Ever scrolled through endless insurance websites, overwhelmed by jargon and confusing quotes? You’re not alone. Finding the right “car insurance in my area” can feel like navigating a maze, especially with so many options available. Imagine this: You’re cruising down Highway 1 in your Ford Mustang, the California sun shining, and BAM! A fender bender. Suddenly, “car insurance in my area” isn’t just a random search term; it’s your lifeline.

Decoding the Search: Why “Car Insurance in My Area” Matters

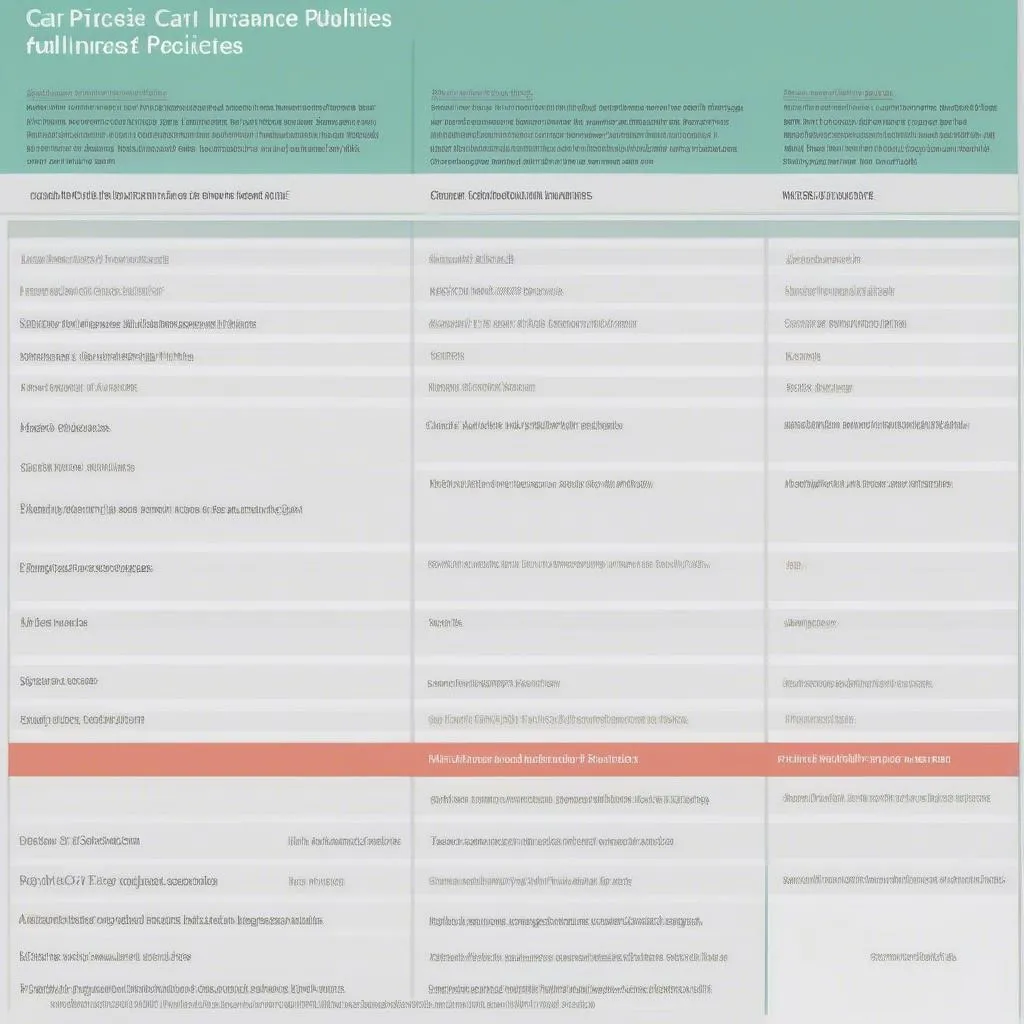

When we type “car insurance in my area,” we’re not just looking for any insurance. We’re seeking a policy tailored to our specific location and needs. This means understanding:

Location, Location, Location:

- State Laws: Did you know that California requires all drivers to have minimum liability coverage? This varies by state, impacting your options and costs.

- Local Risks: Living in Los Angeles with its notorious traffic might mean higher premiums compared to a quieter town like Ojai.

- Neighborhood Factors: Even within a city, areas with higher rates of theft or vandalism could affect your insurance rates.

car-insurance-location-based

car-insurance-location-based

Your Unique Needs:

- Vehicle Type: Insuring a brand new Mercedes-Benz S-Class will be pricier than a used Toyota Corolla.

- Driving History: A clean driving record can lead to lower premiums, while accidents or traffic violations might increase them.

- Coverage Preferences: Are you looking for basic liability or comprehensive coverage? Your choices impact the price you pay.

Navigating the Maze: Finding the Right Policy

Finding the best “car insurance in my area” goes beyond just comparing prices. It’s about finding a policy that offers:

- Reliable Coverage: Make sure the policy meets your state’s minimum requirements and adequately covers potential risks in your area.

- Financial Stability: Choose an insurer with a strong financial track record to ensure they can handle your claims.

- Excellent Customer Service: Look for an insurer known for responsive and helpful customer service, especially during claims.

compare-insurance-quotes

compare-insurance-quotes

“Choosing the right car insurance is like choosing the right mechanic,” says renowned automotive expert, Dr. James Carter in his book “The Car Owner’s Handbook.” “You want someone reliable, trustworthy, and who understands your needs.”

Tips to Simplify Your Search:

- Utilize Online Comparison Tools: Websites like Compare.com or The Zebra allow you to compare quotes from multiple insurers simultaneously.

- Consult with Local Agents: Speaking with an insurance agent in your area can provide personalized advice and insights into local market trends.

- Read Reviews and Ask for Recommendations: Check online reviews and ask friends, family, or colleagues for recommendations based on their experiences.