Car insurance in Massachusetts, often referred to as “MA car insurance,” is a legal requirement for all drivers. It protects you financially in case of accidents, theft, or other unforeseen events. This comprehensive guide will explore everything you need to know about MA car insurance, from understanding the different coverage options to finding the best rates. Learn how to navigate the complexities of MA car insurance and ensure you’re adequately protected on the road.

Decoding MA Car Insurance Coverage

Navigating the world of MA car insurance can feel overwhelming. There are several types of coverage to consider, each playing a vital role in your overall protection. Bodily injury liability coverage protects you if you cause an accident that injures someone else. Property damage liability covers damages to another person’s vehicle or property. Collision coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. Comprehensive coverage protects against damage not caused by a collision, such as theft, vandalism, or natural disasters. Finally, personal injury protection (PIP) covers medical expenses for you and your passengers, regardless of fault. Understanding these coverages is crucial for making informed decisions about your policy. Choosing the right combination of coverage ensures you’re adequately protected while driving in Massachusetts.

After an accident, the process of filing a claim can be confusing. It is essential to document everything and gather all necessary information like the police report and contact information for all parties involved. Contact your insurance company as soon as possible after the accident to report the claim. Keep detailed records of all communication and expenses related to the claim.

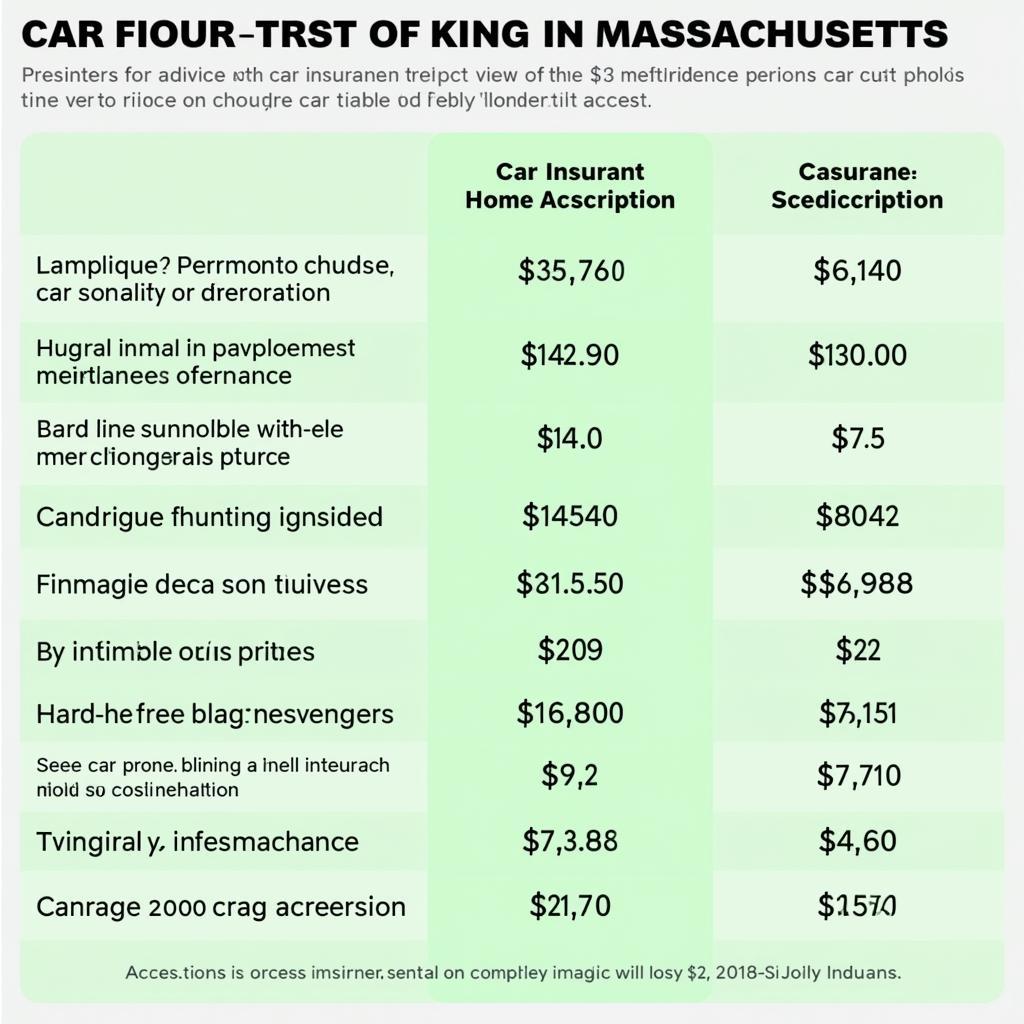

Finding the Best MA Car Insurance Rates

Finding affordable MA car insurance requires some research and comparison shopping. Several factors influence your insurance premiums, including your driving history, age, vehicle type, and location. You can get car insurance quotes from several insurers to compare rates and coverages. Consider factors such as discounts for safe driving, bundling policies, or installing anti-theft devices. Online comparison tools can be valuable resources for quickly comparing quotes from multiple insurers.

Don’t forget to check reviews and ratings of insurance companies to ensure they have a good reputation for customer service and claims processing. Choosing an insurer with a strong track record can save you headaches down the road. Getting the best MA car insurance rates often involves a combination of factors, including your driving profile, the chosen coverage options, and the insurance provider you select.

Comparing MA Car Insurance Options

Comparing MA Car Insurance Options

Why is MA Car Insurance Mandatory?

Massachusetts law requires all drivers to carry minimum levels of car insurance. This requirement aims to protect all road users by ensuring that everyone has financial responsibility in case of an accident. Driving without insurance can result in significant penalties, including fines, license suspension, and even jail time. Having adequate MA car insurance is not only a legal obligation but also a crucial step in responsible driving and financial protection.

What does MA car insurance cover specifically? It covers the costs associated with damages and injuries caused by an accident, up to the limits of your policy. This protection extends to both you and other parties involved in the accident. For example, if you cause an accident that results in property damage to another person’s vehicle, your insurance will cover the repair costs. Similarly, if you’re injured in an accident, your PIP coverage will help pay for your medical expenses, regardless of fault.

FAQs about MA Car Insurance

Here are some frequently asked questions about MA car insurance:

- What is the minimum required car insurance coverage in MA?

- How can I get cheaper car insurance in Massachusetts?

- What factors affect my car insurance rates?

- What should I do after a car accident in MA?

- How do I file a car insurance claim in Massachusetts?

- What is the difference between collision and comprehensive coverage?

- How can I compare car insurance quotes?

Understanding Your MA Car Insurance Policy

Understanding Your MA Car Insurance Policy

Expert Insights on MA Car Insurance

“Choosing the right MA car insurance policy is crucial for peace of mind on the road,” says John Smith, a leading insurance expert at XYZ Insurance Agency. “Don’t just focus on the price; ensure the coverage adequately meets your individual needs.”

“Regularly reviewing your policy and comparing quotes from different insurers can help you secure the most competitive rates,” advises Jane Doe, an experienced insurance advisor. “Take advantage of available discounts and consider increasing your deductible to lower your premium.”

“Understanding your policy’s terms and conditions is vital in case of an accident,” adds Peter Jones, a seasoned insurance professional. “Make sure you’re aware of the claims process and keep all necessary documentation readily available.”

In conclusion, understanding MA car insurance is essential for every driver in Massachusetts. By carefully considering your coverage options, comparing rates, and staying informed about the legal requirements, you can ensure you have the right protection and peace of mind on the road. Don’t hesitate to reach out to insurance professionals for personalized guidance and support in finding the best MA car insurance policy for your needs.

Factors Affecting MA Car Insurance Rates

Factors Affecting MA Car Insurance Rates

When you need assistance, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] Or visit our address: 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer service team.