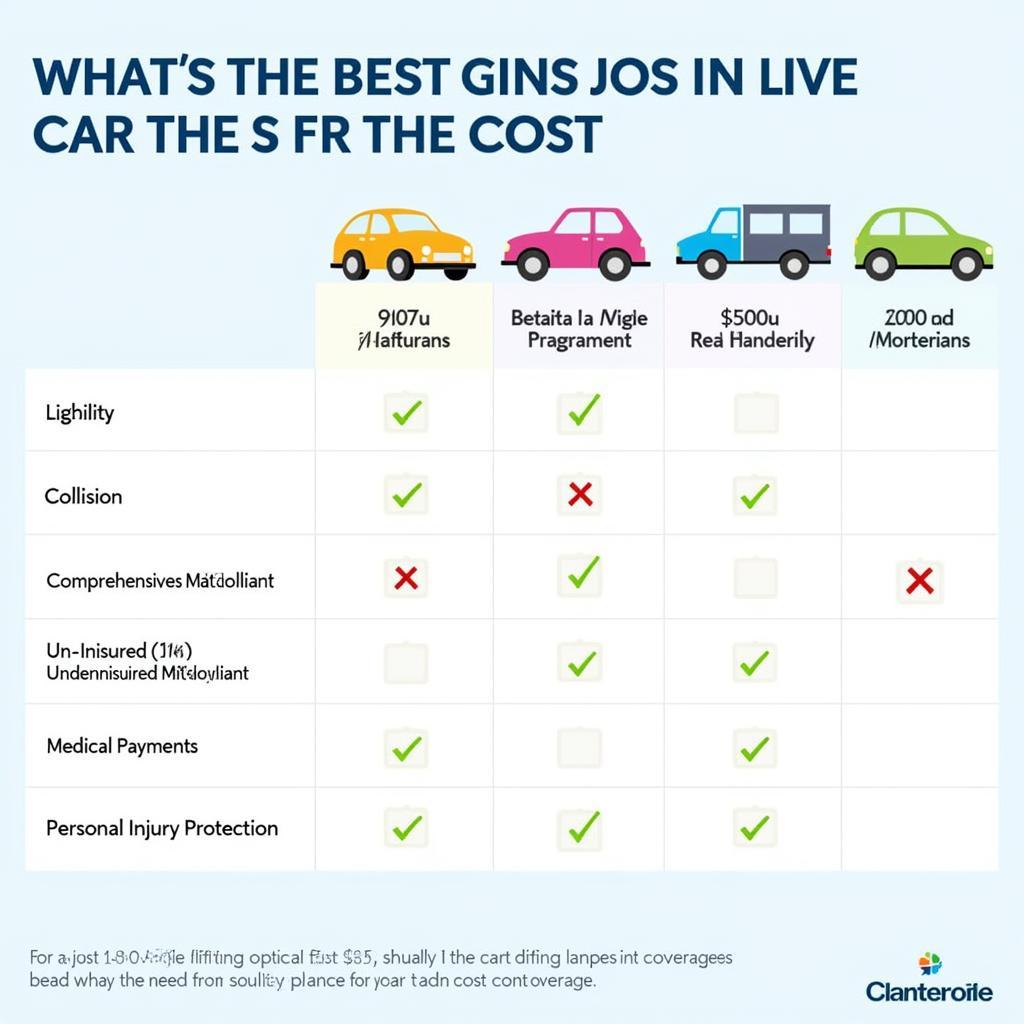

Choosing the Right Coverage for Your Needs

Selecting the right car insurance coverage requires careful consideration of your individual circumstances. Factors such as your vehicle’s value, your driving record, and your budget all play a role in determining the best coverage options for you.

“Understanding your car insurance policy is crucial for maximizing your benefits and ensuring you’re adequately protected in case of an accident.” – Jane Doe, Senior Insurance Analyst

Car Insurance: Choosing the Right Coverage for Your Needs

Car Insurance: Choosing the Right Coverage for Your Needs

Looking for enterprise cars for sale? We have resources for that too. Or perhaps you’re in need of premium urgent care after an accident?

Car Insurance Coverage Types: Your Key to Peace of Mind

Understanding car insurance coverage types is essential for every driver. By understanding the various options available, you can make informed decisions and ensure you have the right protection for yourself, your vehicle, and others on the road. Choosing the appropriate coverage can provide peace of mind and financial security in the event of an accident. Remember to review your policy regularly and adjust your coverage as needed.

FAQ

- What is the minimum car insurance coverage required by law? (This varies by state.)

- What factors affect car insurance premiums?

- How can I lower my car insurance costs?

- What should I do after a car accident?

- How do I file a car insurance claim?

- What is the difference between collision and comprehensive coverage?

- What does uninsured/underinsured motorist coverage protect me against?

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer support team.