Finding the cheapest car insurance in Georgia can feel like navigating a maze. With so many providers and policy options, it’s easy to get overwhelmed. This guide will provide you with the essential information you need to find affordable car insurance in GA, ensuring you get the best coverage without breaking the bank.

Understanding Car Insurance in Georgia

Before diving into the search for the cheapest car insurance, it’s crucial to understand Georgia’s minimum requirements. The state mandates liability coverage, which protects you financially if you cause an accident that injures someone else or damages their property. These minimums are often not enough to fully protect your assets, so it’s wise to consider higher limits. Additionally, factors like your driving history, age, and vehicle type can impact your insurance premiums.

Knowing which factors influence your rates can help you make informed decisions. For example, maintaining a clean driving record and opting for a safer vehicle can significantly lower your premiums. Comparing quotes from multiple insurers is also essential, as prices can vary considerably. Remember, the cheapest option isn’t always the best; finding the right balance between affordability and adequate coverage is key.

If you’re looking for affordable options for smaller vehicles, check out our guide on cheap small cars.

Georgia Car Insurance Map

Georgia Car Insurance Map

Factors Affecting Your Car Insurance Rates in GA

Several factors contribute to the cost of car insurance in Georgia. Your driving record is a major one, with accidents and traffic violations leading to higher premiums. Your age and experience also play a role, as younger, less experienced drivers are statistically more likely to be involved in accidents. The type of vehicle you drive matters too; sportier, more expensive cars generally cost more to insure. Where you live in Georgia also impacts your rates, as urban areas with higher traffic density often have higher premiums. Finally, your credit score can influence your insurance costs in many states, including Georgia.

Understanding these factors allows you to take control of your insurance costs. By practicing safe driving habits, maintaining a good credit score, and choosing a vehicle that fits your budget and insurance needs, you can significantly reduce your premiums.

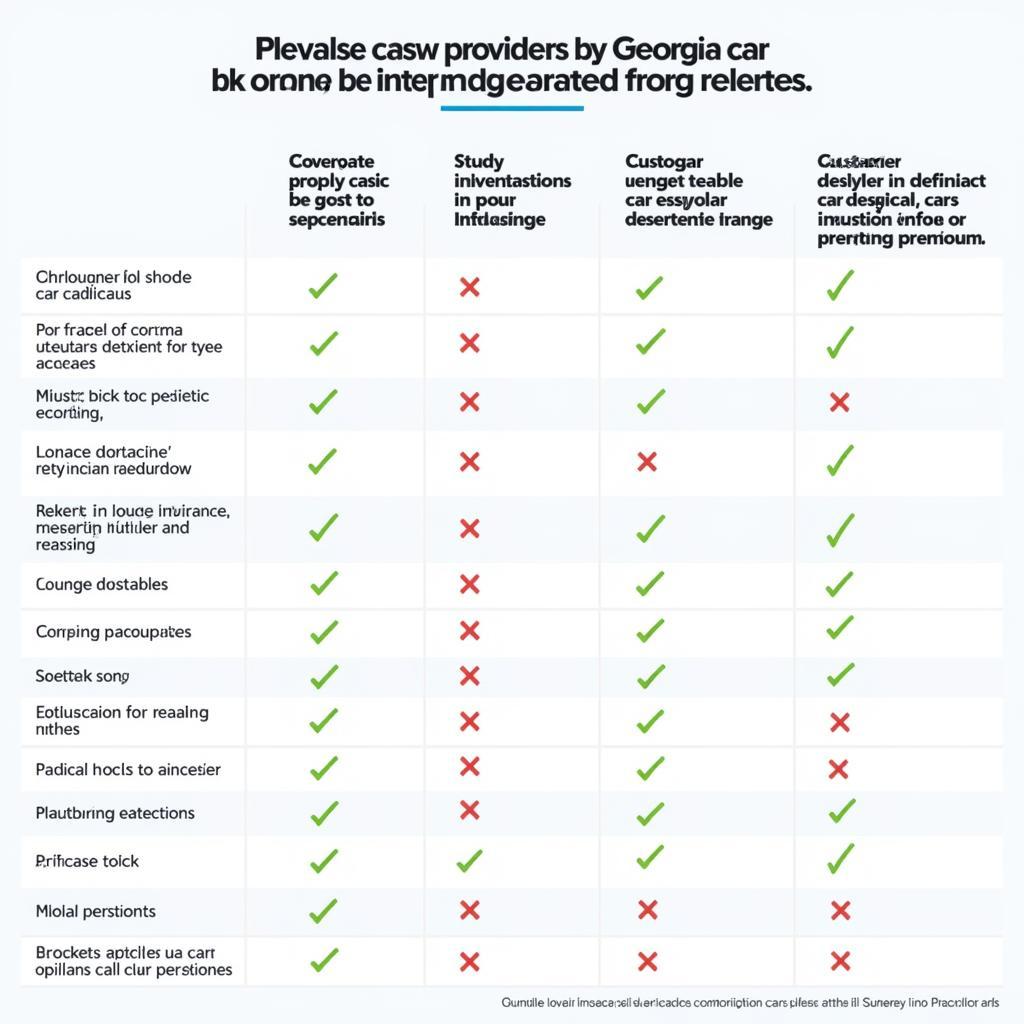

Car Insurance Comparison Chart

Car Insurance Comparison Chart

Choosing the right auto car insurance companies can be a daunting task. Our guide can simplify this process for you.

Finding the Cheapest Car Insurance in GA: Tips and Tricks

There are several strategies you can employ to find the cheapest car insurance in GA. Start by comparing quotes from multiple insurers. Don’t settle for the first quote you receive. Utilize online comparison tools and contact insurers directly to get a comprehensive overview of available options. Consider bundling your car insurance with other policies, such as homeowners or renters insurance, as many companies offer discounts for bundling. Look for discounts based on your profession, affiliations, or even good student status.

Maintaining a clean driving record is one of the most effective ways to lower your premiums. Avoiding accidents and traffic violations demonstrates responsible driving habits and can lead to significant savings over time. Choosing a car with a high safety rating can also lower your insurance costs, as insurers view these vehicles as less risky to insure.

If you own a business, understanding car insurance for business is essential for protecting your company’s assets.

Comparing Car Insurance Quotes in GA

When comparing car insurance quotes, don’t just focus on the price. Ensure you’re comparing apples to apples by checking that the coverage limits and deductibles are similar across different policies. Read reviews of different insurers to gauge their customer service and claims handling processes. Consider factors such as online accessibility and ease of making payments.

Finding the cheapest car insurance requires diligence and research. By following these tips and taking advantage of available resources, you can find the right coverage at a price you can afford. Looking for a broader perspective on car prices? Explore our guide on cheapest to expensive cars.

Conclusion

Finding the cheapest car insurance in GA requires a proactive approach. By understanding the factors that affect your premiums, comparing quotes, and employing smart shopping strategies, you can secure affordable coverage without compromising on protection. Remember to review your policy regularly and adjust your coverage as needed to ensure it continues to meet your evolving needs. Don’t forget to explore options for a rental car company near me if you need temporary transportation.

FAQ

- What is the minimum car insurance required in Georgia?

- How does my credit score affect my car insurance rates?

- What are some common car insurance discounts in GA?

- How can I compare car insurance quotes effectively?

- What factors should I consider when choosing a car insurance company?

- How often should I review my car insurance policy?

- What is the difference between liability and collision coverage?

For assistance, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our customer service team is available 24/7.