Car ins, short for car insurance, is a crucial aspect of vehicle ownership. It provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could arise from incidents in a vehicle. Understanding car insurance is essential for every driver. This guide dives deep into the world of car ins, exploring its various types, coverage options, and factors influencing premiums. We’ll also look at how to choose the right policy and navigate the claims process. Ready to learn more about protecting your investment and your future? Let’s explore the complexities of car ins together.

Now, let’s delve deeper into the different aspects of car insurance. Finding the right car ins policy can sometimes feel overwhelming. For those seeking affordable options in Nevada, consider exploring resources like car insurance Las Vegas.

Different Types of Car Ins Coverage

Several types of car ins coverages are available, each designed to protect you in specific situations. Choosing the right combination of coverages is essential to create a comprehensive safety net.

Liability Coverage

This is the most basic and often mandatory type of car ins. It covers bodily injury and property damage you might cause to others in an accident.

Collision Coverage

Collision coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It even covers single-vehicle accidents, such as hitting a tree or a pole.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage not related to a collision, such as theft, vandalism, fire, or natural disasters.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are hit by a driver who is uninsured or doesn’t have enough insurance to cover your damages.

Medical Payments Coverage (MedPay) or Personal Injury Protection (PIP)

These coverages pay for medical expenses for you and your passengers after an accident, regardless of fault.

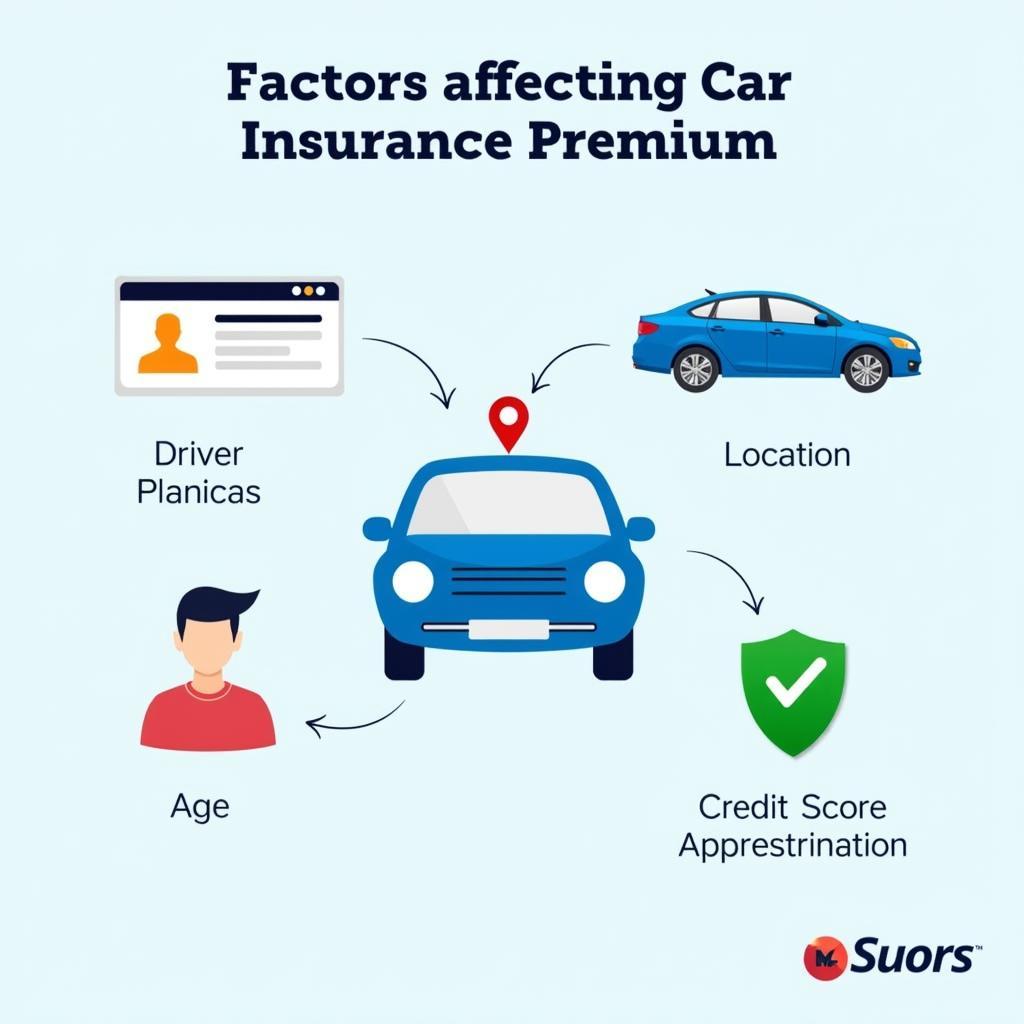

Factors Affecting Car Ins Premiums

Several factors can influence your car ins premiums, understanding these can help you make informed decisions to potentially lower your costs.

Your Driving Record

A clean driving record with no accidents or traffic violations generally leads to lower premiums.

Your Vehicle

The make, model, and age of your vehicle play a role in determining your premium. More expensive and high-performance cars typically cost more to insure.

Your Location

Where you live can significantly impact your car ins rates. Areas with high rates of accidents or theft tend to have higher premiums. If you’re in Nevada and looking for competitive rates, checking out options for car insurance Las Vegas NV could be beneficial.

Your Age and Gender

Statistically, younger and less experienced drivers, as well as male drivers, are often considered higher risk and may face higher premiums.

Your Credit Score

In some states, your credit score can be a factor in determining your insurance rates. A higher credit score often results in lower premiums.

Factors that Influence Car Insurance Costs

Factors that Influence Car Insurance Costs

How to Choose the Right Car Ins Policy

Choosing the right car ins policy involves careful consideration of your needs and budget.

Assess Your Needs

Determine the level of coverage you need based on your driving habits, the value of your vehicle, and your financial situation.

Compare Quotes

Get quotes from multiple insurance providers to compare coverage options and prices.

Read Reviews

Research the reputation and customer service of different insurance companies.

Check for Discounts

Many insurers offer discounts for safe driving, bundling policies, or having anti-theft devices installed in your vehicle. Looking for ways to save on car rentals? Consider checking out rideshare car rental options.

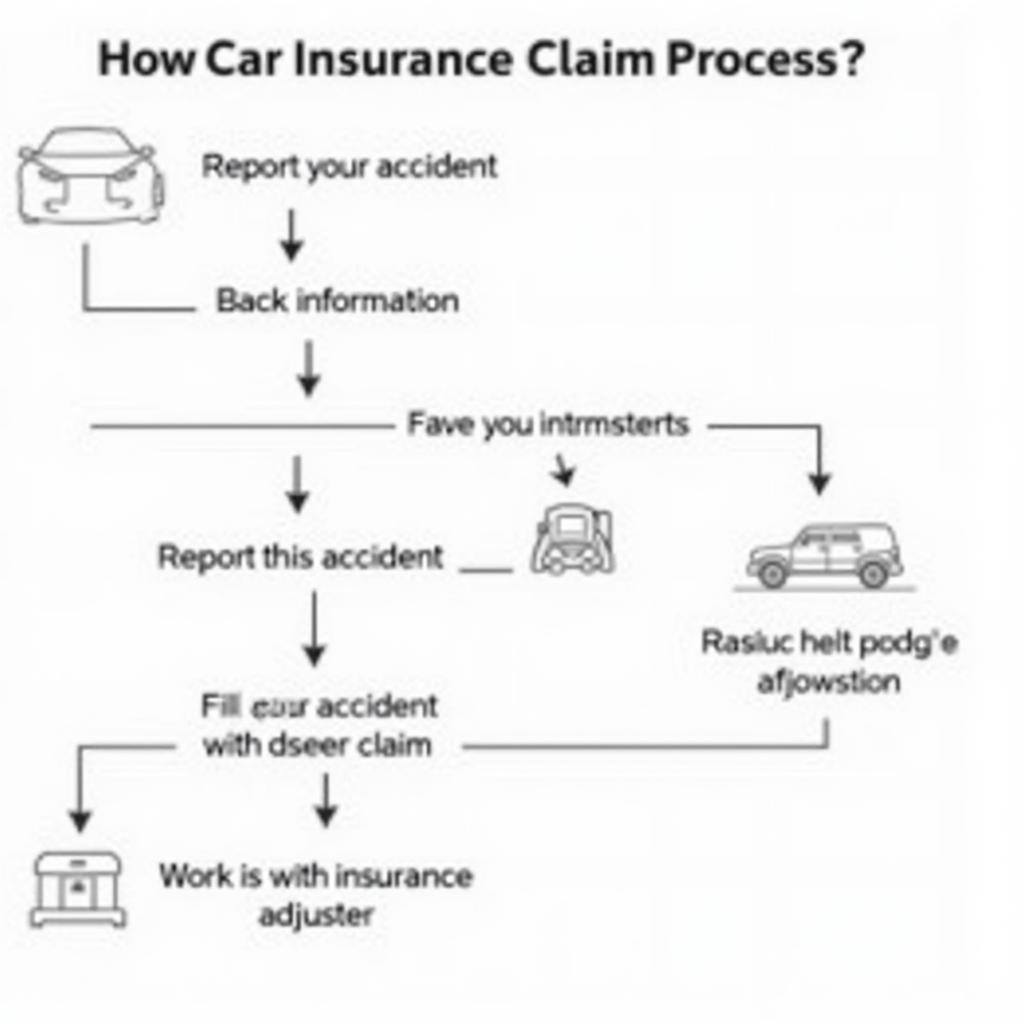

Navigating the Car Ins Claims Process

If you’re involved in an accident, understanding the claims process is crucial.

Report the Accident

Contact your insurance company as soon as possible after an accident to report the incident.

Gather Information

Collect information at the scene, including photos, witness statements, and the other driver’s insurance information. In some cases, finding cheap one way car rentals might be necessary after an accident.

File a Claim

Work with your insurance adjuster to file a claim and provide all necessary documentation.

Conclusion

Car ins is a vital investment for every driver, offering financial protection and peace of mind. Understanding the different types of coverage, factors affecting premiums, and the claims process can empower you to make informed decisions about your car ins needs. By taking the time to research and compare options, you can find the right policy to protect yourself and your vehicle. Remember to explore local options like car insurance Las Vegas Nevada for competitive rates in your area.

FAQ

- What is the minimum car ins required by law?

- How can I lower my car ins premiums?

- What should I do after a car accident?

- How do I choose the right deductible?

- What is the difference between collision and comprehensive coverage?

- What is gap insurance?

- How often should I review my car ins policy?

Navigating the Car Insurance Claim Process

Navigating the Car Insurance Claim Process

For further assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] Or visit us at: 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer service team ready to assist you.