The amortization formula for car loans might seem complex at first glance, but understanding its components can empower you to make informed decisions and manage your car financing effectively. This article will break down the formula, explain its practical applications, and provide valuable insights into car loan amortization.

Breaking Down the Amortization Formula for Car Loans

The amortization formula calculates the monthly payment on a loan, including both principal and interest. It considers the loan amount, interest rate, and loan term. Here’s a closer look:

- M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M: Represents your monthly payment.

- P: Represents the principal loan amount (the initial amount you borrow).

- i: Represents the monthly interest rate (your annual interest rate divided by 12).

- n: Represents the total number of payments (loan term in years multiplied by 12).

Understanding each component is crucial for managing your car loan effectively. For instance, a higher interest rate will lead to a larger monthly payment and a greater total interest paid over the life of the loan. You can use an amortization calculator for car loans to quickly visualize how changes in these variables impact your overall cost.

Applying the Amortization Formula in Real-World Scenarios

Let’s illustrate the formula with an example. Imagine you’re financing a $25,000 car with a 6% annual interest rate over a 5-year term:

- Calculate the monthly interest rate (i): 6% / 12 = 0.5% or 0.005

- Calculate the total number of payments (n): 5 years * 12 months/year = 60 payments

- Plug the values into the formula: M = 25000 [ 0.005 (1 + 0.005)^60 ] / [ (1 + 0.005)^60 – 1]

- Calculate the monthly payment (M): M ≈ $473.71

This means your monthly car payment would be approximately $473.71. Over the 5-year loan term, you would pay a total of $28,422.60, including $3,422.60 in interest. You might want to use our estimate car loan payment tool for a quick overview of your potential monthly payments.

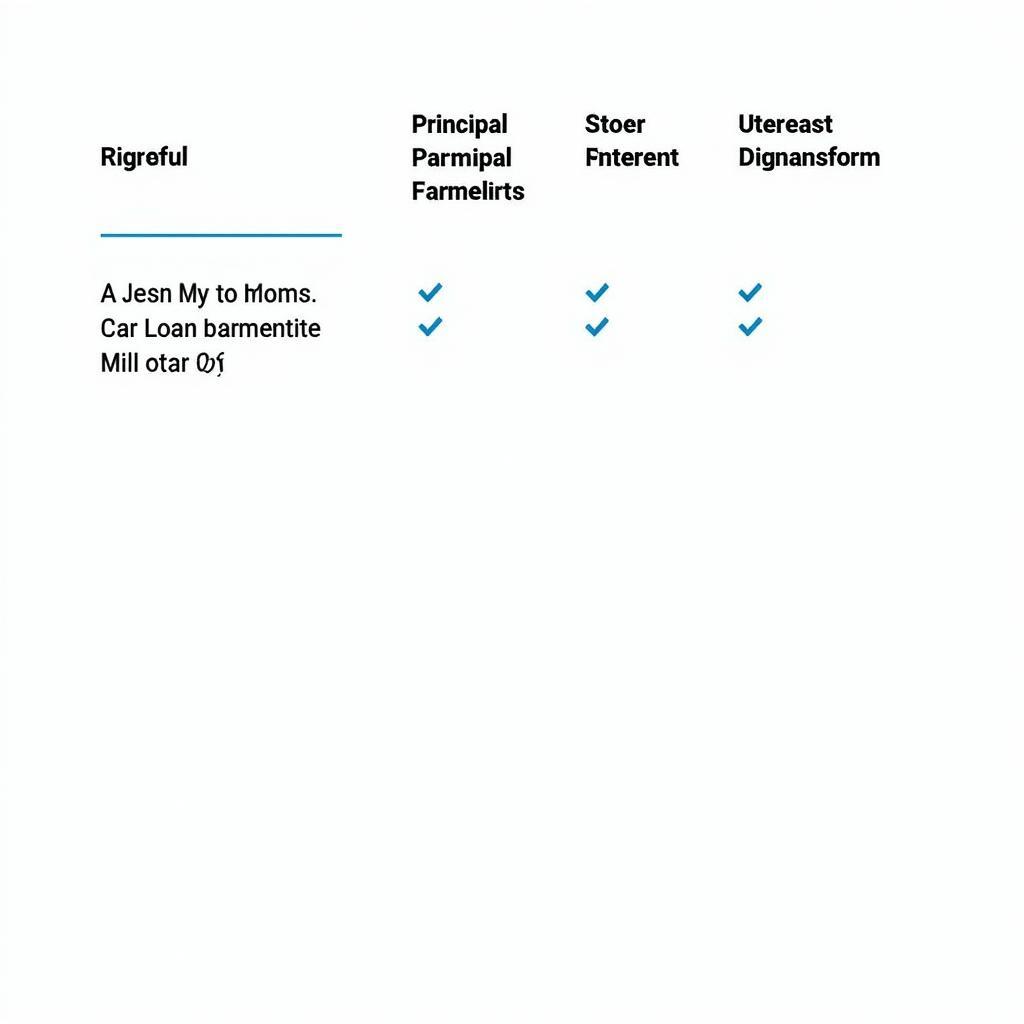

Car Loan Amortization Schedule Example

Car Loan Amortization Schedule Example

Why Understanding Amortization Matters

Understanding amortization helps you make informed decisions when choosing a car loan. A longer loan term might result in lower monthly payments, but you’ll end up paying more interest overall. Conversely, a shorter loan term will result in higher monthly payments but less total interest paid. An accurate financing calculator car can be a valuable tool in this decision-making process.

How Does Amortization Impact My Car Budget?

Knowing your monthly payment is essential for budgeting. It allows you to factor in this expense alongside other financial obligations like rent, utilities, and groceries. Use a car affordability calculator to determine how much car you can comfortably afford.

Amortization Formula Breakdown

Amortization Formula Breakdown

What is an Amortization Schedule?

An amortization schedule is a table that breaks down each payment, showing how much goes towards the principal and how much goes towards interest. It’s a valuable tool for tracking your loan progress and understanding how your payments are applied over time.

“Understanding the amortization formula isn’t just about numbers; it’s about financial empowerment,” says Sarah Miller, Senior Financial Advisor at Auto Finance Solutions. “It allows car buyers to make informed choices and manage their finances effectively.”

Early Loan Repayment and Amortization

Making extra payments towards your car loan can significantly reduce the total interest you pay and shorten the loan term. This is because extra payments primarily go towards reducing the principal balance, which in turn lowers the interest accrued on the remaining balance.

“Early repayment strategies, even small additional payments, can significantly impact the total cost of your car loan,” adds John Davis, Lead Automotive Analyst at Car Insights Group. “It’s a proactive step towards financial freedom.”

Using a car interest calculator can help you see the long-term benefits of early repayment.

Conclusion

The amortization formula car loan calculation is a fundamental concept for anyone financing a vehicle. Understanding its components and practical applications empowers you to make informed decisions, manage your budget effectively, and ultimately save money on your car loan.

FAQ

- What factors affect my car loan interest rate?

- How can I lower my monthly car payment?

- What are the advantages and disadvantages of a longer loan term?

- How can I calculate the total interest paid on my car loan?

- What is the difference between simple and compound interest?

- How does my credit score affect my car loan terms?

- Where can I find a reliable car loan amortization calculator?

Common Loan Amortization Scenarios

- Scenario 1: A buyer wants to know how much interest they will pay over the life of a 5-year loan.

- Scenario 2: A buyer wants to compare the monthly payments for a 3-year loan versus a 5-year loan.

- Scenario 3: A buyer wants to determine how much they can afford to borrow based on their desired monthly payment.

Further Reading and Resources

- Explore our article on calculating car loan interest.

- Learn more about car financing options and strategies.

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our customer support team is available 24/7.