Finding the Best Car Refinance Rates can be a great way to save money on your auto loan. Whether you’re looking to lower your monthly payments, shorten your loan term, or simply get a better interest rate, refinancing can be a smart financial decision. However, with so many lenders and options available, it can be difficult to know where to start. In this comprehensive guide, we’ll break down everything you need to know about car refinancing, including how to find the best rates, what factors to consider, and how to make the process as smooth as possible.

How Car Refinancing Works

Car refinancing involves taking out a new loan to pay off your existing auto loan. By securing a new loan with a lower interest rate, you can reduce your monthly payments and save money over the life of your loan. Here’s how it works:

- Apply for a refinance loan: You’ll need to provide basic information about yourself and your current loan, such as your credit score, income, and vehicle details.

- Get quotes from multiple lenders: Compare interest rates, loan terms, and fees from various lenders to find the best offer.

- Choose the best offer: Select the lender that provides the most favorable terms and proceed with the refinancing process.

- Sign the loan documents: Once you’ve chosen a lender, you’ll need to sign the loan documents and provide any necessary documentation.

- Receive your new loan: Once the loan is approved, you’ll receive the funds to pay off your existing auto loan.

Why You Should Consider Refinancing

There are several compelling reasons why car refinancing can be a smart move:

- Lower monthly payments: A lower interest rate can significantly reduce your monthly car payments, freeing up cash flow for other expenses.

- Shorter loan term: Refinancing can allow you to shorten your loan term, helping you pay off your loan faster and save on interest charges.

- Consolidate multiple loans: If you have multiple auto loans, refinancing can help you consolidate them into a single loan with a lower interest rate.

- Improve your credit score: Refinancing can help you build your credit score by demonstrating responsible borrowing habits.

Factors That Affect Car Refinance Rates

Several factors determine the car refinance rates you qualify for, including:

- Credit score: Your credit score is a primary factor that lenders use to assess your creditworthiness. A higher credit score typically translates to lower interest rates.

- Loan amount: The amount you’re borrowing will also influence the interest rate you’ll receive. Larger loan amounts may come with slightly higher interest rates.

- Loan term: The length of your loan term also affects the interest rate. Shorter terms typically come with lower interest rates, but higher monthly payments.

- Vehicle year and make: The age and condition of your vehicle can also impact the interest rate you qualify for. Newer vehicles with higher values tend to receive more favorable rates.

- Lender’s requirements: Different lenders have different lending criteria and policies, so it’s crucial to compare offers from multiple lenders before making a decision.

Tips for Finding the Best Car Refinance Rates

To maximize your chances of securing the best possible refinance rates, consider these tips:

- Improve your credit score: Before applying for a refinance loan, work on improving your credit score by paying your bills on time, reducing your credit utilization, and avoiding unnecessary credit inquiries.

- Shop around for quotes: Get quotes from multiple lenders to compare interest rates, loan terms, and fees. Don’t settle for the first offer you receive.

- Consider your loan term: Choose a loan term that fits your financial situation and goals. While shorter terms offer lower interest rates, they come with higher monthly payments.

- Understand the fees involved: Be sure to factor in any origination fees, closing costs, or other associated fees when comparing offers.

- Read the fine print: Before signing any loan documents, carefully review the terms and conditions to avoid any surprises.

Conclusion

Refinancing your car loan can be a smart financial decision if you’re looking to lower your monthly payments, shorten your loan term, or get a better interest rate. By understanding the factors that affect refinance rates, shopping around for quotes, and following the tips outlined above, you can increase your chances of securing the best possible deal.

FAQ

Q: How much can I save by refinancing my car loan?

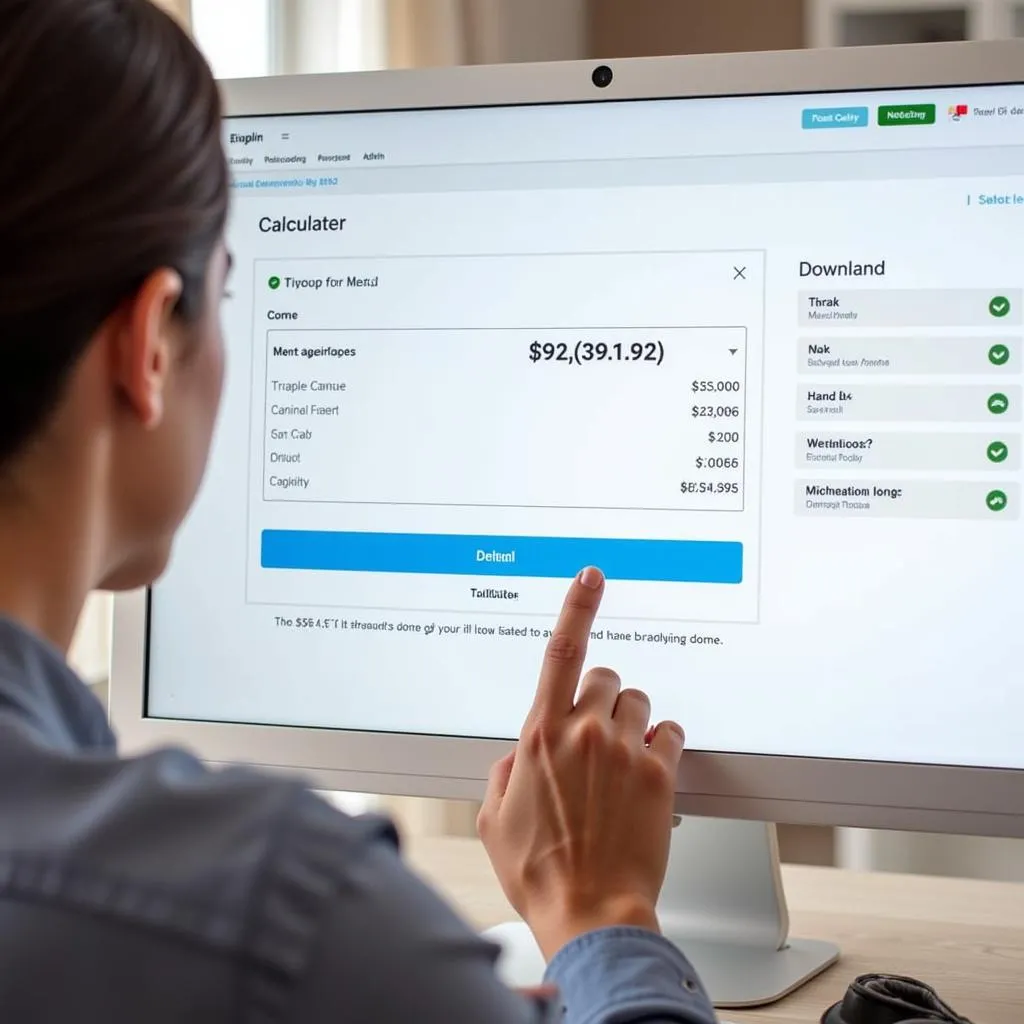

A: The amount you can save will depend on your current interest rate, the new interest rate you qualify for, and the remaining loan balance. Use a car refinance calculator to estimate potential savings.

Q: Can I refinance my car loan if I have bad credit?

A: While it may be more challenging to refinance with bad credit, there are lenders who specialize in working with borrowers with lower credit scores. However, you may face higher interest rates and fees.

Q: How long does it take to refinance a car loan?

A: The refinancing process typically takes 1-2 weeks, but it can vary depending on the lender and the complexity of your application.

Q: What if I’m upside down on my car loan?

A: If you owe more on your car than it’s worth, you may not be able to refinance. However, you may consider other options, such as selling the car or negotiating with your lender.

Q: Are there any risks associated with refinancing a car loan?

A: Yes, there are some risks associated with refinancing, such as higher fees or potentially facing a higher interest rate if your credit score declines. It’s crucial to weigh the benefits and risks before making a decision.

Q: What are some alternative financing options if I can’t refinance?

A: If you can’t refinance your car loan, you may consider other options such as selling the car, negotiating a lower payment with your lender, or taking out a personal loan to consolidate your debt.

Steps Involved in Car Refinancing Loan

Steps Involved in Car Refinancing Loan

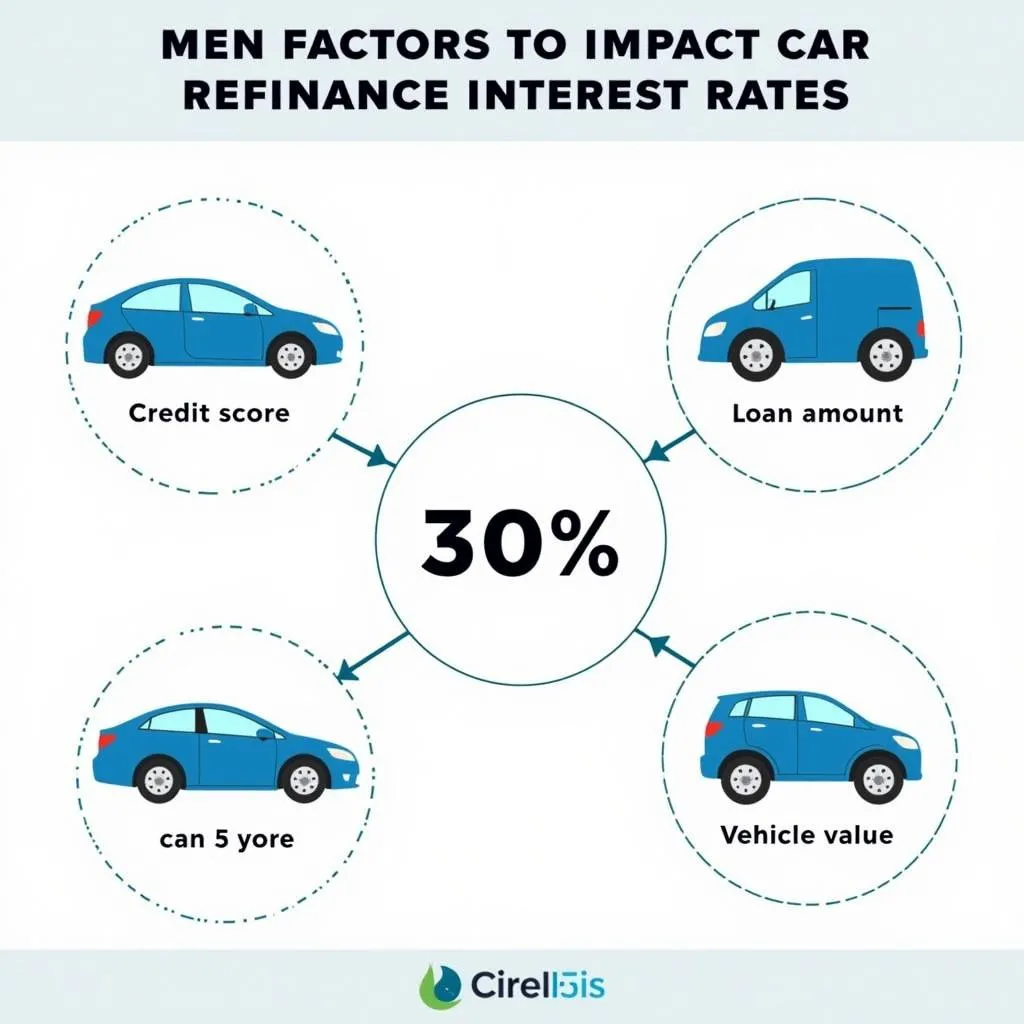

Factors Influencing Car Refinance Rates

Factors Influencing Car Refinance Rates

Using a Car Refinance Calculator

Using a Car Refinance Calculator

Remember, if you’re unsure about whether or not refinancing is right for you, consider consulting with a financial advisor to discuss your options.

Get in touch with us today for a free consultation!

We’re here to help you navigate the world of car finance and find the best solutions for your needs. Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 276 Reock St, City of Orange, NJ 07050, United States.

We have a dedicated team of experts ready to assist you 24/7.