Buying a car in Pinellas County, Florida, involves more than just the sticker price. Understanding the Pinellas County tax on cars is crucial to accurately budgeting for your new vehicle. This comprehensive guide breaks down everything you need to know about these taxes, ensuring you’re fully prepared for your next car purchase.

Deciphering Sales Tax on Vehicles in Pinellas County

When purchasing a car in Pinellas County, you’ll encounter a combined sales tax rate that includes state and local components. The state sales tax rate is 6%, while Pinellas County adds an additional discretionary sales surtax, leading to a total sales tax rate that can vary.

Pinellas County Sales Tax Rate Breakdown

Pinellas County Sales Tax Rate Breakdown

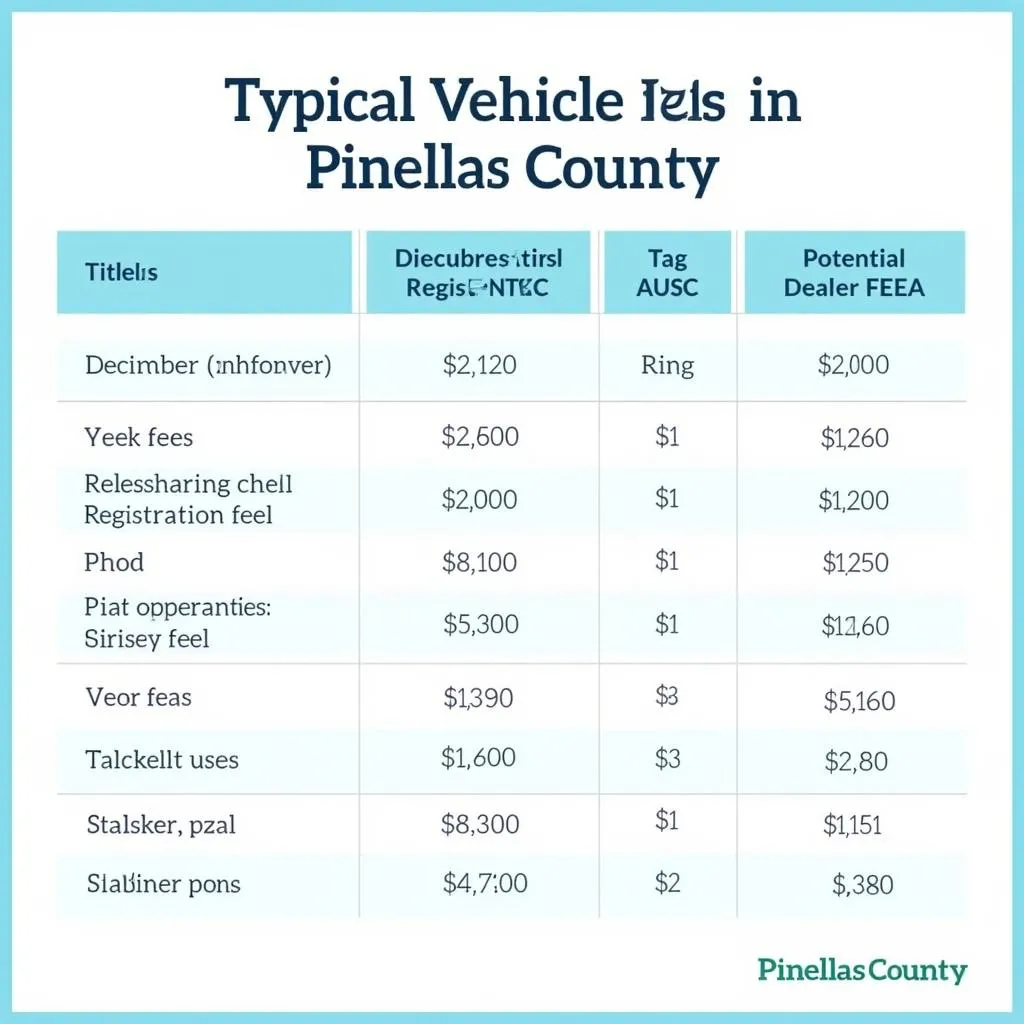

Beyond Sales Tax: Uncovering Other Potential Fees

Besides the sales tax, be prepared for additional fees that contribute to the overall cost of your vehicle purchase in Pinellas County. These can include:

- Title fees: These cover the cost of transferring the vehicle’s title to your name.

- Registration fees: These cover the cost of registering your vehicle in Pinellas County.

- Tag fees: These cover the cost of your vehicle’s license plate.

- Dealer fees: Dealerships may charge fees for processing paperwork, preparing the vehicle, and other services.

Table of Common Vehicle Fees in Pinellas County

Table of Common Vehicle Fees in Pinellas County

Calculating Your Total Tax Liability

To accurately estimate your tax liability, it’s best to use the Pinellas County Tax Collector’s online calculator. This tool allows you to input the vehicle’s purchase price and other relevant information to receive a precise calculation of your total tax obligation.

Expert Insights on Pinellas County Car Taxes

“Many car buyers are surprised by the complexity of vehicle taxes in Pinellas County,” says Sarah Miller, a Senior Tax Advisor at AutoTax Solutions. “Understanding the breakdown of sales tax, additional fees, and potential exemptions can save you money and prevent unexpected costs.”

Navigating Tax Exemptions and Credits

Pinellas County offers tax exemptions and credits for certain individuals and vehicle types, potentially reducing your tax burden. Some common exemptions include:

- Military personnel: Active-duty military members may be eligible for exemptions or reduced rates on vehicle registration fees.

- Vehicles for disabled individuals: Vehicles modified for individuals with disabilities may qualify for tax breaks.

Guide to Pinellas County Tax Exemptions

Guide to Pinellas County Tax Exemptions

Conclusion

Purchasing a car in Pinellas County requires a thorough understanding of the associated taxes and fees. By familiarizing yourself with the sales tax rates, additional fees, and potential exemptions, you can confidently navigate the car buying process and make informed financial decisions. Remember to utilize resources like the Pinellas County Tax Collector’s website and seek guidance from tax professionals to ensure you’re maximizing your savings and staying compliant with local regulations.

FAQs

What is the current sales tax rate on vehicles in Pinellas County?

The sales tax rate in Pinellas County combines a 6% state rate with a local discretionary sales surtax. The final rate may vary, so check with the Pinellas County Tax Collector for the most up-to-date information.

Are there any exemptions to the Pinellas County sales tax on vehicles?

Yes, Pinellas County offers tax exemptions for certain individuals and vehicle types. Common exemptions include those for active-duty military personnel and vehicles modified for individuals with disabilities.

How can I calculate the exact amount of tax I’ll owe on a car purchase?

The Pinellas County Tax Collector provides an online calculator where you can input the vehicle’s purchase price and other relevant details to receive a precise calculation of your total tax liability.

What other fees can I expect when buying a car in Pinellas County?

In addition to sales tax, expect fees for title transfer, registration, tags, and potential dealer processing charges.

Where can I find more information about Pinellas County vehicle taxes and fees?

The Pinellas County Tax Collector’s website is your best resource for detailed information on vehicle taxes, fees, exemptions, and other relevant details.

Need More Help?

For further assistance regarding Pinellas County tax on cars, contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our dedicated customer support team is available 24/7 to provide guidance and address your inquiries.