Car insurance in Maryland is more than just a legal requirement; it’s crucial for protecting yourself and others on the road. Understanding the complexities of car insurance md can seem daunting, but this guide will break down the essentials, helping you navigate the process of selecting the right coverage for your needs and budget.

Finding the right car insurance in Maryland involves understanding the state’s minimum requirements, different coverage options, and factors that influence your premiums. This comprehensive guide will equip you with the knowledge to make informed decisions, ensuring you’re adequately protected while driving in the Old Line State. Navigating the complexities of car insurance can be challenging, especially when trying to find affordable options. Resources like cheap car insurance ma can be helpful in understanding how to compare and find budget-friendly coverage.

Understanding Maryland Car Insurance Requirements

Maryland law mandates that all drivers carry minimum levels of car insurance. These minimum requirements are designed to protect individuals involved in accidents. Failure to maintain adequate insurance can result in penalties, including fines, suspension of your driver’s license, and even jail time. The minimum requirements for car insurance md include bodily injury liability, property damage liability, and uninsured motorist coverage.

Bodily Injury Liability Coverage

This coverage pays for medical expenses and other damages if you’re at fault in an accident that injures another person. Maryland requires a minimum of $30,000 per person and $60,000 per accident.

Property Damage Liability Coverage

If you damage someone else’s property in an accident, this coverage helps pay for the repairs or replacement. The minimum requirement in Maryland is $15,000.

Uninsured Motorist Coverage

This protects you if you’re hit by an uninsured driver or in a hit-and-run accident. Maryland requires minimum coverage of $30,000 per person and $60,000 per accident for bodily injury, and $15,000 for property damage.

Exploring Additional Coverage Options

While meeting the minimum requirements is essential, consider additional coverage options for enhanced protection.

Collision Coverage

This covers damage to your vehicle in a collision, regardless of fault.

Comprehensive Coverage

This covers damage to your car from events other than collisions, such as theft, vandalism, or natural disasters.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers, regardless of fault.

Underinsured Motorist Coverage

This protects you if you’re hit by a driver whose insurance is insufficient to cover your damages.

What does palliative care mean in the context of car insurance? While seemingly unrelated, understanding different types of care, like palliative care meaning, can emphasize the importance of comprehensive coverage and protection in various aspects of life.

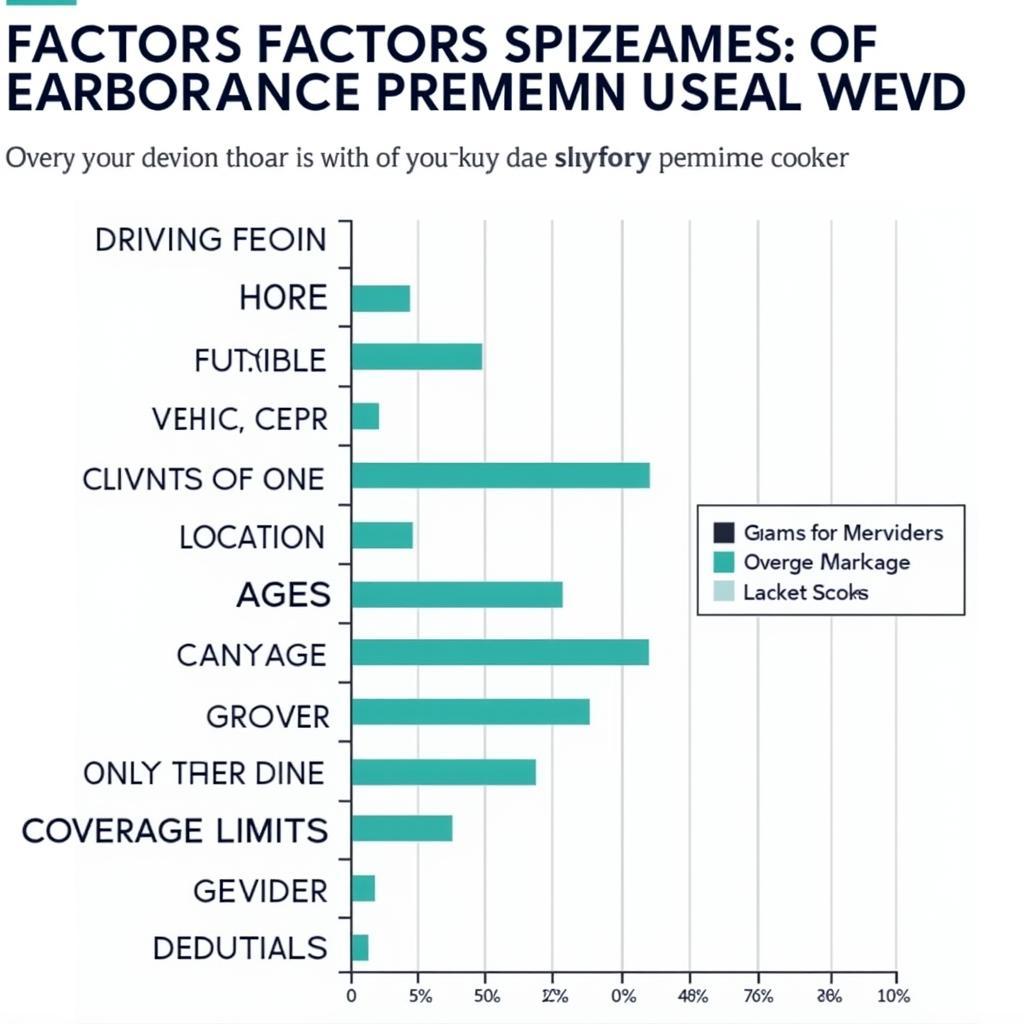

Factors Influencing Car Insurance Premiums in Maryland

Several factors influence your car insurance premiums in Maryland. Understanding these factors can help you manage your insurance costs.

- Driving Record: A clean driving record can lower your premiums, while accidents and traffic violations can increase them.

- Vehicle Type: The make, model, and age of your vehicle can impact your insurance rates.

- Location: Where you live and park your car can affect your premiums.

- Credit Score: In Maryland, insurers can use your credit score to determine your rates.

- Age and Gender: Younger drivers and males typically pay higher premiums.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles will result in higher premiums.

Factors Affecting Car Insurance Premiums in MD

Factors Affecting Car Insurance Premiums in MD

Finding Affordable Car Insurance in Maryland

Finding affordable car insurance requires research and comparison shopping. Here are some tips to help you save money:

- Compare Quotes: Get quotes from multiple insurers to compare rates and coverage options.

- Bundle Policies: Bundling your car insurance with other policies, like homeowners or renters insurance, can save you money.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations can keep your premiums low.

- Consider Higher Deductibles: Opting for a higher deductible can lower your premium, but ensure you can afford the deductible in case of an accident.

- Take Advantage of Discounts: Many insurers offer discounts for safe driving, good students, and other factors. Inquire about available discounts. Finding accessible healthcare is also important. Learn more about doctor care.

“Understanding your car insurance needs and the factors influencing premiums is crucial for securing adequate coverage at a reasonable price,” says John Smith, a senior insurance advisor at Maryland Insurance Solutions. “By comparing quotes, bundling policies, and maintaining a good driving record, you can effectively manage your car insurance costs.”

Finding Affordable Car Insurance in Maryland

Finding Affordable Car Insurance in Maryland

Conclusion

Car insurance in Maryland is essential for protecting yourself and others on the road. By understanding the minimum requirements, exploring additional coverage options, and considering the factors that influence premiums, you can make informed decisions and secure the right coverage for your needs and budget. Remember, car insurance md is an investment in your safety and financial security. For urgent medical needs, consider resources like walgreens urgent care. If you’re in the 85143 area and need urgent medical attention, you can find helpful resources by searching for urgent care near 85143.

FAQ

- What is the minimum car insurance required in Maryland? Bodily injury liability ($30,000 per person/$60,000 per accident), property damage liability ($15,000), and uninsured motorist coverage ($30,000 per person/$60,000 per accident for bodily injury and $15,000 for property damage).

- What is the difference between collision and comprehensive coverage? Collision covers damage to your vehicle in a collision, while comprehensive covers damage from other events like theft or natural disasters.

- How can I lower my car insurance premiums? Compare quotes, bundle policies, maintain a good driving record, consider higher deductibles, and take advantage of discounts.

- What factors affect my car insurance rates? Driving record, vehicle type, location, credit score, age, gender, coverage limits, and deductibles.

- Is PIP coverage mandatory in Maryland? No, PIP is not mandatory in Maryland but it is highly recommended.

- What happens if I drive without insurance in Maryland? Penalties include fines, suspension of your driver’s license, and even jail time.

- How often should I review my car insurance policy? It’s a good idea to review your policy annually or when your circumstances change.

“Investing in comprehensive car insurance is a proactive step towards safeguarding your financial future and ensuring peace of mind on the road,” advises Maria Garcia, an insurance specialist at SafeDrive Insurance Agency. “Don’t underestimate the value of adequate coverage, especially in unforeseen circumstances.”

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. We have a 24/7 customer service team.