Buying a car in Virginia? You’ll need to factor in sales tax in virginia for cars as part of your overall budget. This essential cost can significantly impact your final purchase price, so understanding how it works is crucial. This article provides a comprehensive guide to navigating the complexities of Virginia car sales tax. virginia car sales tax

Decoding Virginia’s Car Sales Tax

Virginia’s car sales tax can seem confusing at first, but it boils down to a few key components. The state levies a 4.15% tax on the purchase price of your vehicle. Additionally, there’s a regional tax of 1% for Northern Virginia and Hampton Roads, bringing the total to 5.15% in those areas. This means the sales tax you pay will depend on where you buy the car.

Remember, the sales tax is calculated based on the vehicle’s purchase price, not the trade-in value. So, if you’re trading in an old car, the tax applies only to the difference you pay after the trade-in allowance.

How is Sales Tax in VA on Cars Calculated?

Calculating the sales tax on your car purchase is straightforward. Multiply the purchase price by the applicable tax rate. For example, if you’re buying a $20,000 car outside of Northern Virginia and Hampton Roads, you’ll pay $830 in sales tax ($20,000 x 0.0415). If you buy the same car in Northern Virginia, you’ll pay $1,030 ($20,000 x 0.0515).

Virginia Car Sales Tax Calculator

Virginia Car Sales Tax Calculator

“Understanding the sales tax calculation upfront prevents any surprises when you finalize your purchase,” says John Miller, a seasoned automotive financial advisor. “It’s always better to be prepared.”

What About Used Cars?

The sales tax in Virginia for cars applies to both new and used vehicles. The process for calculating the tax is the same, regardless of whether the car is brand new or pre-owned.

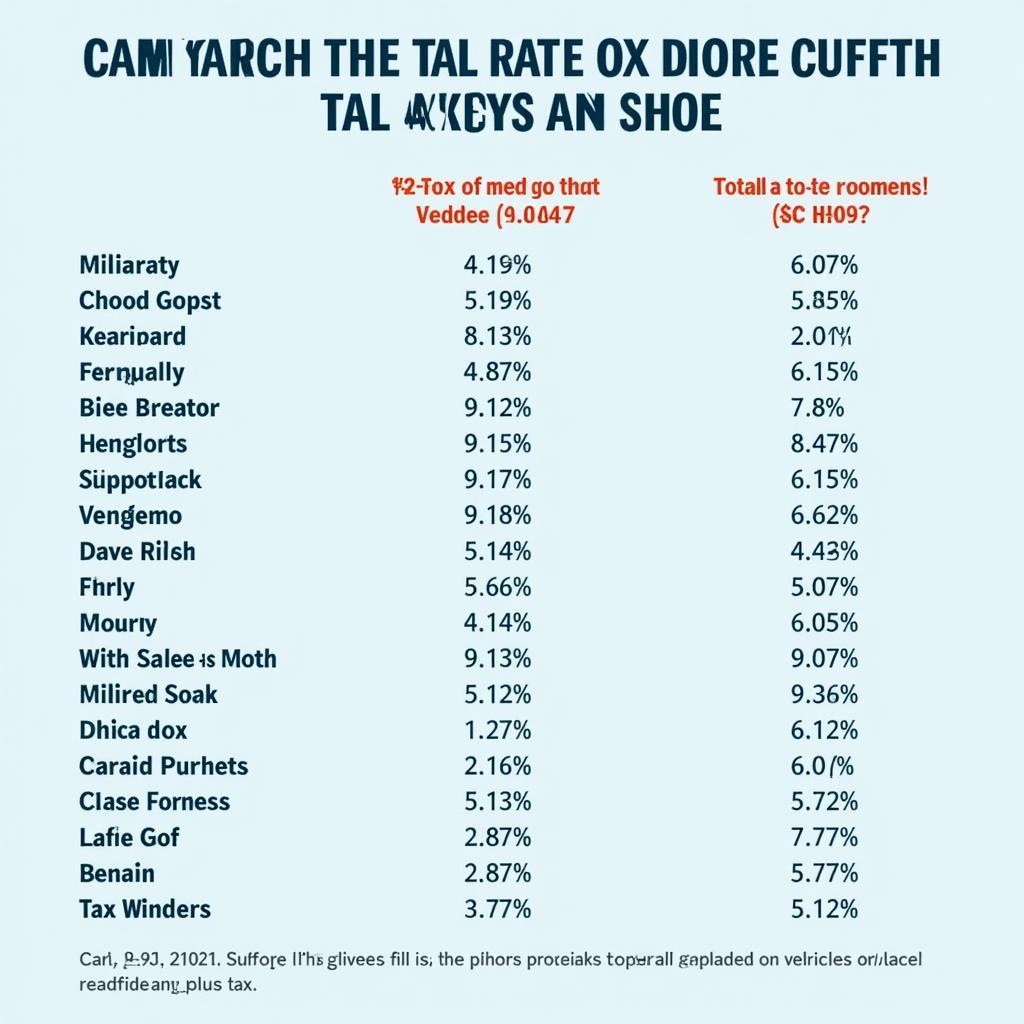

Navigating Regional Tax Differences

The regional tax differences in Virginia are based on specific localities. It’s important to verify the exact sales tax rate in the county where you’re purchasing the vehicle. This information is readily available online and from dealerships. sales tax in va on cars

“Double-checking the regional tax rate is a crucial step, especially when comparing prices across different dealerships,” advises Maria Sanchez, a leading automotive industry expert. “A seemingly small difference in the tax rate can impact your total cost.”

Virginia Regional Sales Tax Comparison Chart

Virginia Regional Sales Tax Comparison Chart

Are There Any Exemptions?

While Virginia has some sales tax exemptions, they generally don’t apply to car purchases. The standard sales tax rates discussed above typically apply to all passenger vehicle transactions.

Conclusion: Mastering Sales Tax in Virginia for Cars

Understanding sales tax in virginia for cars is a vital part of the car buying process. By being aware of the state’s tax structure, regional variations, and calculation methods, you can accurately budget for your new vehicle and avoid any financial surprises. Remember to factor in the 4.15% or 5.15% rate depending on your location and always double-check the local regulations.

FAQs

- What is the base sales tax rate for cars in Virginia? 4.15%

- What is the sales tax rate in Northern Virginia and Hampton Roads? 5.15%

- Is sales tax calculated on the trade-in value? No, only on the difference after the trade-in.

- Is the tax different for new and used cars? No, the same rates apply.

- Where can I find the exact sales tax rate for my county? Online or at dealerships.

- Are there any sales tax exemptions for car purchases? Generally, no.

- How do I calculate the sales tax on my car purchase? Multiply the purchase price by the applicable tax rate (0.0415 or 0.0515).

Car dealerships in other states, like Nevada, may have different tax structures. If you’re considering purchasing a car elsewhere, be sure to research the local regulations. For instance, you might want to look into car dealerships Reno NV if you’re considering buying in that area. car dealerships reno nv

Need help with your car diagnostic tools? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our customer support team is available 24/7.