When it comes to buying a new car, understanding your financial options is key. A car loan calculator Google search can be your first step towards making an informed decision. These handy tools offer a quick estimate of potential monthly payments, helping you determine a comfortable budget before stepping foot in a dealership.

Understanding Car Loan Calculators

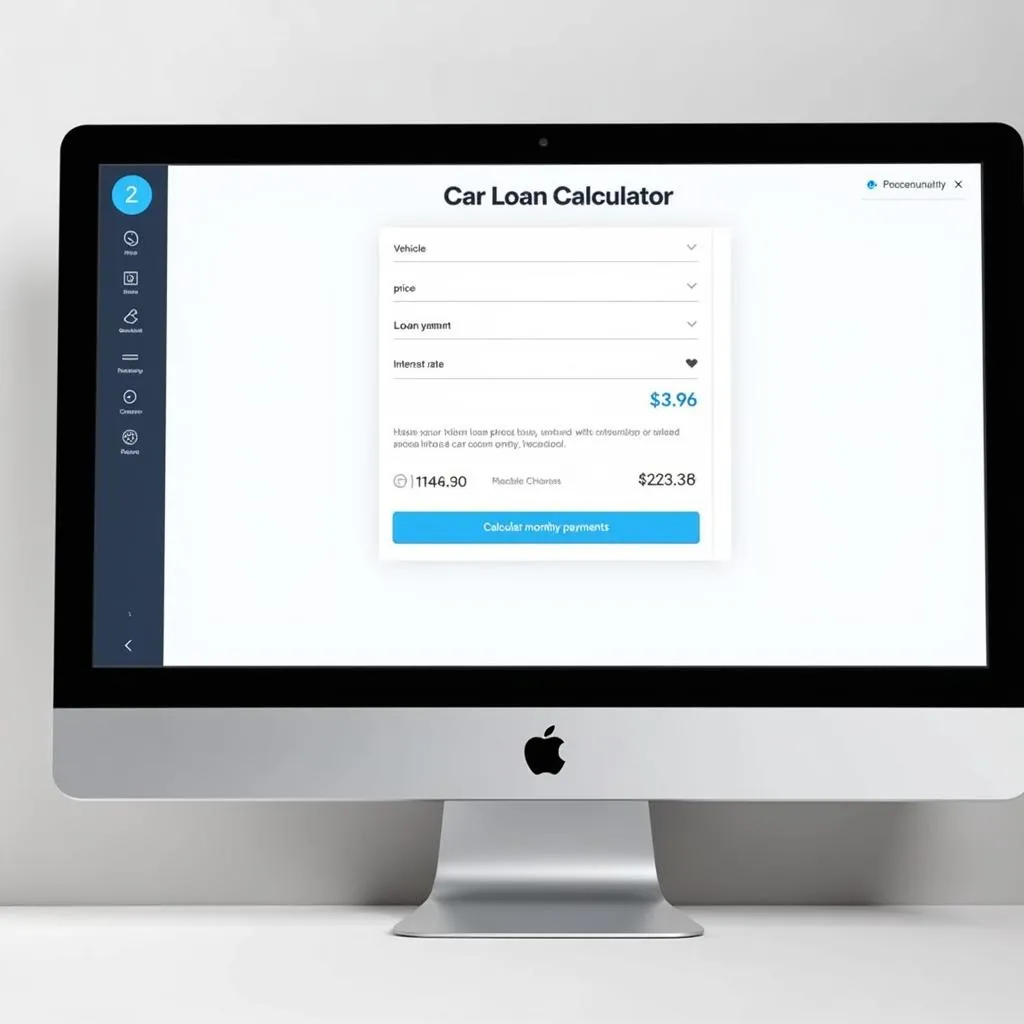

Car loan calculators, often readily available through a simple car loan calculator Google search, are designed with user-friendliness in mind. They require a few key pieces of information to work their magic:

- Vehicle Price: The total cost of the car you’re eyeing.

- Down Payment: The upfront amount you’re prepared to pay.

- Loan Term: The desired length of your loan, typically measured in months.

- Interest Rate: The percentage charged on top of your loan amount, impacting your overall cost.

By inputting these details, the calculator crunches the numbers and provides an estimated monthly payment. This instant insight empowers you to:

- Set Realistic Expectations: Get a clear picture of affordability based on your financial situation.

- Compare Loan Offers: Assess different loan options from various lenders and dealerships.

- Negotiate with Confidence: Having a solid understanding of loan terms strengthens your position when discussing financing.

Using a Car Loan Calculator Interface

Using a Car Loan Calculator Interface

The Power of Google Search for Car Loans

Google, your trusty search engine companion, goes beyond simply providing a list of car loan calculators. It opens up a world of resources that can be immensely helpful during your car-buying journey:

- Discover Lenders: Uncover a variety of lenders, from banks and credit unions to online financing options.

- Compare Interest Rates: Quickly compare current interest rate trends and offers from competing lenders.

- Read Reviews: Gain valuable insights from other borrowers’ experiences with different lenders.

Tips for Using Car Loan Calculators Effectively

While car loan calculators offer valuable estimates, remember they are just a starting point. To make the most of these tools:

- Shop Around for Interest Rates: Don’t settle for the first rate you find. Explore multiple lenders to secure the best possible deal.

- Factor in Additional Costs: Remember to include expenses like taxes, registration fees, and insurance when budgeting for your new car.

- Explore Loan Term Variations: Experiment with different loan terms to see how they affect your monthly payments and overall interest paid.

Adjusting Loan Terms on a Calculator

Adjusting Loan Terms on a Calculator

Beyond the Calculator: Factors Affecting Your Loan

While a car loan calculator Google search provides a helpful starting point, several factors can influence your final loan terms:

- Credit Score: A higher credit score typically translates to more favorable interest rates.

- Debt-to-Income Ratio (DTI): Lenders assess your existing debt obligations to determine your ability to repay the loan.

- Loan Term: Shorter loan terms often come with higher monthly payments but lower overall interest costs.

- Trade-In Value: If you’re trading in an existing vehicle, its value can offset the loan amount.

Making Informed Decisions

Navigating the world of car financing can feel overwhelming, but a car loan calculator Google search is a powerful tool to put you in the driver’s seat. By combining these convenient calculators with thorough research and careful consideration of your financial situation, you can confidently steer towards a car purchase that aligns with your budget and goals.

FAQs about Car Loan Calculators

1. Are car loan calculators accurate?

Car loan calculators provide estimates based on the information you input. The final loan terms offered by a lender may vary.

2. Do I need a good credit score to use a car loan calculator?

No, car loan calculators do not require a credit check. They simply calculate estimated payments based on the provided details.

3. Can I get pre-approved for a car loan online?

Yes, many lenders offer online pre-approval processes, allowing you to get a conditional loan offer before visiting a dealership.

4. What is APR and why is it important?

APR (Annual Percentage Rate) represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage. It provides a more comprehensive view of the loan’s cost compared to the interest rate alone.

5. Should I choose a shorter or longer loan term?

A shorter loan term typically results in higher monthly payments but lower overall interest paid. A longer term has lower monthly payments but can lead to paying more interest over the life of the loan.

Have More Questions? We’re Here to Help!

Need assistance finding the right car loan solution for your needs? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 276 Reock St, City of Orange, NJ 07050, United States. Our dedicated customer support team is available 24/7 to answer your questions and guide you through the process.