Understanding your lease payments is crucial before signing on the dotted line. A leasing a car payment calculator empowers you to make informed decisions and secure the best possible lease deal. This guide will delve into the intricacies of car leasing calculators, providing you with the knowledge and tools to navigate the process confidently.

Decoding the Leasing a Car Payment Calculator

A leasing a car payment calculator is an online tool designed to estimate your monthly lease payments. By inputting key information like the MSRP, down payment, residual value, and money factor, the calculator generates an estimate of your monthly obligation. This tool allows you to experiment with different variables and see how they impact your overall lease cost. Understanding these variables is essential for effective use of the calculator. For example, a higher down payment can lower your monthly payments, but it also means a larger upfront investment.  Leasing Car Payment Calculator Interface

Leasing Car Payment Calculator Interface

Knowing the difference between leasing and financing can greatly influence your decision. Check out our guide on lease vs finance car for more insights.

Key Factors Affecting Your Lease Payment

Several factors contribute to your monthly lease payment. Understanding these factors is vital for making informed decisions.

-

MSRP (Manufacturer’s Suggested Retail Price): This is the starting point for negotiations and significantly influences your lease payment.

-

Down Payment: A larger down payment lowers your monthly payment but requires a greater initial investment.

-

Residual Value: This is the vehicle’s predicted value at the end of the lease term. A higher residual value typically results in lower monthly payments.

-

Money Factor: This represents the interest rate on your lease. A lower money factor translates to lower monthly payments.

-

Lease Term: The length of your lease agreement, typically expressed in months. Longer lease terms generally lead to lower monthly payments, but you’ll pay more in interest over time.

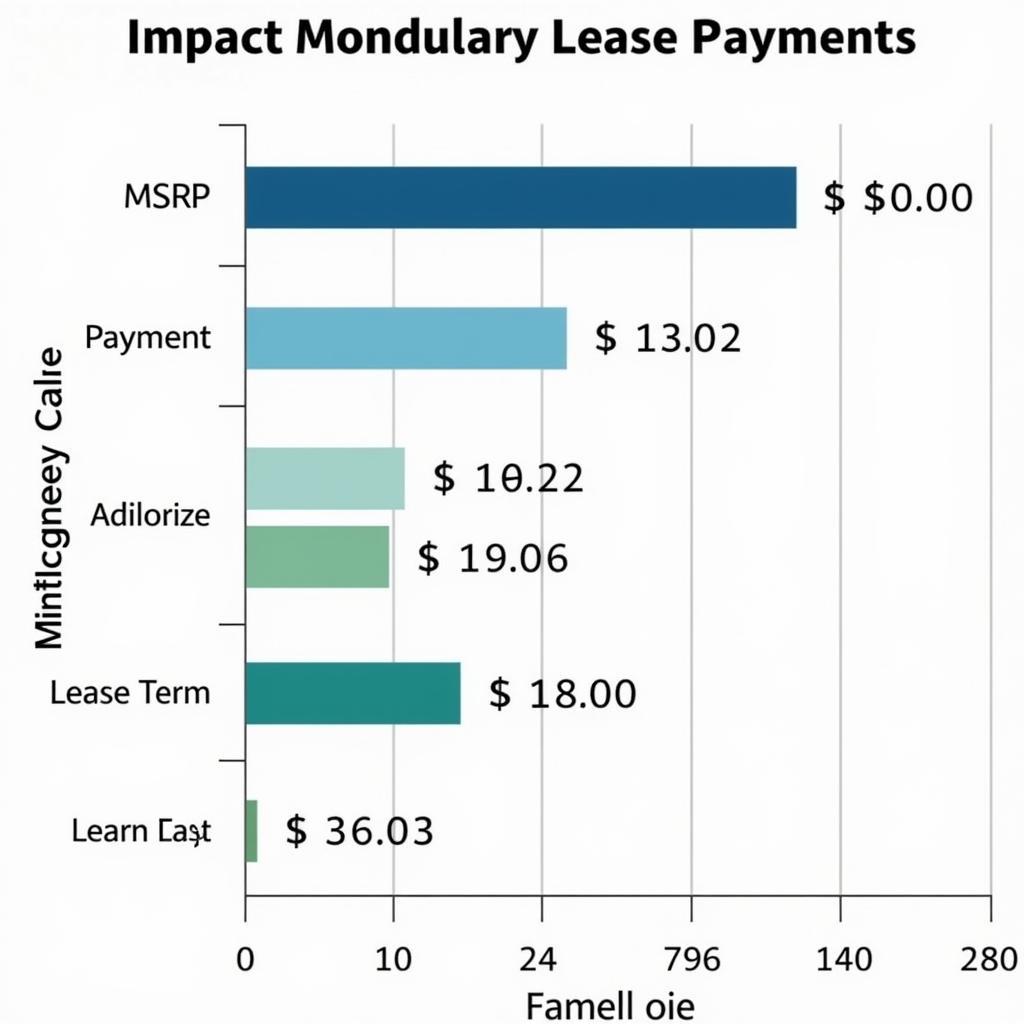

Factors Affecting Lease Payments Chart

Factors Affecting Lease Payments Chart

Having a reliable car payment calculator can be immensely beneficial. Our car calculator offers a comprehensive solution for all your car financing needs.

Utilizing a Leasing a Car Payment Calculator Effectively

Using a leasing a car payment calculator is straightforward. Simply input the required information, and the calculator will generate an estimate. However, the key to effective utilization lies in understanding the interplay of the different factors. Experimenting with different scenarios can help you determine the optimal balance between down payment, monthly payment, and lease term.

How does the MSRP affect my lease payment?

A higher MSRP generally leads to a higher lease payment.

What is the impact of the money factor?

A lower money factor results in a lower monthly lease payment.

Should I make a large down payment?

A larger down payment lowers your monthly payment but requires a bigger upfront investment. Consider your financial situation and budget.

“Negotiating a lower MSRP is crucial for securing a favorable lease deal,” advises John Smith, Senior Automotive Finance Advisor at AutoLease Experts. “Don’t be afraid to haggle – it can save you significant money in the long run.”

Beyond the Calculator: Negotiating Your Lease

While a leasing a car payment calculator is a valuable tool, it’s just one piece of the puzzle. Negotiating the terms of your lease is equally important. Don’t be afraid to negotiate the MSRP, money factor, and other terms to secure the best possible deal. Knowledge is power, and understanding the intricacies of leasing empowers you to make informed decisions.

Negotiating a Car Lease

Negotiating a Car Lease

PNC offers competitive car loan rates. Learn more about pnc car loan options.

Conclusion: Leasing Smarter with a Calculator

A leasing a car payment calculator is an indispensable tool for anyone considering leasing a vehicle. By understanding the factors influencing your lease payment and utilizing the calculator effectively, you can navigate the leasing process with confidence and secure the best possible deal. Remember to negotiate the terms of your lease and always read the fine print before signing.

For more information on car leasing, explore our comprehensive guide on vehicle car leasing.

FAQ

- What is a money factor in a car lease?

- How does the residual value affect my lease payment?

- What are the advantages of leasing a car?

- What are the disadvantages of leasing a car?

- Can I negotiate the terms of my lease?

- What happens at the end of my lease term?

- How can I find the best lease deals?

“Understanding your budget and financial goals is paramount when considering leasing a car,” emphasizes Jane Doe, Certified Financial Planner at MoneyWise Solutions. “A lease calculator helps you visualize the financial implications and make a well-informed decision.”

You can also use an estimate car payment calculator to get a broader understanding of your potential car payments.

Need More Help?

Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our 24/7 customer service team is ready to assist you.